Michael Burry is the founder of Scion Asset Management and is most famous for forecasting the bursting of the housing bubble and the financial crisis of 2008. His story was the basis for the critically acclaimed “Big Short” movie, in which Burry was played by Christian Bale.

In a recent Tweet, Burry stated he believes that inflation has peaked, but warned that it is “not the last peak of this cycle." Burry is referring to the latest inflation numbers which showed the Consumer Price Index (CPI) has dropped to 6.5%, down from 7.1% in the prior month and its peak of 9.1% in June 2022. Overall this is a positive sign as it shows the Federal Reserve’s interest rate hikes are working in slowing down inflation. However, inflation is still far above a healthy level.

Burry warned that the “U.S. is in a recession by any definition." He believes the "Fed will cut and the government will stimulate" in response to lower inflation. Then he forecasts “another inflation spike."

Although these projections shouldn’t be taken as fact, it is a possible scenario. JPMorgan (JPM, Financial) forecasts a recession in 2023, as do many other analysts.

Thus, in this post, we will go over two communications stocks that Burry has invested into in the third quarter of 2022 after selling most of his 13F portfolio in the second quarter of 2022.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Liberty Latin America Ltd

Liberty Latin America Ltd (LILAK, Financial) is a telecommunications company with a footprint of operations across Latin America and the Caribbean. The business offers a range of services which include cable television, high-speed internet and traditional telephone services. Latin America is an emerging region and had ~533 million internet users as of 2021. The overall region has a ~68.8% internet penetration rate, which is below the 92% rate in the U.S. This means Liberty Latin America has a huge growth opportunity to equip this growing region.

The company makes its revenue through the rental of its internet/phone infrastructure to consumers and businesses. In addition, the company offers a plethora of premium content, which includes video on demand and pay per view events.

An interesting “hidden asset” of Liberty Latin America could be its vast footprint of data centers. These data centers are in high demand due to the growth in the Cloud and digital transformation tailwinds. The Cloud industry was valued at $405.6 billion in 2021 and is forecast to grow at a rapid 19.9% compound annual growth rate, reaching $1.7 trillion by 2029 according to estimates from Grand View Research.

Guru investments

In the third quarter of 2022, Michael Burry purchased 155,761 shares of Liberty Latin America. During the quarter, shares traded at an average price of $7 per share. At the time of writing the stock is trading at ~$9 per share.

Legendary investor Mario Gabelli (Trades, Portfolio) also invested in the stock in the third quarter of 2022, as did Jim Simons (Trades, Portfolio)' Renaissance technologies.

Solid financials

Liberty Latin America reported solid financial results for the third quarter of 2022. Revenue was $1.22 billion, which beat analyst expectations by $8.21 million and increased by 2% year-over-year. This may not be a very fast growth rate, but in the prior year, the company grew at over 34% rate, which is solid.

In terms of profitability, Liberty Latin America reported operating income of $157.5 million, which increased by a solid 8% year-over-year and beat analyst expectations.

The company also has a strong balance sheet with $836.8 million in cash and short term investments compared to total debt of $8.4 billion, the majority of which is long-term debt.

Valuation

Liberty Latin America trades at a price-sales ratio of 0.41, which is 39% cheaper than its five-year average. The stock also trades at an enterprise-value-to-Ebit ratio of 13, which is 26% cheaper than its five-year average.

The GF Value chart indicates a fair value of $9.83 per share, making the stock “fairly valued” at the time of writing.

Charter Communications Inc.

Burry also owns shares in Charter Communications (CHTR, Financial), another company in the internet connectivity market. Charter Communications has approximately 33 million customers across the U.S. which are signed up to services under its Spectrum brand label. Spectrum's offerings include internet connection, TV services, mobile and traditional phone packages.

Charter recently announced a joint venture partnership with Comcast (CMCSA, Financial). The goal of this is to create a “next generation” streaming platform which can take on major players such as Netflix (NFLX) and Disney+ (DIS). Netflix turned a huge chunk of TV viewership from a multi-channel to a single streaming provider, but now, we seem to be seeing a shift to multi-streaming, which I consider to be like traditional TV channels in some ways (except you choose which "channels" to subscribe to). I believe this is only possible as streaming providers have reached such a scale that they can offer extremely low cost packages. For example, Netflix costs around $10 per month, and the company has even been flexing its pricing increases with no major pushback.

Charter Communications has also recently announced a partnership with Cloud communications provider RingCentral. The company specializes in Cloud based phone systems, video conferencing and even Cloud contact centers. Together, Charter Communications and RingCentral have launched two new products. This includes the Spectrum business connect and Spectrum Enterprise Unified Communications platform. These products are targeted at small-medium sized businesses and enterprises in order to provide a Cloud phone solution coupled with Charter’s high speed internet. This platform is ideal for remote workers and is poised to benefit from trends in this growing industry.

Guru investors

In the third quarter of 2022, Michael Burry purchased ~10,000 shares of Charter Communications at an average purchase price of $428 per share.

Other gurus who own shares of the stock include Dodge & Cox and Warren Buffett (Trades, Portfolio).

Solid financials

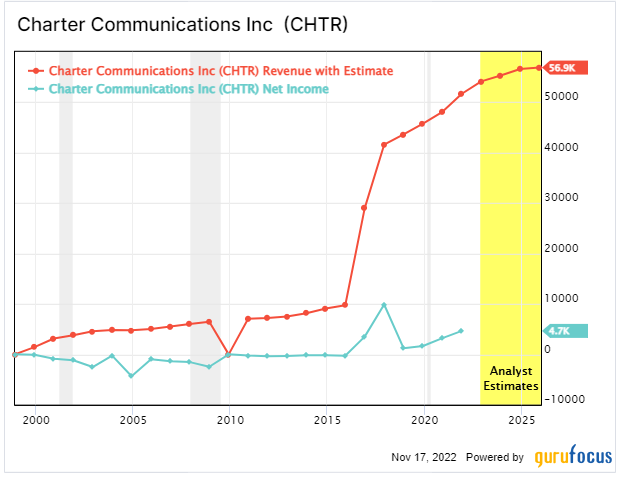

Charter Communications reported solid financial results for the third quarter of 2022. Its revenue was $13.55 billion, which rose by just 3% year-over-year. This is a fairly slow growth rate, but it is expected for a legacy telecom company. A positive is last year the company grew its revenue by 9% year-over-year.

The company generated solid operating income of $3.33 billion, which increased by nearly 15% year-over-year. Earnings or profits are the lifeblood of any business, so it's great to see profitability increasing.

Charter Communications also increased its free cash flow from $1.1 billion in the third quarter of 2020 to $1.4 billion by the same quarter of 2022. However, its free cash flow is down from the $1.7 billion reported in the second quarter of 2022. This looks to have been driven mainly by increased capital expenses.

Charter Communications has $480 million in cash and marketable securities on its balance sheet. The company has a substantial amount of total debt equating to over $97 billion. This is pretty atrocious but expected for a legacy telecommunications organization. The positive is the majority of this debt ($95.5 billion) is long term debt. In addition, its “current debt” due within the next two years equated to ~$1.5 billion, which is manageable.

Valuation

The company trades at a price-earnings ratio of 12.06, which is 72% lower than its five-year average. This means the stock is undervalued relative to historic multiples.

The GF Value chart has calculated a fair value of $753 per share. This means the stock is deeply undervalued at its $338 per share price at the time of writing. A word of caution though, the GF Value system does indicate the stock could be a value trap due to declining fundamentals and high debt.

Final thoughts

Both Liberty Latin America and Charter Communications are two legacy telecommunications companies which are helping to connect the world. Charter Communications has steady revenue and growing profitability, which is a positive sign. However, its high debt is pretty atrocious (even for a telecom company). Liberty Latin America is more of an interesting play in my eyes as the company can benefit from the increasing internet penetration across Latin America.