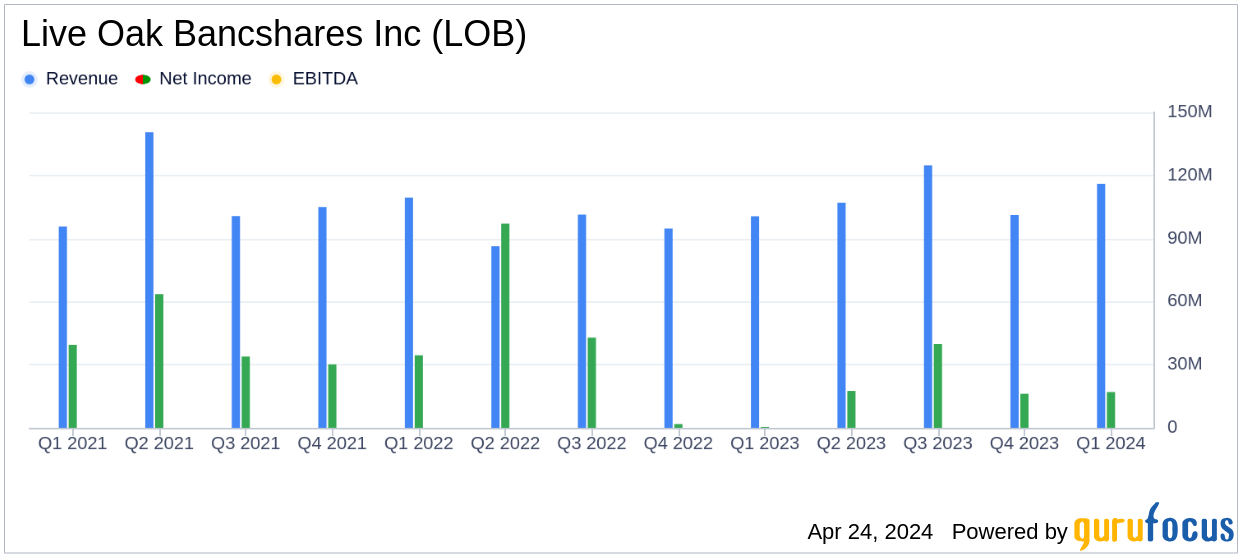

On April 24, 2024, Live Oak Bancshares Inc (LOB, Financial) disclosed its first-quarter financial results through its 8-K filing. The company reported a net income of $16.5 million, translating to earnings of $0.36 per diluted share, which fell short of the analyst's expectations of $0.47 per share. However, the total revenue of $116.2 million was in line with the estimated $116.66 million, demonstrating a consistent performance amidst challenging market conditions.

About Live Oak Bancshares Inc

Live Oak Bancshares Inc operates as the bank holding company for Live Oak Banking Company, providing lending and deposit-related services to small businesses across the United States. A significant portion of the bank’s loans are partially guaranteed by federal programs, making it a critical financier for small businesses in various industries.

Performance Highlights and Challenges

The first quarter saw a slight decline in total revenue by 2.9% compared to the previous quarter, mainly due to a decrease in noninterest income and a challenging environment for the banking industry. Despite these hurdles, Live Oak Bancshares managed to grow its loan and lease portfolio by 2.2% from the previous quarter, reaching $9.22 billion. This growth underscores the company's robust origination capabilities and its strategic focus on expanding its asset base.

Financial Achievements and Industry Impact

Live Oak's ability to maintain a stable revenue stream and manage expenses effectively is evident from its noninterest expense reduction, which decreased by 15.6% from the fourth quarter of 2023. Such financial management is crucial in the banking industry, particularly in periods of economic uncertainty, and highlights Live Oak's operational efficiency.

Detailed Financial Analysis

The net interest income slightly increased to $90.1 million, up from $89.6 million in the previous quarter, reflecting a careful balance between interest income and expense amidst fluctuating interest rates. The bank’s focus on maintaining a healthy loan portfolio is also apparent from its managed net charge-offs, which decreased to $3.2 million from $4.4 million in the previous quarter, indicating improved asset quality.

However, the bank faced challenges in its noninterest income, which saw a decrease due to losses in loan servicing asset revaluation and equity method investment losses. This was partially offset by gains in other noninterest income, primarily from increased fair value of equity warrant assets.

Strategic Initiatives and Forward Outlook

Live Oak Bancshares continues to focus on strategic growth and operational efficiency to navigate the complex banking landscape. The increase in borrowings by $100 million through a fixed-rate term loan highlights the bank's proactive measures to strengthen its capital position for future growth.

The company's commitment to innovation and customer service, as emphasized by CEO James S. Mahan III, positions it well to continue its support for America's small businesses, despite the ongoing challenges in the banking sector.

Conclusion

While Live Oak Bancshares Inc missed EPS estimates this quarter, its alignment with revenue projections and strategic growth initiatives provide a stable outlook for the company. Investors and stakeholders will likely watch closely how the bank maneuvers through the evolving economic conditions and capitalizes on its strong foundation in small business lending.

Explore the complete 8-K earnings release (here) from Live Oak Bancshares Inc for further details.