Jana Partners (Trades, Portfolio) has revealed its portfolio for the third quarter of 2021. The firm’s top trades include new buys into Macy’s Inc. (M, Financial) and Valvoline Inc. (VVV, Financial), reductions to the firm’s holdings in the S&P 500 ETF Trust (SPY, Financial) and Laboratory Corp of America Holdings (LH, Financial) alongside an addition to its Treehouse Foods Inc. (THS, Financial) position.

The activist firm was founded by Barry Rosentein in 2001 and takes a value-orientated approach to investing. The team seeks companies that are undergoing or are expected to undergo changes driven by certain events. They seek to aid value creation by becoming an actively involved shareholder.

Portfolio overview

At the end of the quarter, the firm’s portfolio contained 10 stocks with three new holdings, including BlackSky Technology Inc. (BKSY, Financial). It was valued at $1.25 billion and has seen a turnover rate of 17%. Top holdings in the firm’s portfolio include Conagra Brands Inc. (CAG, Financial), Treehouse Foods, Vonage Holdings Corp. (VG, Financial), Encompass Health Corp. (EHC, Financial) and CyrusOne Inc. (CONE, Financial).

The top represented sectors are consumer defensive (38.27%), health care (20.7%) and communication services (12.99%).

Macy’s

For the first time since 2016, the firm established a new holding in Macy’s (M, Financial). Managers purchased 4.62 million shares that traded at an average price of $20 throughout the quarter. Overall, the purchase had a 8.36% impact on the equity portfolio and is now the firm’s seventh-largest holding. GuruFocus estimates that the firm has gained 35.70% on the holding.

Founded in 1858, Macy's operates nearly 600 stores under the Macy's brand, 56 stores under the Bloomingdale's brand and about 160 freestanding Bluemercury specialty beauty stores. Macy's also operates e-commerce sites, owns 65% of a Chinese e-commerce joint venture and licenses two Bloomingdale's stores in the United Arab Emirates and Kuwait. Women's apparel, accessories, shoes, cosmetics and fragrances constituted 58% of Macy's 2020 sales. The retailer recently consolidated its headquarters in New York City.

On Dec. 2, the stock was trading at $27.41 per share with a market cap of $8.17 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 8 out of 10. There are two severe warning signs issued for a declining gross margin and declining revenue per share. The company has watched revenue decline consistently over the last five years and struggled this year with net income falling into the red.

Macy’s (M, Financial) shares are also owned by David Tepper (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Yacktman Asset Management (Trades, Portfolio), the Yacktman Fund (Trades, Portfolio) and the Yacktman Focused Fund (Trades, Portfolio).

S&P 500 ETF Trust

The firm slashed its S&P 500 ETF Trust (SPY, Financial) holding by 56.24% with the sale of 183,700 shares. The shares sold at an average price of $439.92 throughout the quarter, landing the firm at a total estimated gain of 21.65% on the holding. The sale had a -6.49% impact on the equity portfolio overall.

The ETF has performed well on a year-to-date basis, showing a gain of 21.67%. As of Dec. 2, the shares were trading at $458.33 per share, but showed a loss of 4.03% over the last week amidst the market pullback.

Shares of the ETF are also owned by Ray Dalio (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Warren Buffett (Trades, Portfolio) and Al Gore (Trades, Portfolio).

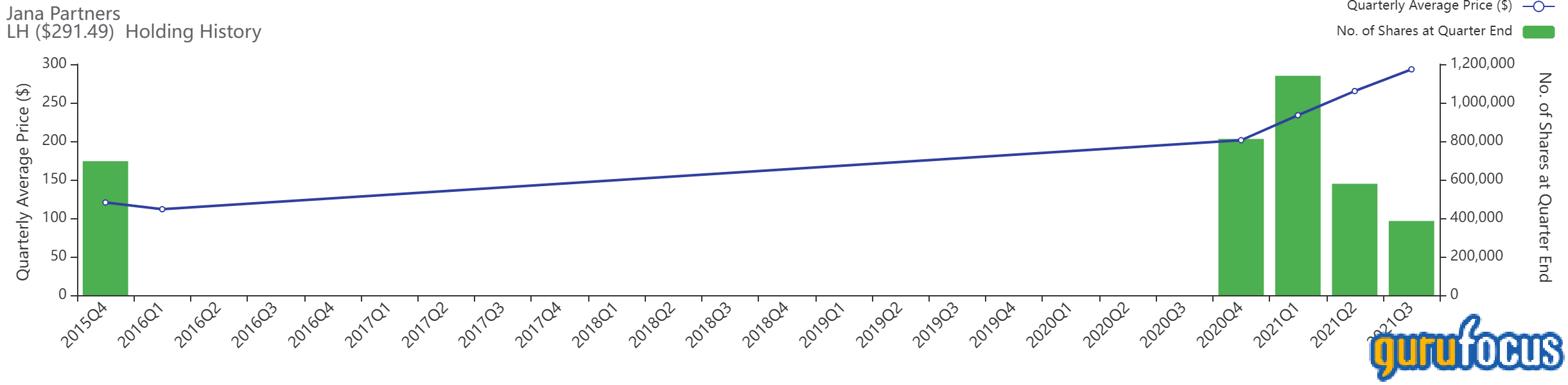

Laboratory Corp of America

Jana Partners (Trades, Portfolio) also pulled back its Laboratory Corp. of America (LH, Financial) position. The firm cut the position by 33.4% with the sale of 193,290 shares. During the quarter, the shares traded at an average price of $293.32. GuruFocus estimates the firm has gained 22.13% on the holding and the sale had a -4.40% impact on the equity portfolio.

Laboratory Corp. of America is one of the nation's two largest independent clinical laboratories, with roughly 20% of the independent lab market. The company operates approximately 2,000 patient-service centers, offering a broad range of 5,000 clinical lab tests, ranging from routine blood and urine screens to complex oncology and genomic testing. With the addition of Covance, LabCorp also has a sizable footprint in the global contract research organization market.

The stock was trading at $292.10 per share with a market cap of $27.95 billion on Dec. 2. The GF Value Line shows the stock trading at a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 8 out of 10. There are currently no severe warning signs issued for the company, but medium signs warn of insiders selling and share prices approaching a 10-year high. The company’s cash-to-debt ratio of 0.32 ranks worse than 80.32% of industry competitors and has pulled down overall financial strength.

Other top guru shareholders in LabCorp (LH, Financial) include the Vanguard Health Care Fund (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), John Rogers (Trades, Portfolio), Simons' firm and Wallace Weitz (Trades, Portfolio).

Treehouse Foods

The firm’s second-largest holding, Treehouse Foods (THS, Financial), grew by 35.07% with the purchase of an additional 1.33 million shares. The holding saw a small reduction in the second quarter and share prices were down to an average of $40.91 per share during the third quarter. Overall, the purchase had a 4.27% impact on the equity portfolio and GuruFocus estimates the total loss of the holding at 9.30%.

Treehouse Foods, the largest private label manufacturer in the U.S., is the product of a slew of acquisitions, the most significant being the 2016 acquisition of Ralcorp, Conagra's former private brands business. The company operates in over 25 categories, including snacks, meals and single-serve beverages. Retailers represent its most significant end-market, where it sells products for resale under retailer brands, but it also serves foodservice customers (providing a similar service as its retail business), industrial (selling bulk food for repackaging and repurposing) and branded consumer goods companies (under co-packing arrangements).

On Dec. 2, the stock was trading at $39.24 per share with a market cap of $2.18 billion. According to the GF Value Line, the stock is trading at a modestly undervalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 9 out of 10. There are four severe warning signs issued for a declining gross margin, a declining operating margin, declining revenue per share and an Altman Z-Score placing the company in the distress column. 2020 proved to be a strong year for the company with its return on capital far exceeding the weighted average cost of capital.

Simons' firm, Steven Scruggs (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Keeley-Teton Advisors, LLC (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) also own Treehouse Foods (THS, Financial) shares.

Valvoline

Finishing off the firm’s top trades of the quarter was a new buy into Valvoline (VVV, Financial). The firm purchased 1.27 million shares to establish a holding in the automotive products supplier for the first time since 2016. The shares traded at an average price of $31.05 during the quarter for a total estimated gain of 6.34% on the holding. The new buy had an overall impact of 3.18% on the equity portfolio.

Valvoline produces, markets and sells automotive maintenance products, particularly lubricants, to retail outlets and installer customers worldwide. The company caters to do-it-yourself customers by selling products to auto parts stores and leading mass-merchandisers via direct sales and distributors. Valvoline targets the do-it-for-me segment by selling products to car dealers, general repair shops and third-party quick-lube chains. Valvoline also operates and franchises quick-lube oil change centers, in addition to selling products and providing Valvoline-branded signage to smaller-scale independent operators.

As of Dec. 2, the stock was trading at $34.79 per share with a market cap of $6.28 billion. The GF Value Line shows the stock trading at a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 7 out of 10. There are three severe warning signs issued for assets growing faster than revenue, a declining gross margin and a declining operating margin. Despite the warning sign, the company’s operating margin of 15.43 outshines 70.18% of industry competitors.

Jana Partners (Trades, Portfolio) is joined by Glenn Greenberg (Trades, Portfolio), Simons' firm, Mario Gabelli (Trades, Portfolio), Pioneer Investments and Steven Cohen (Trades, Portfolio).