There is no MBA/CFA program anywhere in which this is taught even though the concept when explained is universally acknowledged.My Addition:

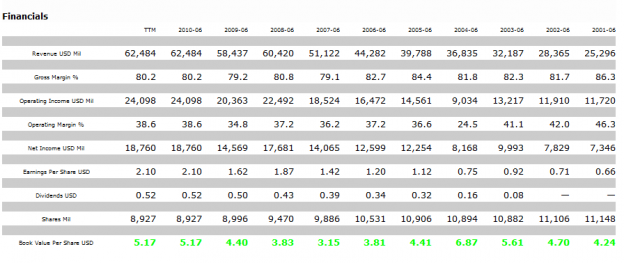

The key to gaining capital appreciation in stocks is simple, i.e. the stock must have growth in the BV/Shr ratio. MSFT is spotty at best and if you were looking at 6/2007 you would have lost close to 20% from 6/2001.

You will find that every test of BV/Shr growth with that of stock price growth over time shows good correlation. For Exxon Mobil the BV/Shr growth rate is ~11.5% and is virtually identical to the price appreciation over a business cycle.

This is Morningstar data.

This would be the reason MSFT stock has essentially gone nowhere in the past 10 years. There has been no sustained increase in BV/share. MSFT BV today is the same as 2006……it share price? The same as 2006. This is no coincidence. For MSFT to be a “value” now, you have to believe it will do something it has not done this decade, grow BV/share for the 5th consecutive year. Will we get a 10%-15% jump in the stock, who knows? But, if you are looking for price appreciation into the 30”²s to 40”²s, I fear your wait may just a a very prolonged one……

Todd Sullivan