Yacktman Asset Management (Trades, Portfolio) has revealed its portfolio for the third quarter of 2021 which ended on Sept. 30. The firm’s top trades include additions to its Canadian Natural Resources Ltd. (CNQ, Financial) and Cognizant Technology Solutions Corp. (CTSH, Financial) holdings alongside reductions to its ConocoPhillips (COP, Financial), Exxon Mobil Corp. (XOM, Financial) and Macy’s Inc. (M, Financial) positions.

The firm’s goal is to own securities they believe offer an attractive rate of return for the level of risk in the investment. A generalist approach is used, which means all analysts are responsible for the entire investment universe instead of divvying up research. They focus on qualitative and quantitative information and are patient as long as investment theses remain intact. Purchases are made into companies that possess one or more of the following three attributes: good business, have shareholder-orientated management and a low purchase price.

Portfolio overview

At the end of the quarter, the firm’s portfolio contained 62 stocks with no new holdings. It was valued at $10.40 billion and has seen a turnover rate of 2%. Top holdings in the firm’s portfolio include PepsiCo Inc. (PEP, Financial), Alphabet Inc. (GOOG, Financial), Canadian Natural Resources, Microsoft Corp. (MSFT, Financial) and Procter & Gamble Co. (PG, Financial).

The top sectors represented within the portfolio include consumer defensive (23.77%), communication services (18.06%) and financial services (16.12%).

Canadian Natural Resources

The firm’s top trade was a 30.31% addition to its position in Canadian Natural Resources (CNQ, Financial). Yacktman managers purchased 3.87 million shares that traded at an average price of $33.69 during the quarter. Overall, the purchase had a 1.36% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at 36.79%.

Canadian Natural Resources is one of the largest oil and natural gas producers in western Canada, supplemented by operations in the North Sea and Offshore Africa. The company's portfolio includes light and medium oil, heavy oil, bitumen, synthetic oil, natural gas liquids and natural gas. Production averaged 1.16 million barrels of oil equivalent per day in 2020, and the company estimates that it holds over 11.5 billion boe of proven and probable crude oil and natural gas reserves.

On Nov. 2, the stock was trading at $43.15 per share with a market cap of $50.74 billion. According to the GF Value Line, the stock is trading at a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 5 out of 10. There is currently one severe warning sign issued for declining revenue per share. Rising debt levels over the last several years have landed the company at a cash-to-debt ratio of 0.04, which ranks worse than 88.66% of the oil and gas industry.

Other top guru shareholders in Canadian Natural Resources include the Yacktman Fund (Trades, Portfolio), the Yacktman Focused Fund (Trades, Portfolio), Pioneer Investments, Azvalor Internacional FI (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

Cognizant Technology Solutions

Managers of the firm also added to its Cognizant Technology Solutions (CTSH, Financial) holding for the third quarter in a row. The purchase of 1.39 million shares boosted the holding by 31.62%. During the quarter the shares were purchased at an average price of $73.76. GuruFocus estimates the total gain of the holding at 19.04% and the purchase had a 1% impact on the equity portfolio overall.

Cognizant is a global IT services provider, offering consulting and outsourcing services to some of the world's largest enterprises spanning the financial services, media and communications, health care, natural resources and consumer products industries. Cognizant employs nearly 300,000 people globally, roughly 70% of whom are in India, although the company's headquarters are in Teaneck, New Jersey.

As of Nov. 2, the stock was trading at $78.23 per share with a market cap of $41.17 billion. The stock is trading at a fairly valued rating according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 9 out of 10. There are currently three severe warning signs issued for assets growing faster than revenue, a declining gross margin and a declining operating margin. Despite the warning sign, the company’s operating margin of 14.5% ranks better than 79.24% of industry competitors alongside an equally strong net margin of 10.48%.

Cognizant (CTSH, Financial) shares are also owned by Dodge & Cox, Richard Pzena (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Diamond Hill Capital (Trades, Portfolio) and Al Gore (Trades, Portfolio).

ConocoPhillips

A long-term holding in ConocoPhillips (COP, Financial) was slashed by 80.08% during the quarter. The 1.06 million shares that were sold traded at an average price of $57.76 throughout the period. The holding has managed to squeeze out a small gain of 5.48% and the sale had a -0.63% impact on the equity portfolio.

ConocoPhillips is a U.S.-based independent exploration and production company. At the end of 2020, it produced 727,000 barrels per day of oil and natural gas liquids and 2.4 billion cubic feet per day of natural gas, primarily from the United States, Norway and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2020 were 4.5 billion barrels of oil equivalent.

The stock was trading at $73.07 per share with a market cap of $97.76 billion on Nov. 2. A significantly overvalued rating is given to the stock by the GF Value Line.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 1 out of 10. There are currently two severe warning signs issued for a Beneish M-Score indicating the company may manipulate its financials and declining revenue per share. The company showed signs of recovery through 2019 with revenue and net income trending toward levels seen at the beginning of the decade, but 2020 knocked revenue to the lowest reported in the last decade.

Dodge & Cox, Ken Fisher (Trades, Portfolio), Pioneer Investments, Bill Nygren (Trades, Portfolio) and the Smead Value Fund (Trades, Portfolio) also maintain ConocoPhillips (COP, Financial) shares.

Exxon Mobil

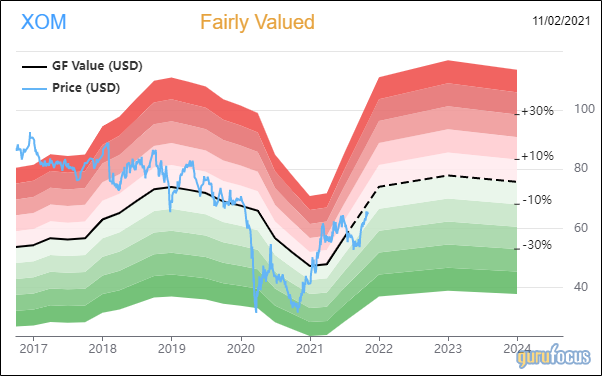

The firm also slashed its Exxon Mobil (XOM, Financial) during the quarter. The holding was cut by 80.21% with the sale of 955,602 shares. The shares traded at an average price of $57.05 during the quarter. Overall, the firm has lost 8.64% on the holding and the sale had a -0.59% on the equity portfolio.

ExxonMobil is an integrated oil and gas company that explores for, produces and refines oil around the world. In 2020, it produced 2.3 million barrels of liquids and 8.5 billion cubic feet of natural gas per day. At the end of 2019, reserves were 15.2 billion barrels of oil equivalent, 58% of which were liquids. The company is the world's largest refiner with a total global refining capacity of 4.8 million barrels of oil per day and one of the world's largest manufacturers of commodity and specialty chemicals.

On Nov. 2, the stock was trading at $64.83 per share with a market cap of $274.57 billion. According to the GF Value Line, the stock is trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 5 out of 10. There are currently four severe warning signs issued for new long-term debt, a low Piotroski F-Score, a declining gross margin and declining revenue per share. The company’s capital efficiency has struggled in recent years with its return on invested capital falling into the red in 2020.

Other top guru shareholders in Exxon Mobil (XOM, Financial) include First Eagle Investment (Trades, Portfolio), Pioneer Investments, Ken Fisher (Trades, Portfolio), Richard Pzena (Trades, Portfolio) and the T Rowe Price Equity Income Fund (Trades, Portfolio).

Macy’s

Rounding out the firm’s top trades of the quarter was a reduction in its Macy’s (M, Financial) position. Managers of the firm cut the position by 32.63% with the sale of 2.7 million shares that traded at an average price of $20 during the quarter. GuruFocus estimates the firm has lost 20.55% on the position and the sale had a -0.50% impact on the equity portfolio.

Founded in 1858, Macy's operates nearly 600 stores under the Macy's brand, 56 stores under the Bloomingdale's brand and about 160 freestanding Bluemercury specialty beauty stores. Macy's also operates e-commerce sites, owns 65% of a Chinese e-commerce joint venture and licenses two Bloomingdale's stores in the United Arab Emirates and Kuwait. Women's apparel, accessories, shoes, cosmetics and fragrances constituted 58% of Macy's 2020 sales. The retailer recently consolidated its headquarters in New York City.

As of Nov. 2, the stock was trading at $28.52 per share with a market cap of $8.84 billion. The stock is trading at a significantly overvalued rating according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 8 out of 10. There are currently two severe warning signs issued for a declining gross margin and declining revenue per share. The company’s cash flows have fallen from a peak in 2014, yet were still able to cover the company’s dividend payout this year.

Macy’s (M, Financial) shares are also owned by Jim Simons (Trades, Portfolio)' Renaissance Technologies, David Tepper (Trades, Portfolio), the Yacktman Fund (Trades, Portfolio), the Yacktman Focused Fund (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).