In light of major U.S. carriers launching new 5G network service around the nation, five telecom stocks with high business predictability, earnings yields and return on capital are SK Telecom Co. Ltd. (SKM, Financial), PT Telkom Indonesia (Persero) Tbk (TLK, Financial), Rogers Communications Inc. (RCI, Financial), TELUS Corp. (TU, Financial) and Cogent Communications Holdings Inc. (CCOI, Financial) according to the Joel Greenblatt (Trades, Portfolio) Magic Formula Screen, a Premium feature of GuruFocus.

On Wednesday, Verizon Communications Inc. (VZ, Financial) and AT&T Inc. (T, Financial) launched the C-band 5G networks across the U.S., allowing millions of users to access the new service by the end of the year.

As such, investors may find opportunities in telecom companies with high business predictability and meet Greenblatt’s magic formula. The Gotham Asset Management leader seeks stocks that have high returns on capital and earnings yields. For the return on capital calculation, Greenblatt considered earnings before interest and taxes divided by net fixed assets and working capital. Likewise, Greenblatt defined earnings yield as Ebit divided by enterprise value.

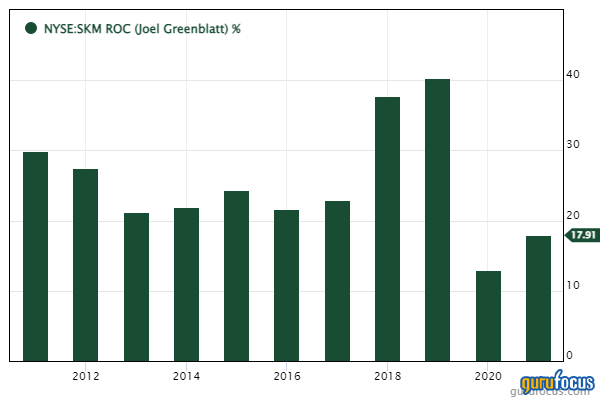

SK Telecom

Shares of SK Telecom traded around $26.10, showing the stock is significantly undervalued based on Wednesday’s price-to-GF Value ratio of 0.65.

GuruFocus ranks the South Korean telecom company’s profitability 7 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a return on capital that outperforms more than 70% of global competitors and an earnings yield that tops over 89% of global telecom companies.

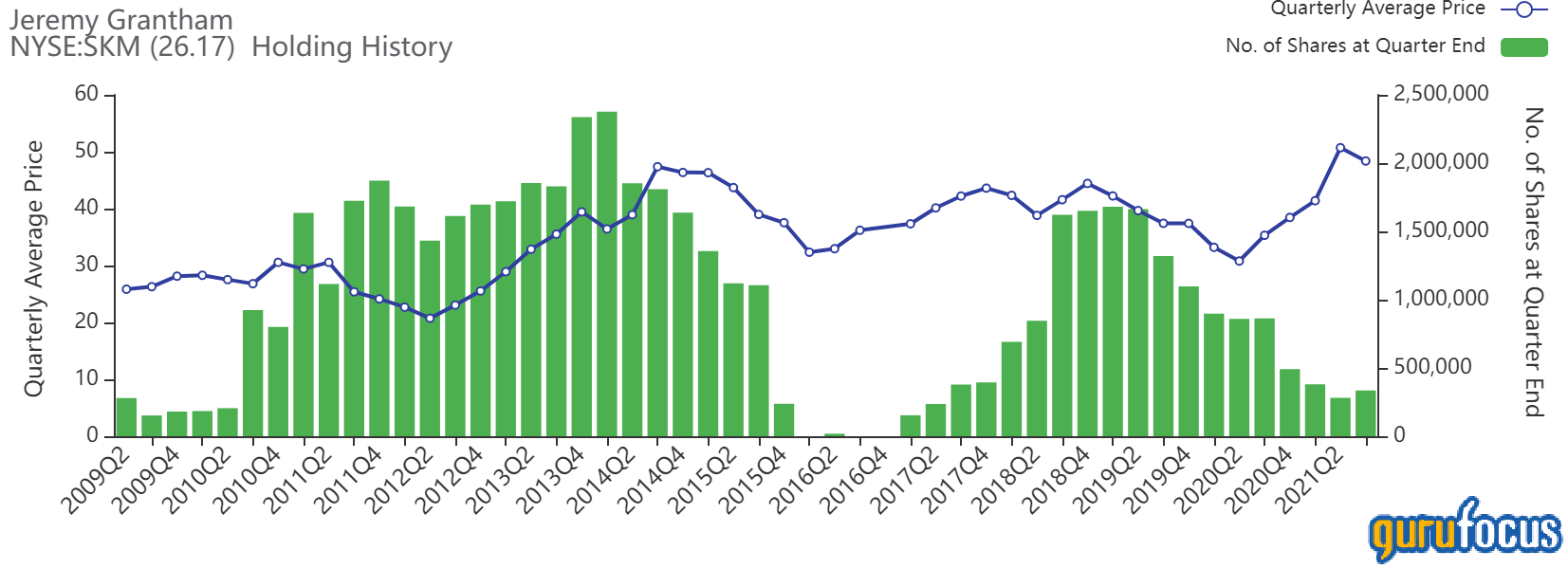

Jeremy Grantham (Trades, Portfolio)’s GMO has a holding in SK Telecom.

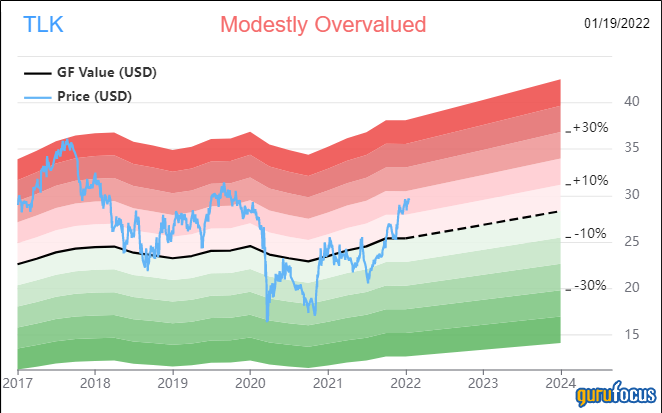

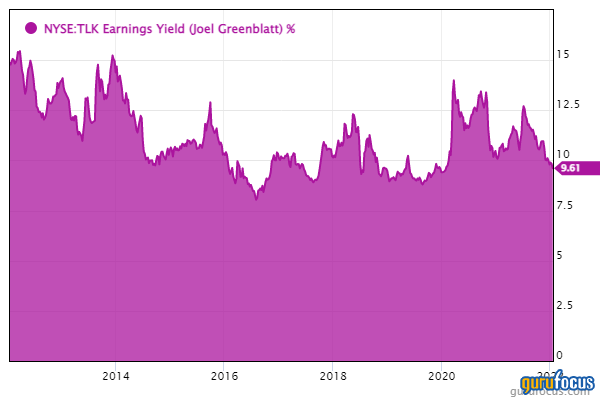

PT Telkom Indonesia

Shares of PT Telkom Indonesia traded around $29.77, showing the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.17.

GuruFocus ranks the Indonesian telecom company’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank, an earnings yield that outperforms more than 79% of global competitors and a return on capital that tops more than 70% of global telecom companies.

Rogers Communications

Shares of Rogers Communications (RCI, Financial) traded around $49.71, showing the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 0.97.

GuruFocus ranks the Toronto-based company’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, an operating margin that outperforms more than 85% of global competitors and earnings yields and returns on capital that top over 61% of global telecom companies.

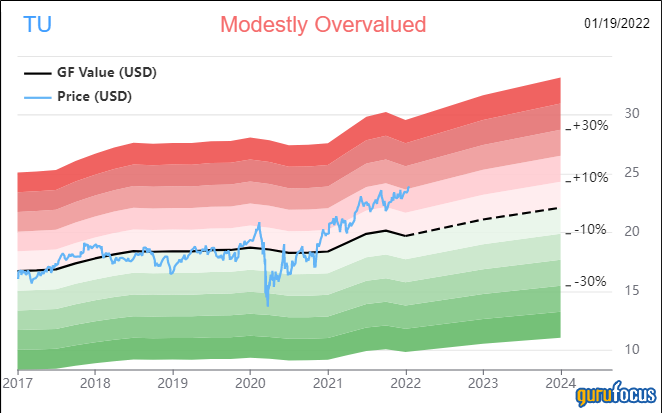

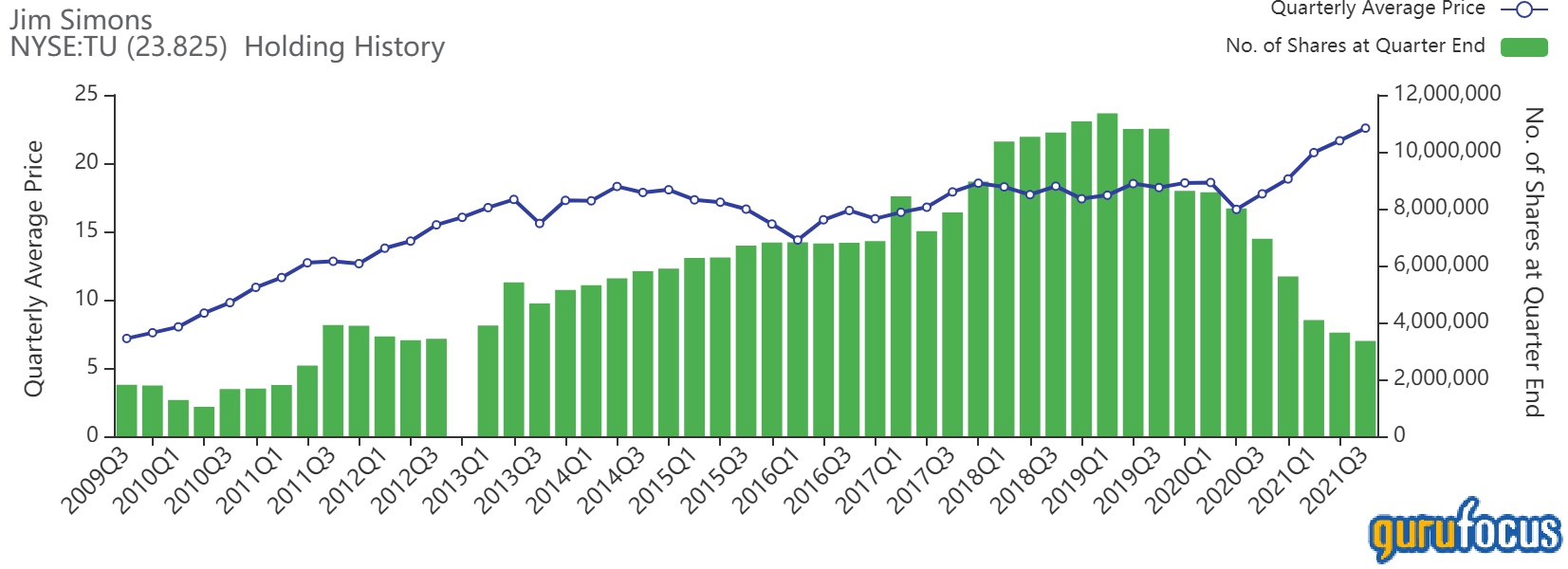

TELUS

Shares of TELUS (TU, Financial) traded around $23.88, showing the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.21.

GuruFocus ranks the Vancouver-based company’s profitability 8 out of 10 on the back of a 4.5-star business predictability rank despite earnings yields and returns on capital outperforming just over 55% of global competitors.

Gurus with holdings in TELUS include Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

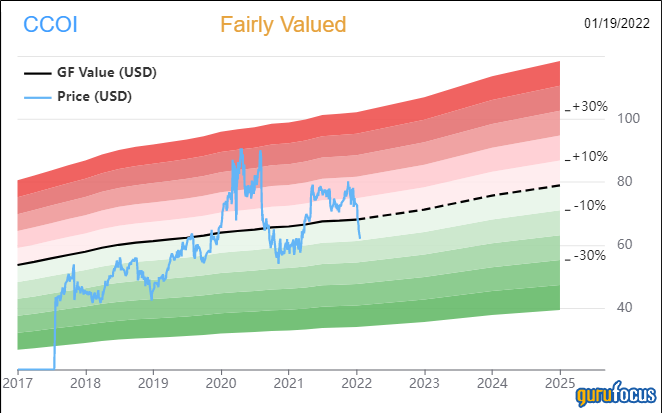

Cogent Communications

Shares of Cogent Communications (CCOI, Financial) traded around $62.01, showing the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 0.91.

GuruFocus ranks the Washington, D.C.-based internet network company’s profitability 8 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and a return on capital that outperforms approximately 60% of global competitors.