Parnassus Investments is comprised of a collection of funds covering a variety of areas from the value (via the Endeavour Fund) to the Growth Fund and many more. The overall investment business was founded by Jerome Dodson (Trades, Portfolio) in 1984. Generally, Dodson aims to invest in businesses with competitive advantages, high-quality management and a long runway for growth. He also has a tendency to avoid companies with high leverage or those which don’t exercise effective ESG practices.

The Parnassus Mid Cap Growth Fund recently disclosed its mutual fund updates on its website for the second quarter of 2022, which ended on June 30. Notably, the fund loaded up on two big data stocks. The big data industry is forecast to grow at an 11% compounded annual growth rate (CAGR) and reach a value of $273 billion by 2026, according to estimates from M&M Research. Let's take a look.

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

Twilio

The Parnassus Mid Cap Growth Fund purchased 103,370 shares of Twilio (TWLO, Financial) in the quarter, during which shares traded around an average price of $59.14.

Twilio is a global software company and a leader in communications as a service (CaaS). Its flagship product is its messaging API which enables companies to send bulk text messages to customers. A prime example of this is Airbnb (ABNB, Financial), which utilizes the text message service to inform guests of their booking. Another product Twilio offers is its “Flex” solution, which is effectively a cloud-based contact center. This is a brilliant product as it mitigates the need for physical call center offices with large overheads and instead offers a scalable solution.

In 2020, Twilio acquired Segment for $3.2 billion, and this became its Customer Data Platform (CDP) segment. A CDP effectively enables businesses to collect all their customer data in a single place and then profile each audience, before sending personalized engagement to each.

Another positive of Twilio is the business is founder-led by CEO Jeff Lawson. I like founder-led businesses as this often creates aligned incentives with investors and can lead to greater success.

Financials

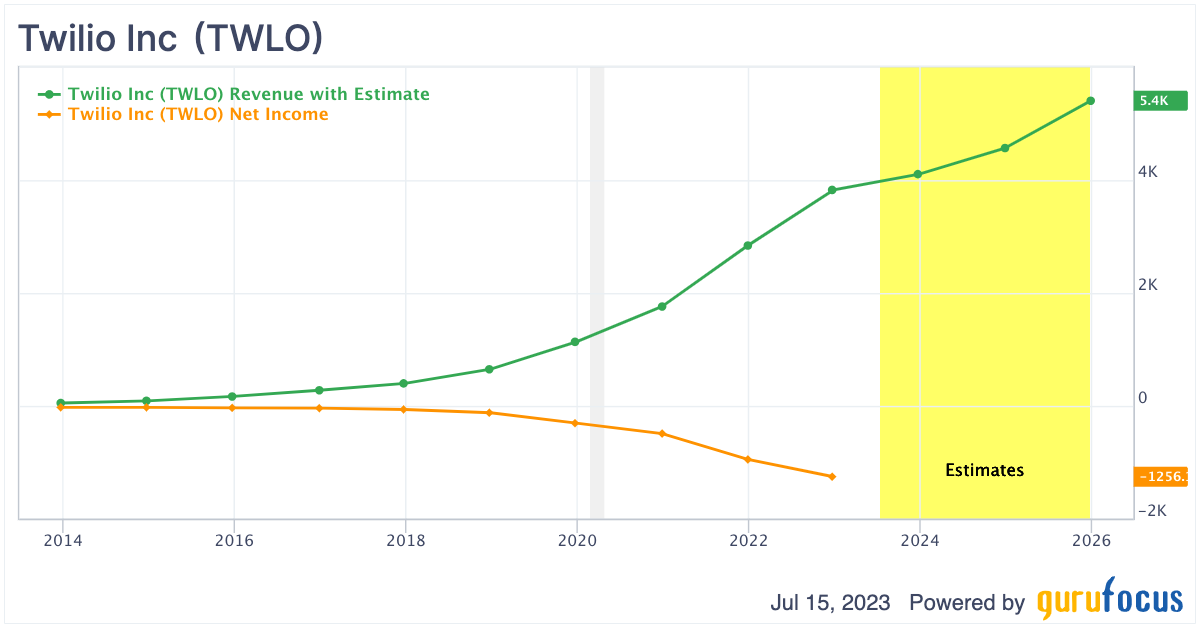

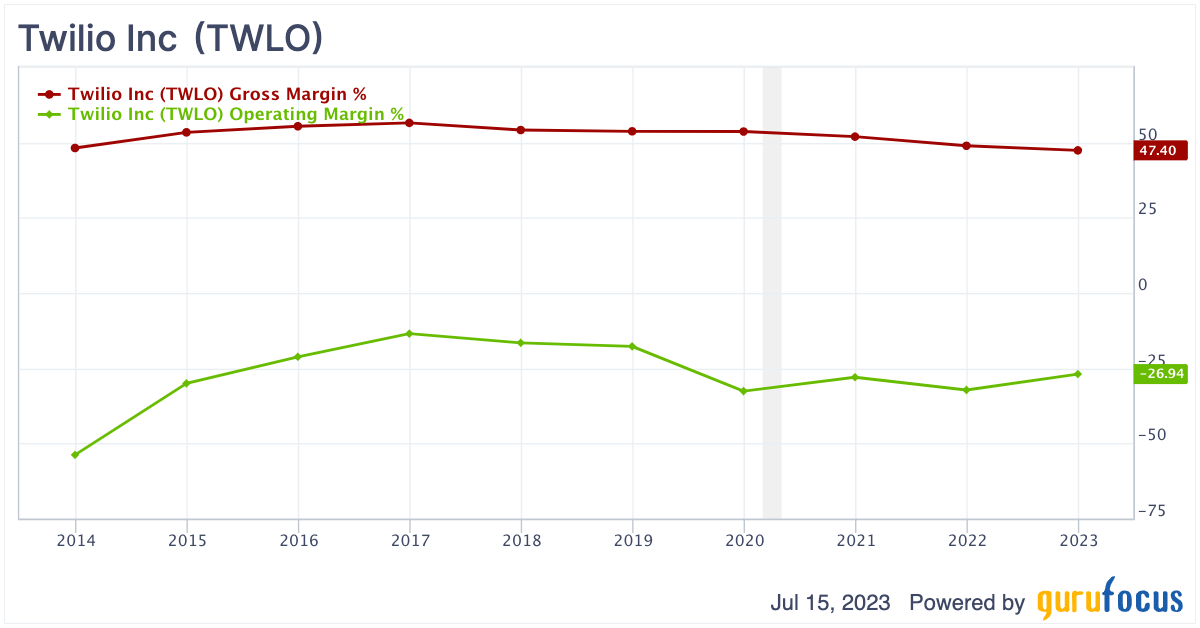

Twilio reported strong financial results for its first quarter of fiscal 2023. Its revenue was $1.01 billion, which beat analyst forecasts by $3.81 million and rose by ~15% year over year.

This growth rate was slower than the prior 22% year-over-year growth rate reported in the fourth quarter of 2022 and the rapid 48% growth rate reported in the first quarter of 2022. However, given the macroeconomic climate, this was expected.

Overall, the top line was driven by a solid increase in active customer accounts from 268,000 in the first quarter of 2022 to a staggering 300,000 in the first quarter of 2023.

Twilio also has a super high dollar-based net expansion rate of 106%, which means customers are sticking with the platform and spending more. However, the percentage of upsells has slowed down since the prior year when the company reported a net expansion rate of 127%.

The company reported an operating loss of $118 million, which was an improvement over the $211.8 million loss reported in the prior quarter. Its

earnings per share (EPS) was $0.47, which beat analyst forecasts by $0.26.

The company has a solid balance sheet with $3.9 billion in cash and short-term investments compared to $1.2 billion in total debt.

Valuation

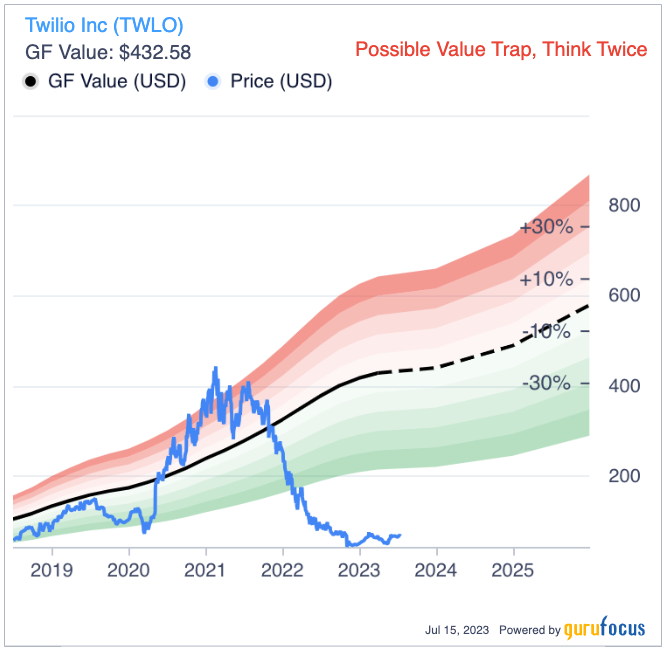

In terms of valuation, Twilio trades at a price-sales ratio of 3, which is 80% cheaper than its five-year average.

The GF Value chart indicates a fair value of $433 per share and thus the stock is undervalued, though the system flags it as a "possible value trap” due to the previous high valuation ratios and the sharp decline in earnings per share, though I think these are short-term issues and the company can recover.

Verisk Analytics

The fund purchased 15,100 shares of Versik Analytics (VRSK, Financial) in the quarter. For the three months ended June 30, shares traded for an average price of $210.

Verisk Analytics is a data analytics company that operates across a variety of industries. This mostly includes insurance solutions, such as underwriting, fraud detection and compliance. In the financial services sector, Verisk provides predictive analytics and risk data solutions to banks, mortgage lenders and credit card issuers. In addition, the company serves the energy sector in providing data on production, infrastructure and risk.

Given the company’s strong roots in handling big data, Verisk is poised to benefit from the growth in the artificial intelligence industry. In its first quarter 2023 earning call, management explained it is listening to customers with regards to their thoughts on AI applications and developing “internal policies” to proceed.

Financials

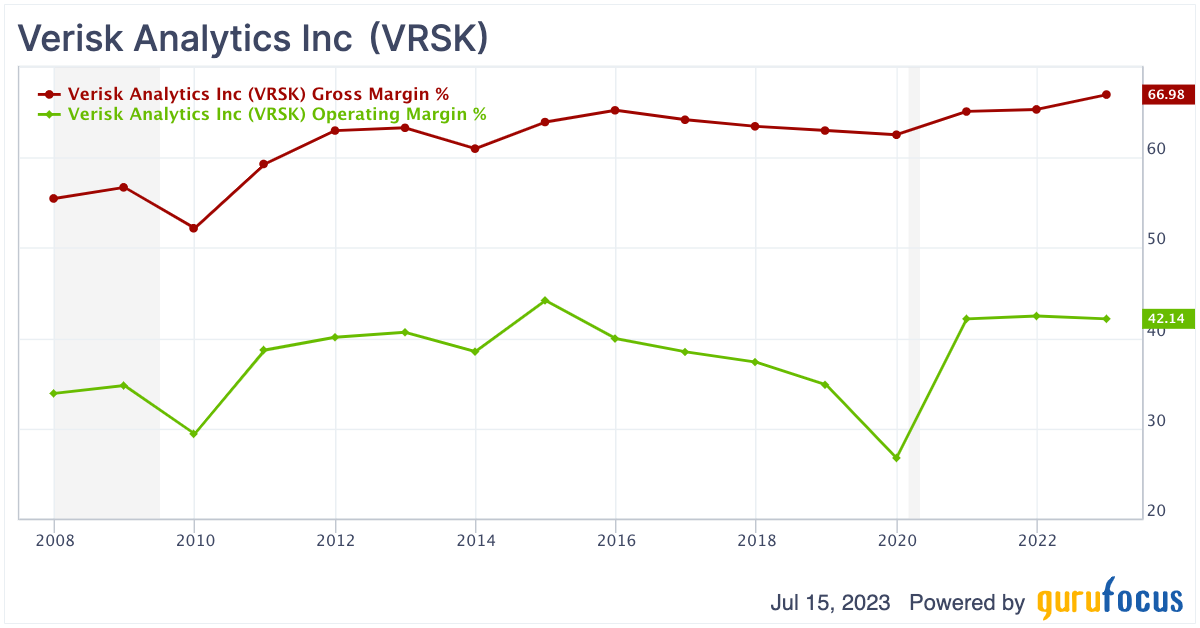

For the first quarter of 2023, Verisk reported $652 million in revenue, which increased by 1% year over year. This may not seem too exciting but it was a stark improvement over the 17% decline in revenue reported in the fourth quarter of 2022. In addition, the company beat analyst forecasts by $18.04 million which was positive.

Its top line was driven by strong growth in the insurance business. This was partially offset by the sale of its financial services business unit for $515 million in cash to credit check giant TransUnion (TRU, Financial).

Verisk also sold its 3E compliance business for a substantial $950 million to New Mountain Capital. The company received another boost from the sale of its energy business Wood Mackenzie for a staggering $3.1 billion. The buyer was Veritas Capital, a private equity firm. Management used some of the proceeds of the sale to pay down $1.4 billion of its debt. In addition, the company bought back a huge $2.5 billion worth of shares.

Downsizing can be a sign of trouble, but I think it's a positive for Verisk as these sales have enabled it to focus on its core business, which generates 80% of its revenue from subscription services. Its other 20% of revenue comes from its transactional-related business, which benefited from a boom in the automotive insurance industry. Life insurance also saw strong growth, as did travel insurance.

Verisk reported operating income of $295.1 million, which increased by a rapid 19.43% year over year. Its EPS was $1.27, which beat analyst forecasts by $0.20. This was driven by solid cost reduction initiatives, which boosted its adjusted Ebitda margin by 480 basis points to 52.2%.

Valuation

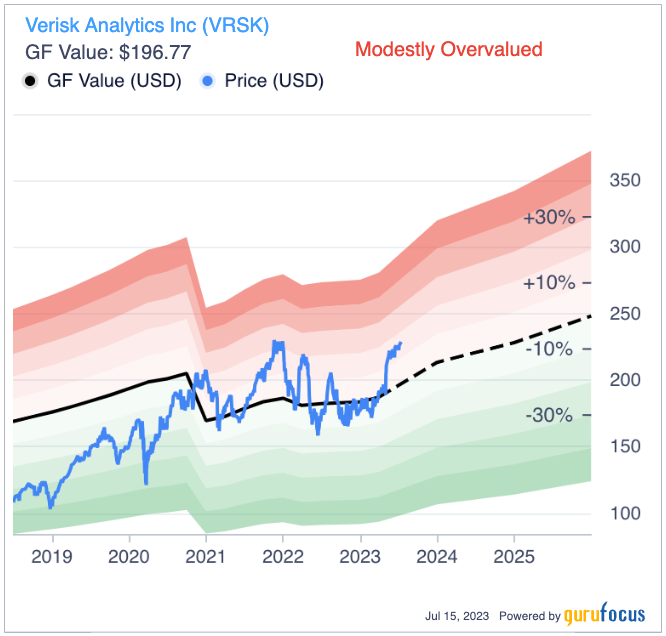

Verisk has a price-sales ratio of 15.

The GF Value chart indicates a fair value of $197 per share and thus the stock is “modestly overvalued” at the time of writing.

Final thoughts

Both Twilio and Verisk are two interesting technology companies. Both have made a series of acquisitions (in the case of Twilio) or disposals (for Verisk) over the past couple of years and are now fully aligned to focus on the strongest value creation opportunities. Despite its lower profitability, I personally prefer Twilio right now due to its steady growth and strong base of notable customers such as Airbnb. However, Verisk is a less obvious play on the tailwinds in big data, and thus could also be a great value opportunity if it were to trade cheaper, in my opinion.