This piece in the New York Times touches on a topic that is nothing new for FMMF readers, but apparently a revelation for readers of the Times judging from its status as the 2nd most popular story. (I only wish comments had not been disabled because I would have love to seen the reactions) While the NYT story focuses on HarleyDavidson , which ironically I just discussed last Thursday....

, which ironically I just discussed last Thursday....

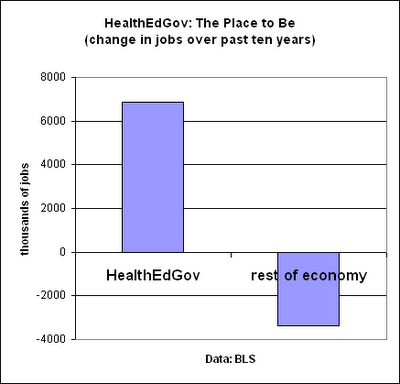

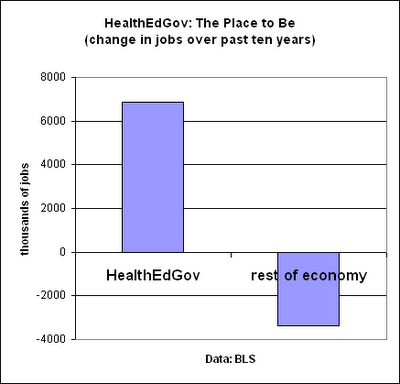

[this data is about a year old, I am sure it has actually gotten worse since]

The interesting question for me is what societal pressures will arise from these complex relationships that have developed. In theory as profits boom, corporations should hire - but most are not. Even if they did, why hire here, even if domiciled in the US? There is no government strategy here as in other countries. In fact the word's government and strategy don't even fit together in the US of A, with our tremendous leadership (ahem). And even if there is hiring in the U.S. the normal upward wage pressures do not exist as there is a huge global labor pool competing for a finite amount of jobs, so there is no power by labor. Supply and demand - you add a cool 300-400M new global workers to the pie, and these things happen. If you won't take the job at X price there are another 6 Americans who will; not to mention 25 others in other countries. [Sep 4, 2009: Job Seekers Across America Willing to Take Substantial Pay Cuts] I touched on this even 3 years ago on the website, when the recession was only a twinkle in my eye - the % of GDP going to corporate profits versus labor was at an all time high *then*. Now it has accelerated. Just another 'stress' on the system even as the 'recovery' carries on.

Can we blame the corporation*? No, not really - a corporation's job is only to make money, not provide a societal benefit (in the U.S......other countries have different viewpoints i.e. Germany) Remember, in the American utopia no one would work in a corporation except for the C-level executive. In a perfect world all jobs (except C-level execs) would be offshored and/or automated and if political pressure arises, said C-level exec threatens to move his remaining people robots overseas. I exaggerate but you get where we are headed.

*ironically, corporation's are humans in the US of A, as determined by the Supreme Court.

The counter argument to utopia is "at some point there won't be enough Americans to pay for the products said corporations produce, hence this cannot continue!" ... to which I say we're already reaching that point. See record amount of American's income derived from government transfer payments (now approaching 1 in 5 dollars). As long as the government can print, borrow, beg and hand out to it's people - it can continue for a long time. Plus the Asian populace (who has our money... and old jobs) can now spend and slowly take American consumers place. We're all going to global arbitrage baby.

Pretty demoralizing as Americans, but when we put on our speculator hat, we shall clap like seals as the "system is working" for us (and the C-level execs who use said corporations as personal cash cows). Well, as long as we have jobs that create enough income to be able to invest in the masters of the universe stock!

--------------

On to the NYT piece:

And remember, if worse comes to worse - you play one desperate state against another. But only if you cannot move the jobs completely out of the US of course.

So if you scratch your head at the performance of companies... versus the domestic macro economic figures we are seeing, this should help answer some of your questions on how it is happening. What is good for American consumers is no longer good for multinational American companies. [Jun 23, 2009: Companies Say Cuts are Here to Stay] In short, the economy does not need you anymore. [Sep 22, 2009: BusinessInsider - The Real Problem is the Economy Does not Need you Anymore] Even Jim Cramer knows it to be true. [Jan 12, 2010: Jim Cramer is Right]

Trader Mark

http://www.fundmymutualfund.com/

, which ironically I just discussed last Thursday....

, which ironically I just discussed last Thursday....As I wrote the past 3-4 weeks I expected U.S. multinationals aka the master of the universe to do very well, and they are doing so. People truly underestimate how their top cost (labor) is ever decreasing as U.S. states and indeed nations desperate to employ their people are throwing ever better tax incentives to keep or attract these large corporations; these truly have been the biggest beneficiaries of globalization. While reading through the Harley Davidson report I saw how the company is baiting their labor in one state (Wisconsin) versus the threat of moving the work to another - I've read hundreds upon hundreds of these stories the past 10+ years... and those are simply the companies who bother to keep U.S. employees rather than just go offshore. Most of our states are running huge deficits now but still offering tax incentives to attract or keep corporations in house - that says it all. If you are a large employer, the world is your oyster..... this applies to countless of our largest corporations; in fact Harley is a pittance compared to some of our supersized multinationals. As I read over the Ford report last Friday (a company I am very familiar with due to local proximity) I was reminded that the company has cut half its domestic workforce. Most of the cuts seen in corporate America are far less "news worthy"... its 2000 cuts here, 3500 there. In fact, United Technologies (UTX, Financial) one of the country's largest industrialsannounced another 1500 job cuts on top of the 900 already chopped in 2010 (2400 total this year after a more serious blood letting last). That might not sound like a lot but 2400 is akin to 400-500 small businesses employing 5-6 people.

- The industrial conglomerate last week posted almost a 14% increase in second-quarter net income, citing a "relentless focus on cost." It cut deeply into its payroll during the worst of the recession, cutting 11,600 jobs last year.

- .... will cut another 1,500 this year and next on top of the 900 positions it has already eliminated in 2010.

- Ari Bousbib, president of commercial companies at United Technologies, told investor analysts last month that the company has cut costs at its Fire and Security segment by moving manufacturing to low-cost sites.

[this data is about a year old, I am sure it has actually gotten worse since]

The interesting question for me is what societal pressures will arise from these complex relationships that have developed. In theory as profits boom, corporations should hire - but most are not. Even if they did, why hire here, even if domiciled in the US? There is no government strategy here as in other countries. In fact the word's government and strategy don't even fit together in the US of A, with our tremendous leadership (ahem). And even if there is hiring in the U.S. the normal upward wage pressures do not exist as there is a huge global labor pool competing for a finite amount of jobs, so there is no power by labor. Supply and demand - you add a cool 300-400M new global workers to the pie, and these things happen. If you won't take the job at X price there are another 6 Americans who will; not to mention 25 others in other countries. [Sep 4, 2009: Job Seekers Across America Willing to Take Substantial Pay Cuts] I touched on this even 3 years ago on the website, when the recession was only a twinkle in my eye - the % of GDP going to corporate profits versus labor was at an all time high *then*. Now it has accelerated. Just another 'stress' on the system even as the 'recovery' carries on.

Can we blame the corporation*? No, not really - a corporation's job is only to make money, not provide a societal benefit (in the U.S......other countries have different viewpoints i.e. Germany) Remember, in the American utopia no one would work in a corporation except for the C-level executive. In a perfect world all jobs (except C-level execs) would be offshored and/or automated and if political pressure arises, said C-level exec threatens to move his remaining people robots overseas. I exaggerate but you get where we are headed.

*ironically, corporation's are humans in the US of A, as determined by the Supreme Court.

The counter argument to utopia is "at some point there won't be enough Americans to pay for the products said corporations produce, hence this cannot continue!" ... to which I say we're already reaching that point. See record amount of American's income derived from government transfer payments (now approaching 1 in 5 dollars). As long as the government can print, borrow, beg and hand out to it's people - it can continue for a long time. Plus the Asian populace (who has our money... and old jobs) can now spend and slowly take American consumers place. We're all going to global arbitrage baby.

Pretty demoralizing as Americans, but when we put on our speculator hat, we shall clap like seals as the "system is working" for us (and the C-level execs who use said corporations as personal cash cows). Well, as long as we have jobs that create enough income to be able to invest in the masters of the universe stock!

--------------

On to the NYT piece:

- .... despite that drought, Harley’s profits are rising — soaring, in fact. Last week, Harley reported a $71 million profit in the second quarter, more than triple what it earned a year ago. This seeming contradiction — falling sales and rising profits — is one reason the mood on Wall Street is so much more buoyant than in households, where pessimism runs deep and joblessness shows few signs of easing.

- Many companies are focusing on cost-cutting to keep profits growing, but the benefits are mostly going to shareholders instead of the broader economy, as management conserves cash rather than bolstering hiring and production. Harley, for example, has announced plans to cut 1,400 to 1,600 more jobs by the end of next year. That is on top of 2,000 job cuts last year — more than a fifth of its work force.

- “Because of high unemployment, management is using its leverage to get more hours out of workers,” (in English, these are the productivity measures we see every month, and why they are flying) said Robert C. Pozen, a senior lecturer at Harvard Business School and the former president of Fidelity Investments. “What’s worrisome is that American business has gotten used to being a lot leaner, and it could take a while before they start hiring again.”

- And some of those businesses, including Harley-Davidson, are preparing for a future where they can prosper even if sales do not recover. Harley’s goal is to permanently be in a position to generate strong profits on a lower revenue base. (same story with the automakers - see Ford now able to prosper at 11-12M annual auto sales, rather than 16M+ seens just a few years ago)

- “There’s no question that there is an income shift going on in the economy,” Mr. Harris added. “Companies are squeezing their labor costs to build profits.”

- Profit margins — the percentage of revenue left over after expenses — crumble in most recessions, as overall sales fall but fixed costs like infrastructure, commodities and rent remain the same. In 2002, during the recession that followed the bursting of the technology bubble in addition to the Sept. 11 attacks, margins sank to 4.7 percent. Although the most recent downturn was far more severe, profit margins bottomed out at 5.9 percent in 2009 and quickly rebounded. By next year, analysts expect margins to hit 8.9 percent, a record high.

- The difference this time is that companies wrung more savings out of their work forces, said Neal Soss, chief economist for Credit Suisse in New York. In fact, while wages and salaries have barely budged from recession lows, profits have staged a vigorous recovery, jumping 40 percent between late 2008 and the first quarter of 2010. [Oct 20, 2009: WSJ - Slump Prods Firms to to Seek New Compact with Workers]

- Harley’s evolution is part of longer-term shift in American manufacturing. At Ford, revenue in its North American operations is down by $20 billion since 2005, but instead of a loss like it had that year, the unit is expected to earn more than $5 billion in 2010. In large part, that is because Ford has shrunk its North American work force by nearly 50 percent over the last five years.

- When Alcoa reported a turnaround this month in profits and a 22 percent jump in revenue, its chief financialofficer

, Charles D. McLane Jr., assured investors that it was not eager to recall the 37,000 workers let go since late 2008.

, Charles D. McLane Jr., assured investors that it was not eager to recall the 37,000 workers let go since late 2008.

And remember, if worse comes to worse - you play one desperate state against another. But only if you cannot move the jobs completely out of the US of course.

- Harley has warned union employees at its Milwaukee factory that it would move production elsewhere in the United States if they did not agree to more flexible work rules and tens of millions in cost-saving measures.

So if you scratch your head at the performance of companies... versus the domestic macro economic figures we are seeing, this should help answer some of your questions on how it is happening. What is good for American consumers is no longer good for multinational American companies. [Jun 23, 2009: Companies Say Cuts are Here to Stay] In short, the economy does not need you anymore. [Sep 22, 2009: BusinessInsider - The Real Problem is the Economy Does not Need you Anymore] Even Jim Cramer knows it to be true. [Jan 12, 2010: Jim Cramer is Right]

Trader Mark

http://www.fundmymutualfund.com/