Tariffs, Weak Data, and Record Highs: The Week Markets Couldn’t Make Up Their Mind. The TPP weekend wrap by Lane Clark.

The UK’s FTSE 100 Index delivered a mixed performance this week, adding 1.34% to reach a record high before retreating on Friday following disappointing economic data and renewed trade tensions. The benchmark index closed 0.38% lower at 8,941.12 points, while the FTSE 250 mirrored this decline, ending at 21,613.25 points.

Sterling faced significant pressure, falling 0.67% against the dollar to $1.3488 and declining 0.51% versus the euro to €1.1547. The currency’s weakness reflected broader market concerns about escalating trade tensions and domestic economic softness.

Market strategist Patrick Munnelly from TickMill attributed the Friday selloff to President Trump’s latest tariff announcements, which disrupted Wall Street’s recent rally. Trump revealed plans to send tariff letters to Canada and Europe imminently, while proposing to increase overall tariff rates on other nations to 15–20% from the current 10% baseline. A particularly aggressive 35% tariff on Canadian goods is set to take effect on August 1st.

The UK’s economic data painted a concerning picture, with GDP contracting 0.1% in May despite forecasts for modest growth. This decline followed April’s 0.3% drop, driven by weakness in manufacturing and construction sectors. While services showed a marginal 0.1% increase, it couldn’t offset the 0.9% production decline and 0.6% construction fall.

Despite the monthly setback, the three-month GDP figure remained positive at 0.5% growth through May, supported by earlier strength in March. The annual growth rate of 0.7% met expectations, though concerns about the recovery’s sustainability persist.

The Bank of England faces mounting pressure ahead of its August meeting, with markets anticipating a third rate cut this year. CBI lead economist Ben Jones warned that “a sluggish recovery remains the likeliest path” amid trade uncertainty and rising business costs.

Trade data revealed mixed results, with the UK’s total goods and services deficit widening by £6.7bn to £13.2bn over the three months to May. While exports to the EU rose 2.9% to £14.4bn and non-EU exports increased 1.5% to £14.7bn, shipments to the US remained well below March levels despite a slight recovery.

Consumer activity continued to struggle, with retail footfall declining 1.8% year-on-year in June, following May’s 1.7% decrease. High streets bore the brunt of the decline with a 3.0% drop, while extreme weather conditions further impacted shopping centre and retail park visits.

Europe

European markets demonstrated resilience this week, with the pan-European STOXX Europe 600 Index climbing 1.15% on hopes for expanded US trade agreements. However, gains were tempered by Friday’s decline following President Trump’s threat of higher EU tariffs.

Major European indices posted solid gains throughout the week. France’s CAC 40 surged 1.73%, Germany’s DAX advanced 1.97%, and Italy’s FTSE MIB added 1.15%, reflecting investor optimism about potential trade developments.

Economic data across the eurozone presented mixed signals. Retail sales volumes disappointed in May, falling 0.7% month-on-month, exceeding expectations and indicating continued consumer restraint. The annual growth rate decelerated to 1.8% from April’s 2.7%, suggesting weakening momentum in household spending.

Germany’s industrial sector showed signs of recovery, with production rebounding 1.2% in May after April’s 1.6% decline. However, this positive development was overshadowed by weak trade performance, as exports contracted 1.4% following the previous month’s 1.6% fall.

Italy’s manufacturing sector continued to face headwinds, with production declining 0.7% in May, nearly erasing April’s 0.9% gain. The persistent struggles in Italian manufacturing highlight the broader challenges facing the eurozone’s industrial base.

The U.S.

American equity markets concluded the week with modest declines, though the tech-heavy Nasdaq Composite showed relative resilience. Despite dominating headlines, market reactions to the latest tariff announcements were notably muted compared to previous trade-related volatility.

Performance patterns showed little divergence between large-cap and small-cap stocks, while growth stocks marginally outperformed their value counterparts. This suggests investors are becoming more accustomed to trade policy uncertainty.

The airline sector provided insights into consumer strength, with Delta Air Lines delivering an encouraging full-year 2025 outlook after withdrawing guidance following April’s tariff announcements. Delta’s confidence in recovering air travel demand lifted the broader airline sector, suggesting consumer resilience remains intact.

In milestone news, NVIDIA reached the $4 trillion market capitalisation threshold for the first time, cementing its position among the “Magnificent Seven” mega-cap technology stocks and underscoring the continued investor appetite for AI-related investments.

President Trump’s latest trade actions targeted major partners, including South Korea and Japan, with 25% tariffs, while implementing varying levels on other countries such as Canada, South Africa, Thailand, and Malaysia. Notably, Brazil faces a dramatic increase to 50% tariffs, linked to legal proceedings against former President Jair Bolsonaro.

The administration also announced an upcoming 50% tariff on copper, triggering immediate spikes in US copper futures while international benchmark prices remained relatively stable, highlighting the localised impact of trade policy on commodity markets.

Federal Reserve minutes from the mid-June policy meeting revealed divisions among policymakers regarding monetary policy direction. While most committee members anticipate rate cuts this year, with two open to reductions as early as late July, some members indicated they don’t expect any rate cuts in 2025. Markets showed minimal reaction to these revelations, suggesting investors are focusing more on economic data than policy speculation.

Asia

Japanese markets faced headwinds this week, with the Nikkei 225 declining 0.61% and the broader TOPIX falling 0.17%. Growing US-Japan trade tensions and mixed domestic economic data weighed on investor sentiment throughout the region.

The yen weakened to approximately JPY 146.8 against the dollar from the previous week’s JPY 146.0, while the 10-year Japanese government bond yield rose to 1.49% from 1.45%, reflecting shifting market dynamics and policy expectations.

Trade tensions escalated as the US announced a 25% tariff on Japanese imports, up from April’s 24% rate. However, the August 1st implementation date provides negotiation time, which investors viewed positively. Political uncertainty adds another layer of complexity, with Prime Minister Shigeru Ishiba’s ruling coalition expected to lose seats in the July 20 Upper House election.

Chinese markets bucked the regional trend, rising on deflation data that sparked hopes for additional stimulus measures. The onshore CSI 300 Index gained 0.82% while the Shanghai Composite added 1.09% in local currency terms. Hong Kong’s Hang Seng Index contributed to the positive sentiment with a 0.93% advance.

China’s persistent deflationary pressures intensified in June, with producer prices falling 3.6% year-on-year, marking the 33rd consecutive month of factory deflation and the steepest decline in nearly two years. The consumer price index unexpectedly rose 0.1%, breaking a four-month decline streak, though analysts attributed this to recent stimulus measures rather than sustained consumer confidence improvements.

The contrasting performance between Chinese and Japanese markets highlights the different policy responses and economic challenges facing Asia’s largest economies, with China’s stimulus hopes offsetting concerns about Japan’s trade and political uncertainties.

The Week Ahead

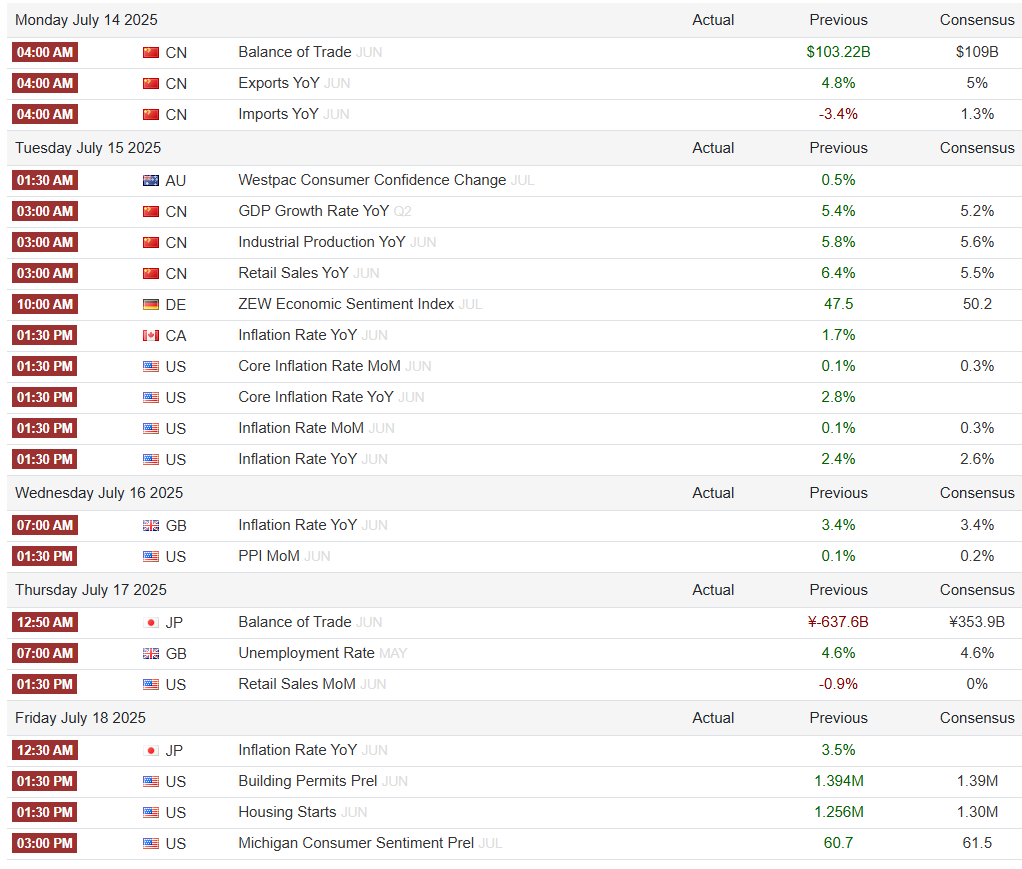

The coming week presents a critical juncture for global markets, with high-impact economic data releases and the opening of earnings season poised to deliver crucial insights into economic health across major economies. From US inflation and growth metrics to Chinese GDP figures and UK policy indicators, investors will scrutinise each release for clues about future monetary policy and economic trajectory.

US Economy Under the Microscope

The United States faces a data-heavy week that could significantly influence Federal Reserve policy decisions. Market participants are bracing for evidence that tariff-driven price pressures are beginning to manifest in official inflation statistics.

Consumer price inflation is expected to show a notable acceleration for June, with both headline and core measures forecast to rise 0.3% month-on-month, according to Reuters consensus. This represents a substantial jump from May’s modest 0.1% increase and would signal that tariff-related costs are filtering through to consumer prices as anticipated.

Producer price data will provide additional confirmation of mounting cost pressures, with expectations pointing to increased business-level inflation that aligns with recent business survey findings over the past two months. This upstream price pressure has been building steadily, reflecting the broader impact of trade policy changes on supply chains.

The inflation outlook carries significant implications for monetary policy. While the Federal Reserve remains committed to two rate cuts before year-end, expecting the initial tariff-driven price surge to fade as economic growth moderates, stronger-than-expected inflation readings could force policymakers to maintain their restrictive stance longer. Conversely, softer inflation data would intensify pressure for earlier rate reductions.

Beyond inflation, a comprehensive suite of economic indicators will paint a broader picture of US economic resilience. Retail sales data should show recovery following May’s sharp 0.9% decline, while industrial production is anticipated to stabilise after contracting 0.3% in the previous month. Inventory levels will be particularly scrutinised, as businesses likely accelerated stockpiling in anticipation of tariff-related price increases.

The earnings season launch will provide corporate America’s perspective on economic conditions, offering real-world insights into how businesses are navigating the current environment of trade uncertainty and shifting consumer behaviour.

Chinese Growth Momentum in Focus

China’s second-quarter GDP release will command significant attention, covering a period marked by heightened trade tensions and policy uncertainty. Economic growth is projected to decelerate from the first quarter’s robust 5.4% annual pace to 5.2%, reflecting the challenging external environment and domestic headwinds.

The GDP figure will be accompanied by high-frequency monthly data for industrial production and retail sales, providing granular insights into how different sectors are responding to the government’s stimulus measures implemented throughout June. These indicators will reveal whether policy support is gaining traction in offsetting external pressures.

The Chinese data will be particularly important for global markets, given the country’s role as a major driver of worldwide growth and commodity demand. Any signs of sharper-than-expected deceleration could ripple through global supply chains and commodity markets.

European Industrial Health Check

Eurozone industrial production data will offer valuable insights into how recent tariff changes are affecting manufacturing activity across the region. The numbers will help assess whether European producers are successfully adapting to the evolving trade landscape or facing significant headwinds.

This data becomes particularly relevant as European markets have shown resilience despite trade tensions, and investors will be keen to understand whether this strength is sustainable in the face of mounting external pressures.

UK Policy Crossroads

The Bank of England’s next policy move will come into sharper focus with the release of June inflation data. Consumer prices were running at 3.5% annually in May, well above the central bank’s 2% target, creating a delicate balancing act for policymakers.

The inflation reading will be closely examined for evidence of whether recent minimum wage increases and National Insurance contribution hikes are contributing to more persistent price pressures. This “stickiness” in inflation could complicate the Bank’s policy deliberations, particularly if wage-price spirals begin to emerge.

Complementing the inflation data, monthly recruitment survey results will shed light on labour market dynamics, providing crucial context for understanding how policy changes are affecting employment patterns and wage growth.

Global Inflation Divergence

The week’s consumer price data releases will highlight the divergent inflation trajectories between major economies. While tariff-related pressures are intensifying price growth in the US, according to PMI survey data, the UK appears to be experiencing some moderation in inflationary pressures.

This divergence reflects the different policy environments and economic structures across these economies, with implications for their respective central banks’ approaches to monetary policy. The contrast will be particularly important for currency markets and cross-border investment flows.

Market Implications

The confluence of these data releases creates a high-stakes environment for financial markets. The combination of inflation data, growth indicators, and corporate earnings will provide a comprehensive assessment of economic health at a time when policy uncertainty remains elevated.

Investors will be parsing each release for signs of economic resilience or vulnerability, with particular attention to how different regions are adapting to the changing global trade environment. The results will likely influence expectations for central bank policy actions and could drive significant market movements across asset classes.

The week ahead represents a critical test of economic narratives that have been building over recent months, with the potential to either validate or challenge prevailing market assumptions about growth, inflation, and policy trajectories.