Seth Klarman (Trades, Portfolio) is a legendary value investor who follows the teachings of Benjamin Graham and, of course, Warren Buffett (Trades, Portfolio).

Despite his value investing roots, however, many of his recent investment’s are firmly in the growth at a reasonable price, or GARP, category. Let us dive into two of my favorites he has been buying.

Fiserv

Fiserv Inc. (FISV, Financial) is a global fintech and payments provider. Since its founding in 1984, the company’s vision has been to "move money and information in a way that moves the world."

It is one of the big three data processing companies in the U.S. and the largest processor of checks in the nation. The company offers a variety of services, which include account processing, data processing, card issuer processing, digital banking and cloud-based point-of-sale solutions (Clover).

Fiserv’s clients include over 10,000 financial institutions, banks, merchants and credit unions. The company notes in its annual report that “most of the services we provide are essential for our clients to run their businesses and are, therefore, non discretionary in nature.” This means the business model is robust as, even during a recession, clients will still need to access data. Management has executed a growth by acquisition strategy, which has proven to be tremendously successful so far.

In the first quarter of 2022, the company acquired Finxact, a provider of “Cloud Banking as a Service.” This is a smart move by the company as legacy banking infrastructure has software that is over 30 years old. This archaic technology can be overhauled and disrupted by services such as this.

Growing financials

Fiserv produced strong earnings in the first quarter of 2022 with adjusted revenue of $3.9 billion, up 10% year over year. The company generated operating income of $699 million, which grew 45% compared to the prior-year quarter. Earnings per share were $1.40, beating analysts' expectations by 5 cents.

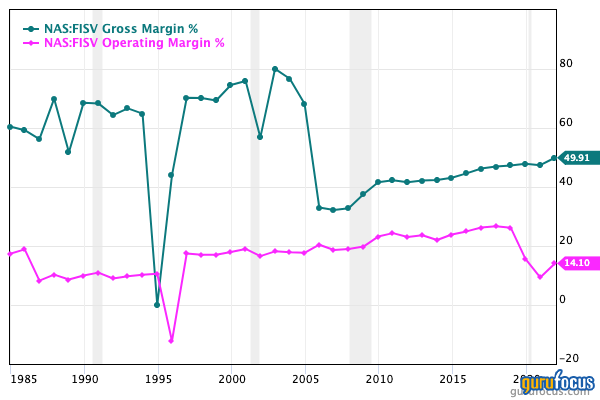

The adjusted operating margin was a healthy 32%, which was up 60 basis points year over year. The company produced strong free cash flow of $603 million.

A risk with Fiserv is the highly levered balance sheet, which has an eye-watering $20.2 billion in long-term debt. The good news is the company has just $240 million in current debt (due within the next two years) and $2.8 billion in cash and short-term investments. Management is bullish on the company’s future and repurchased 5.1 million shares for $500 million.

Valuation and buy points

Klarman was buying the stock at an average price of $101 per share in the first quarter, which is approximately 7% higher than where the stock trades today. There have also been a net of three insider buys over the past three months, with the total number of shares bought at 1,612,575.

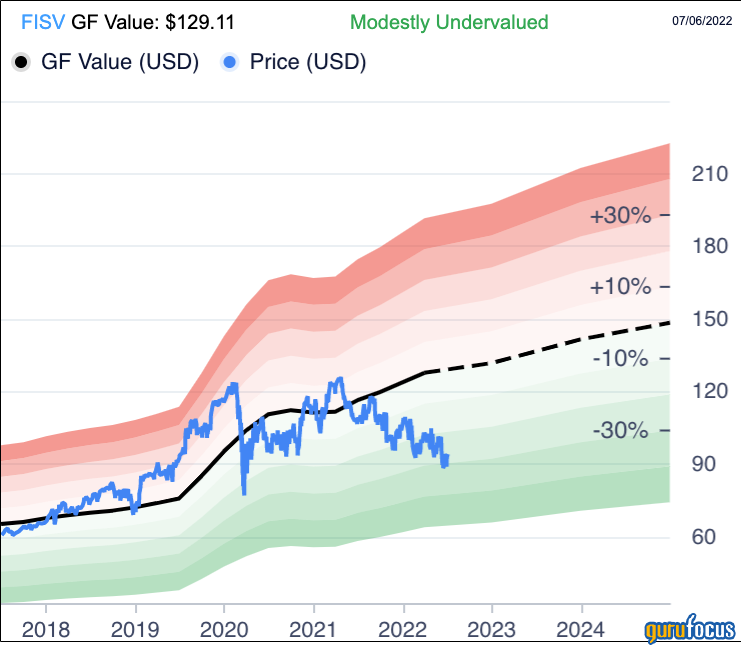

In addition, GuruFocus has highlighted the stock is trading at a price-book ratio of 1.94, which is close to the two-year low of 1.84. In addition, the price-earnings ratio of 36.7 is close to the two-year low of 34.82.

The GF Value Line indicates a fair value of $129 per share. The stock is currently trading at around $94 per share and is thus modestly undervalued.

Dropbox

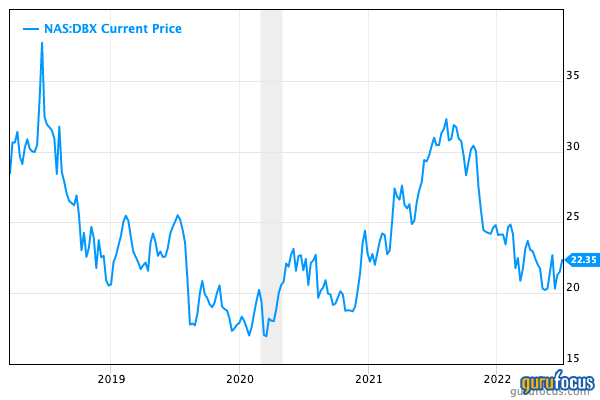

Dropbox Inc. (DBX, Financial) is a pioneer in cloud file storage for consumers. It has 700 million registered users globally, which is double the current population of the U.S. However, since the company was founded in 2007, many competitors have offered alternative solutions, from Microsoft’s (MSFT, Financial) OneDrive to Alphabet's (GOOG, Financial)(GOOGL, Financial) Google Drive and even Apple’s (AAPL, Financial) iCloud. Thus, in 2022 the stock trades about 30% lower than its initial public offering price of $30 per share.

Regardless, Klarman has seen values at these low levels and was buying shares at an average price of $23, which is about 4% higher than where the stock trades today.

Evolving business model

Dropbox has gradually evolved its business model from offering a pure cloud storage solution to a variety of other services. These include content management, secure sharing, PDF editing, team collaboration and content backups. The company even acquired e-signature leader HelloSign in 2019 to offer customers an alternative to traditional paper signatures.

The company produced strong results in the first quarter of 2022. The number of paying users increased 7% year over year to reach 17.1 million. Total annual recurring revenue was $2.3 billion, up by 8.4% compared to the same time last year. Revenue was $562 million, up 9% year over year.

The company’s “land and expand” strategy has been working well as average revenue per paying user increased from $133 to $135 in the prior year. Around 80% of Dropbox’s paying users have the platform for work and thus there is a tremendous market opportunity to expand, similar to the way Slack became embedded into enterprises before being acquired by Salesforce (CRM, Financial) for $27 billion. The GAAP operating income also increased by 45% to $89.5 million.

Dropbox generated free cash flow of $130.7 million. Free cash flow per share of 35 cents was up from 27 cents in the prior year. The gross margin also increased to an extremely high 79.9% from 78.6% in the year-ago quarter. The operating margin also nearly doubled from 8.3% to 15.9%, which is fantastic.

Dropbox has a robust balance sheet with cash, cash equivalents and short-term investments of $1.49 billion. However, it does have fairly high long-term debt of $1.37 billion.

Valuation

In terms of valuation, Dropbox trades at a price-earnings ratio of 24, which is cheaper than historic levels.

The GF Value Line indicates a fair value of roughly $29 per share, which is higher than where the stock trades today. Thus, the stock is modestly undervalued.

Final thoughts

Both Fiserv and Dropbox are incredible technology companies that have large market opportunities for growth. In addition, the recent pullback in share price now means each stock is undervalued relative to historic levels.

As such, it is not surprising to see Klarman buying at the low levels and with a margin of safety.