Chris Davis (Trades, Portfolio)’ Davis Selected Advisors disclosed its equity portfolio for the third quarter earlier this week.

Taking a patient, long-term approach, the guru’s Tucson, Arizona-based firm seeks to invest in durable, well managed companies that can be purchased at value prices, preferably when they are out of favor.

Based on these criteria, 13F filings for the three months ended Sept. 30 show Davis established three new positions, exited three stocks and added to or trimmed a number of other existing investments. His most notable trades included additions to the Meta Platforms Inc. (META, Financial) and Teck Resources Ltd. (TECK, Financial) stakes as well as reductions to the Intel Corp. (INTC, Financial), Alibaba Group Holding Ltd. (BABA, Financial) and Alphabet Inc. (GOOG, Financial)(GOOGL, Financial) holdings.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Meta Platforms

With an impact of 0.91% on the equity portfolio, Davis increased his Meta Platforms (META, Financial) position by 28.73%, buying 949,362 shares. The stock traded for an average price of $162.08 per share during the quarter.

The guru now holds 4.25 million shares, accounting for 4.10% of the equity portfolio and is now the eighth-largest holding. GuruFocus estimates he has gained 11.99% on the long-held investment.

The Menlo Park, California-based social media company formerly known as Facebook has a $294.21 billion market cap; its shares were trading around $113.05 on Friday with a price-earnings ratio of 10.58, a price-book ratio of 2.38 and a price-sales ratio of 2.43.

The GF Value Line suggests the stock is significantly undervalued currently based on its historical ratios, past financial performance and analysts’ projections of future earnings.

Further, the GF Score of 83 out of 100 indicates the company has good outperformance potential, driven by high ranks for profitability, growth and financial strength despite receiving low marks for GF Value and momentum.

Of the gurus invested in Meta, Ken Fisher (Trades, Portfolio) has the largest stake with 0.44% of its outstanding shares. Dodge & Cox, Baillie Gifford (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies, First Eagle Investment (Trades, Portfolio), Steve Mandel (Trades, Portfolio), Chase Coleman (Trades, Portfolio) and Andreas Halvorsen (Trades, Portfolio), among several others, also have large holdings.

Teck Resources

The guru boosted the Teck Resources (TECK, Financial) stake by 16.91%, picking up 1.84 million shares. The transaction impacted the equity portfolio by 0.40%. Shares traded for an average price of $30.87 each during the quarter.

Davis now holds 12.75 million shares in total, which represent 2.76% of the equity portfolio. GuruFocus says he has gained an estimated 25.18% on the investment so far.

The Canadian mining company, which has coal, copper, zinc and oil sands operations, has a market cap of $18.29 billion; its shares were trading around $36.37 on Friday with a price-earnings ratio of 5.54, a price-book ratio of 0.98 and a price-sales ratio of 1.30.

According to the GF Value Line, the stock is fairly valued currently.

The company has good outperformance potential based on its GF Score of 80. It raked in high points for profitability and momentum and middling marks for growth, financial strength and GF Value.

With a 5.21% stake, Dodge & Cox is the company’s largest guru shareholder. Other notable guru investors of Teck Resources include Jeremy Grantham (Trades, Portfolio), David Einhorn (Trades, Portfolio) and Stanley Druckenmiller (Trades, Portfolio).

Intel

The investor curbed the Intel (INTC, Financial) stake by 29.49%, selling 4.88 million shares. The transaction had an impact of -1.17% on the equity portfolio. During the quarter, the stock traded for an average per-share price of $34.09.

Davis now holds a total of 11.7 million shares, which occupy 2.14% of the equity portfolio. GuruFocus data shows he has lost approximately 31.60% on the investment over its lifetime.

The semiconductor chip manufacturer, which is headquartered in Santa Clara, California, has a $122.86 billion market cap; its shares were trading around $29.71 on Friday with a price-earnings ratio of 9.16, a price-book ratio of 1.23 and a price-sales ratio of 1.77.

Based on the GF Value Line, the stock appears to be significantly undervalued currently.

The GF Score of 84 means the company has good outperformance potential. While it received high ratings for profitability, growth and GF Value and middling marks for financial strength, momentum missed the mark with a low rank of 2 out of 10.

PRIMECAP Management (Trades, Portfolio) is Intel’s largest guru shareholder with a 1.18% stake. Seth Klarman (Trades, Portfolio), Michael Price (Trades, Portfolio), Grantham, Fisher and Tweedy Browne (Trades, Portfolio) also have significant positions in the stock.

Alibaba

Davis slashed his holding of Alibaba (BABA, Financial) by 65.03%, dumping 1.42 million shares. The transaction impacted the equity portfolio by -1.03%. The stock traded for an average price of $95.27 per share during the quarter.

The guru now holds 762,491 shares, giving it 0.43% space in the equity portfolio. He has lost an estimated 15.33% on the investment so far according to GuruFocus.

The Chinese e-commerce giant has a market cap of $185.88 billion; its shares were trading around $69.91 on Friday with a price-earnings ratio of 39.01, a price-book ratio of 1.29 and a price-sales ratio of 1.36.

The GF Value Line suggests the stock is significantly undervalued currently.

The retail company has poor future performance potential, however, based on its GF Score of 69. While its profitability, growth and financial strength got high ratings, the GF Value was low at 2. It also did not receive a momentum rank.

Of the gurus invested in Alibaba, David Herro (Trades, Portfolio) has the largest stake with 1.42% of its outstanding shares. PRIMECAP, Dodge & Cox, Al Gore (Trades, Portfolio)’s Generation Investment, Fisher, the iShares MSCI ACWI ex. U.S. ETF, Ron Baron (Trades, Portfolio) and Philippe Laffont (Trades, Portfolio) also have large positions.

Alphabet

The guru reduced his investment in Class C shares of Alphabet (GOOG, Financial) by 9.87%, or 510,286 shares, while the position in the Class A shares (GOOGL, Financial) was trimmed 8.22%, or 393,759 shares. The transactions had impacts of -0.36% and -0.28% on the equity portfolio. During the quarter, the Class C stock traded for an average price of $111.66 each, while the Class A stock traded at an average per-share price of $110.89.

Davis now holds 4.66 million Class C shares and 4.39 million Class A shares, which make up 3.19% and 2.99% of the equity portfolio. For the first investment, he has gained 133.65% so far, while the second has returned 207.22%.

The Mountain View, California-based tech giant, which owns the Google search engine and YouTube, has a $1.24 trillion market cap; its Class C shares were trading around $95.95 on Friday with a price-earnings ratio of 19.05, a price-book ratio of 4.90 and a price-sales ratio of 4.51.

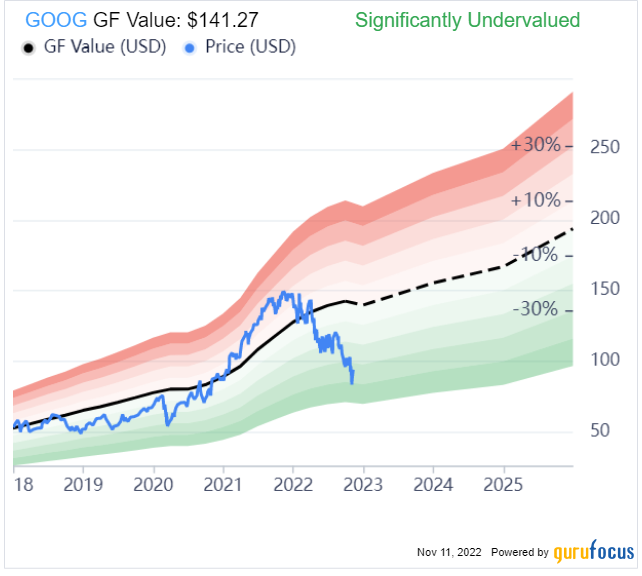

According to the GF Value Line, the stock is significantly undervalued currently.

Further, the GF Score of 97 means the company has high outperformance potential, driven by high ratings for profitability, growth, momentum, GF Value and financial strength.

With a 0.32% stake, Dodge & Cox is Alphabet’s largest guru shareholder. Other major guru investors of the Class C stock include Baillie Gifford (Trades, Portfolio), Tom Russo (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Yacktman Asset Management (Trades, Portfolio), Fisher and First Pacific Advisors (Trades, Portfolio).

Additional trades and portfolio performance

During the quarter, Davis entered new positions in Healthcare Realty Trust Inc. (HR, Financial), Wesco International Inc. (WCC, Financial) and RH (RH, Financial). He also sold out of SL Green Realty Corp. (SLG, Financial), whittled down his holdings of JD.com Inc. (JD, Financial) and Loews Corp. (L, Financial) and increased the Amazon.com Inc. (AMZN, Financial) investment.

The guru’s $14.06 billion equity portfolio, which is composed of 114 stocks, is most heavily invested in the financial services sector at 45.34%.

In 2021, the firm returned 31.46%, significantly outperforming the S&P 500 Index’s 28.7% return.