Insights into FPA Crescent Fund's Latest Portfolio Adjustments

Steven Romick (Trades, Portfolio), a seasoned portfolio manager at FPA, has revealed his investment strategy for the first quarter of 2024 through the latest N-PORT filing. With a history dating back to 1996 at FPA and prior roles including Chairman of Crescent Management and a consulting security analyst, Romick brings a wealth of experience to the table. He holds a Bachelor's degree in Education from Northwestern University. The FPA Crescent Fund, known for its long and short equity positions, seeks value across a company's capital structure, focusing on undervalued stocks and bonds that are out of favor with the consensus. The fund's approach is rooted in absolute value investing, aligning interests with clients, a broad mandate, and a long-term focus, often accepting short-term underperformance for future success.

Summary of New Buys

Steven Romick (Trades, Portfolio) expanded his portfolio with 5 new stocks in the first quarter of 2024, including:

- PowerUp Acquisition Corp (PWUP, Financial), purchasing 46,911 shares, which now comprise 0.01% of the portfolio, valued at $517,430.

- Brand Engagement Network Inc (BNAIW, Financial), acquiring 173,528 shares, with an approximate total value of $20,840.

- Electriq Power Holdings Inc (ELIQW, Financial), adding 414,327 shares, with a total value of $460.

Key Position Increases

Steven Romick (Trades, Portfolio) also bolstered his stakes in 6 stocks, with significant increases in:

- NCR Atleos Corp (NATL, Financial), adding 714,428 shares for a total of 1,942,412 shares, marking a 58.18% increase in share count and a 0.22% impact on the current portfolio, valued at $38,362,640.

- JDE Peets NV (XAMS:JDEP, Financial), with an additional 424,332 shares, bringing the total to 4,466,022 shares, a 10.5% increase in share count, valued at €93,762,850.

Summary of Sold Out Positions

In a notable move, Steven Romick (Trades, Portfolio) exited 10 holdings, including:

- American International Group Inc (AIG, Financial), selling all 612,610 shares, impacting the portfolio by -0.69%.

- Heidelberg Materials AG (XTER:HEI, Financial), liquidating all 11,179 shares, with a -0.02% impact on the portfolio.

Key Position Reductions

Portfolio adjustments also included reductions in 14 stocks, with the most significant being:

- Dell Technologies Inc (DELL, Financial), reduced by 444,102 shares, leading to a -51.48% decrease in shares and a -0.57% impact on the portfolio. The stock traded at an average price of $93.3 during the quarter and has returned 52.65% over the past 3 months and 58.25% year-to-date.

- Holcim Ltd (XSWX:HOLN, Financial), cut by 238,023 shares, resulting in a -5.75% reduction in shares and a -0.31% impact on the portfolio. The stock traded at an average price of CHF 69.89 during the quarter and has returned 22.53% over the past 3 months and 19.27% year-to-date.

Portfolio Overview

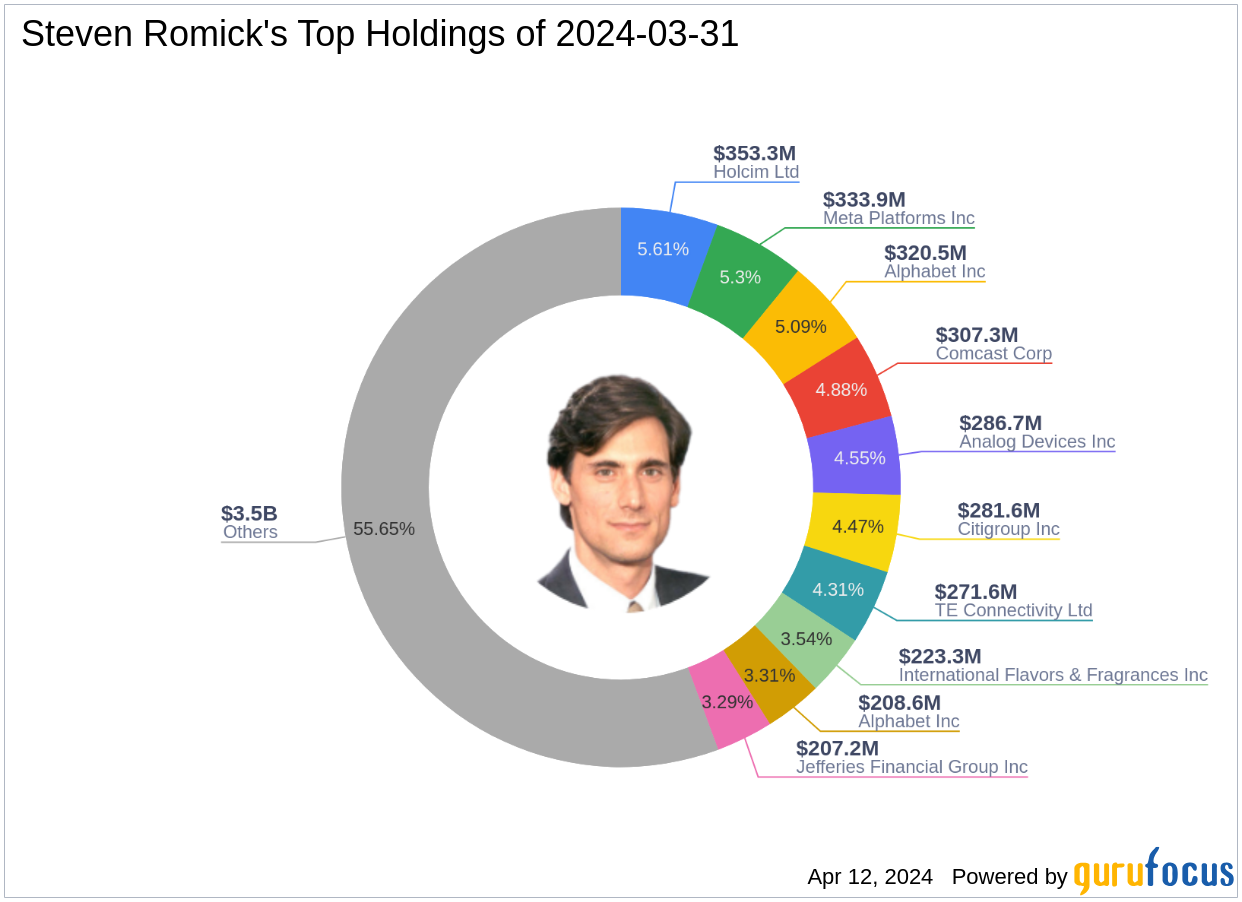

As of the first quarter of 2024, Steven Romick (Trades, Portfolio)'s portfolio comprised 78 stocks. The top holdings included 5.61% in Holcim Ltd (XSWX:HOLN), 5.3% in Meta Platforms Inc (META, Financial), 5.09% in Alphabet Inc (GOOGL, Financial), 4.88% in Comcast Corp (CMCSA, Financial), and 4.55% in Analog Devices Inc (ADI, Financial). The investments span across all 11 industries, with a focus on Communication Services, Technology, Financial Services, Basic Materials, Industrials, Consumer Cyclical, Consumer Defensive, Energy, Real Estate, Utilities, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.