Weitz Investment Management, the firm led by Wallace Weitz (Trades, Portfolio), disclosed in a regulatory filing that its top sells during the third quarter included reductions to its holdings of Comcast Corp. (CMCSA, Financial), Dun & Bradstreet Holdings Inc. (DNB, Financial), CoStar Group Inc. (CSGP, Financial), Black Knight Inc. (BKI, Financial) and Visa Inc. (V, Financial).

The Omaha, Nebraska-based firm manages several funds, including the Weitz Value Fund and Weitz Partners Value Fund. Weitz combines Benjamin Graham’s price sensitivity and insistence on a margin of safety with a conviction that qualitative factors that allow a company to have some control over the company’s destiny can be more important than statistical measurements like book value per share and reported earnings per share.

As of September, the firm’s $1.68 billion 13F equity portfolio contains 55 stocks with a quarterly turnover ratio of 1%. The top four sectors in terms of weight are financial services, communication services, technology and health care, representing 26.45%, 21.37%, 17.77% and 9.27% of the equity portfolio.

Investors should be aware13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Comcast

Weitz sold 450,000 shares of Comcast (CMCSA, Financial), slicing 87.45% of the position and 0.94% of its equity portfolio. Shares averaged $37.39 during the third quarter.

GuruFocus’ GF Value Line labeled the Philadelphia-based cable network company a possible value trap due to its low price-to-GF Value ratio of 0.63 as of Friday and a rank of just 4 out of 10 for financial strength and momentum.

Despite low financial strength and momentum, Comcast has a GF Score of 89 out of 100, driven by a growth rank of 10 out of 10, a profitability rank of 9 out of 10 and a GF Value rank of 8 out of 10.

Comcast’s profitability ranks 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and a gross profit margin that outperforms approximately 80% of global competitors.

Other gurus with holdings in Comcast include Dodge & Cox and First Eagle Investment (Trades, Portfolio).

Dun & Bradstreet Holdings

The firm sold 1,022,617 shares of Dun & Bradstreet Holdings (DNB, Financial), chopping 58.91% of the holding and 0.81% of its equity portfolio. Shares averaged $14.83 during the third quarter.

The Jacksonville, Florida-based company provides business data and analytics across the U.S., Canada and other international markets. The company has a market cap of $6.18 billion with an enterprise value of $9.50 billion.

Dun & Bradstreet’s financial strength ranks 3 out of 10 on several warning signs, which include a low Altman Z-score of 0.72, a low interest coverage ratio of 0.86 and a cash-to-debt ratio that underperforms more than 90% of global competitors.

CoStar Group

Weitz sold 215,900 shares of CoStar Group (CSGP, Financial), trimming 14.75% of the holding and 0.69% of its equity portfolio.

Shares of CoStar averaged $69.42 during the third quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.88 as of Friday.

The Northwest, Washington-based real estate marketing company has a GF Score of 97 out of 100 based on a growth rank of 10 out of 10, a rank of 9 out of 10 for profitability and momentum, a financial strength rank of 8 out of 10 and a GF Value rank of 7 out of 10.

CoStar’s profitability ranks 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, a high Piotroski F-score of 8 out of 9 and a gross profit margin that has increased approximately 1% per year on average over the past five years and outperforms more than 88% of global competitors.

Black Knight

The firm sold 60,000 shares of Black Knight (BKI, Financial), trimming 13.86% of the position and 0.21% of its equity portfolio. Shares averaged $65.86 during the third quarter.

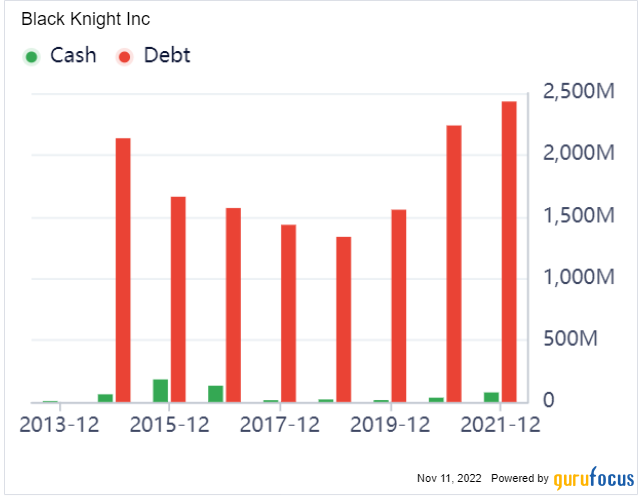

GuruFocus labeled the Jacksonville, Florida-based data analytics software company a possible value trap due to its low price-to-GF Value ratio of 0.67 as of Friday and low financial strength rank of 4 out of 10.

Black Knight’s low financial strength is driven by several warning signs, which include a low Altman Z-score of 2.47 and an interest coverage ratio that is less than 5 and underperforms more than 85% of global competitors.

The company has a GF Score of 79 out of 100: Although the company has a GF Value rank of 10 out of 10, a momentum rank of 8 out of 10 and a profitability rank of 7 out of 10, Black Knight’s growth ranks just 5 out of 10.

Visa

Weitz sold 20,000 shares of Visa (V, Financial), paring 4.59% of the position and 0.21% of its equity portfolio.

Shares of Visa averaged $203.49 during the third quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.76.

The San Francisco-based payment processing company has a GF Score of 99 out of 100, driven by a GF Value rank of 9 out of 10 and a rank of 10 out of 10 for profitability, growth and momentum despite financial strength ranking just 7 out of 10.

Other gurus with holdings in Visa include Frank Sands (Trades, Portfolio)’ Sands Capital Management, Ken Fisher (Trades, Portfolio)’s Fisher Investments and Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial).