The relative calm persists. The TPP midweek update by Lane Clark.

The Relative Calm Persists.

The market is still taking the rolling back of tariff threats as its main focus. The Trump administration does seem to be ‘making deals’, although we fear this may soon run out of steam. It is also unclear exactly what these deals are, but right now, nobody cares — any deal is better than before.

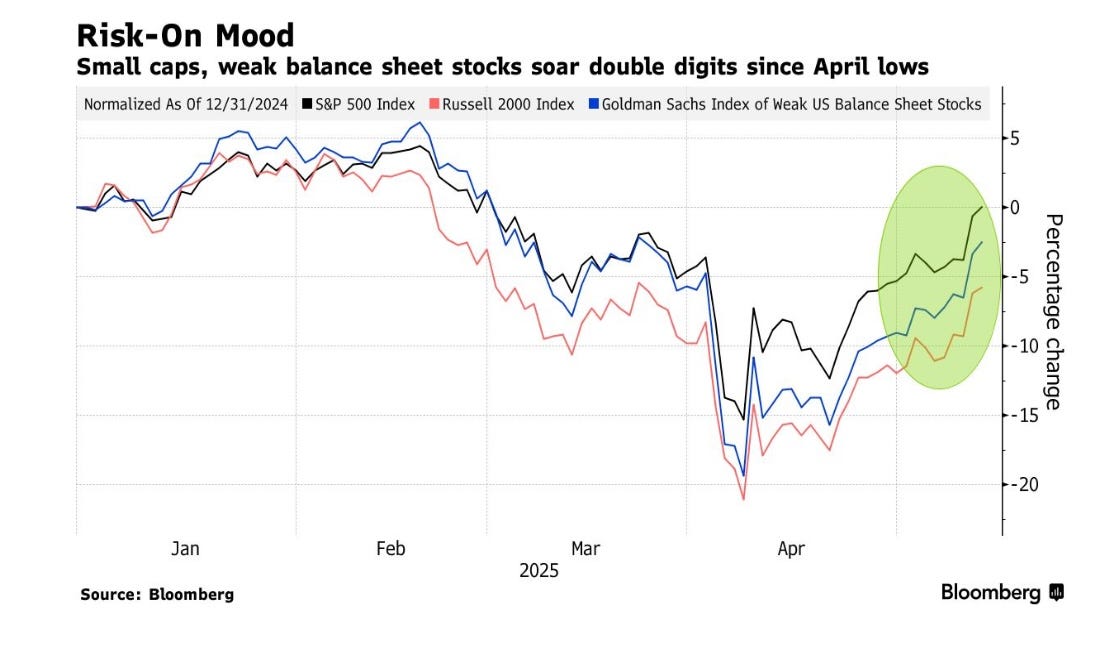

A sharp rebound in risk assets — fuelled by progress in trade talks, economic resilience and receding volatility — followed a month in which the consensus was to brace for the worst. The three-month pause in US-China trade tensions is reassuring investors, yet lurking in the background is the risk that stocks get so extended that they’re vulnerable to any fresh surprises.

“The market’s improved breadth and pickup in bullish momentum reflect a fear of missing out as investors are drawn off the sidelines,” said Craig Johnson at Piper Sandler. “Stocks are getting a little short-term stretched, but we’d view modest pullbacks that confirm support as buying opportunities, especially among sectors with relative strength.”

However, the fact that we are not in the same ridiculous situation we were in at the start of April is definitely showing in equity prices.

At TPP we often see drops like this as a good opportunity to buy. Each situation is different, and each has to be assessed in its own right, but it does seem that the worst-case scenario is off the table. The moment that happened, we knew stocks would recover, it’s just a matter of time. However, much of that move has now happened, so we would tread carefully. Things could change for the worse again very quickly. As stated, we don’t think it’s a ‘worst case’ situation any more, so dips will be good opportunities for now.

Europe has also moved higher this week, although the FTSE 100 seems to have mostly flatlined. Arguably, the FTSE moved more earlier in the month, enjoying a good run as a safe place to hide during this mess, but now that things seem to be calming down and we can see a bit clearer, other indices are overtaking. This may continue if risk appetite increases, but with Trump in charge, we don’t want to assume anything.

The more cautious sentiment may partly have been prompted by concerns that interest rates look set to stay higher for longer in the UK. Bank of England policymakers have been striking notes of wariness about the risk that inflation may stay stubbornly above target. Market expectations for further rate cuts this year have cooled off, with only between one and two further reductions being priced in.

Decision makers are worried that pay growth remains steady, which could have a knock-on effect on broader price rises. In the three months to March, pay growth, including bonuses, came in at 5.5%, above market forecasts. Huw Pill, the chief economist at the Bank of England, voted against cutting rates last week, favouring keeping them unchanged, and other members have stressed they are wary about going too fast.

In equity markets, Marks & Spencer was a top performer on the FTSE 100 following recent heavy losses on the back of a cyber attack, after the retailer revealed on Tuesday that some customer information had been stolen in the incident three weeks ago.

Mondi rallied after an upgrade to ‘overweight’ from ‘neutral’ at JPMorgan, while Hikma gained after an initiation at ‘outperform’ by BNPP Exane.

Burberry also jumped as investors welcomed the luxury brand’s turnaround plans. Burberry said it swung to a full-year loss amid a slump in revenue and that 1,700 jobs could be at risk as part of its ongoing turnaround plan.

Commodities

Oil and most other commodities powered higher, while gold fell, after China and the US ratcheted down trade tensions that had threatened to slash demand for raw materials.

West Texas Intermediate crude rose 1.5% to settle at $61.95 a barrel in New York, while copper advanced 0.8%. European natural gas, soybeans and iron ore also rallied. Shares of the top mining companies surged.

The truce between the world’s two largest economies brought some temporary relief to commodity markets roiled by tariffs that dented the outlook for global economic growth in recent weeks. Oil watchers have slashed demand forecasts, and the trade war already was showing signs of reducing the volume of goods arriving in the US.

Commodities have not been an exception, and prices have been volatile ever since President Donald Trump first announced so-called reciprocal tariffs in early April. Oil prices are still down more than 10% since then as the market contends with rising supplies from the Organisation of the Petroleum Exporting Countries and its allies.

“The oil market got caught up in the euphoria, but the damage has already been done to demand in the short term,” said John Kilduff, founding partner of Again Capital LLC. Still, reduced trade war tensions have removed $3 to $5 of downside from the market, rendering the new price floor near $60 a barrel, he said.

UK Gas is down -1.78% on the day Wednesday placing it down over 30% on the year. This is great for inflation as is the drop in oil. Hopefully this will start to filter through to the consumer soon — but prices are not always being passed on at the moment.

Still to come

Tomorrow morning, we will see the release of UK GDP. This is expected to be flat on the month, with a quarter-over-quarter growth of 0.1% and the 3 month average coming in at 0.6%. The British economy expanded by 0.5% month-over-month in February 2025, following a revised flat reading in January and surpassing expectations of a 0.1% increase. This marked the strongest monthly performance in eleven months. Industrial production surged by 1.5%, rebounding from a 0.5% decline in January, driven primarily by a 2.2% rise in manufacturing output.

Industrial and manufacturing production are also being released, and both are expected to be negative at -0.5%.

Later in the day, we get US retail sales, Jobless Claims, PPI and Industrial production. These will provide a good indication of the strength of the US consumer.

Enjoy the rest of the week, and there will be more from us on the weekend with our ‘Week in Review’. As it stands, TPP portfolios have had a good run back from the tariff shock. A lot of risk has now been taken off the table as profits have been taken. The tariff war is far from over, so we look forward to making some money for clients during the volatility.

If you would like more information on how to open a TPP portfolio, please do contact us, and one of our portfolio managers will get back to you.

Disclaimer: The views expressed in this article are the author’s own and should not be considered in rendering any legal, business or financial advice. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only.

Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to the corresponding past performance.