I updatemarket valuations on a monthly basis. The point of this article is to measure the stock market based on six different metrics. This article does not look at the macro picture and try to predict where the economy is headed. It only uses these six metrics which have been very good past indicators of whether the market is fairly valued.

valuations on a monthly basis. The point of this article is to measure the stock market based on six different metrics. This article does not look at the macro picture and try to predict where the economy is headed. It only uses these six metrics which have been very good past indicators of whether the market is fairly valued.

I collaborate with my colleague Doug Short for some of the data in the article. Doug is an expert on market valuations, and I encourage readers to visit his site dshort.com

As always, I must mention that just because the market is over or undervalued does not mean that future returns will be high or low. From the mid to late 1990s the market was extremely overvalued and equities kept increasing year after year. However, as I note at the end of the article I expect low returns over the next ten years based on current valuations.

To see my previous market valuation article from last month click here.

Below are six different market valuation metrics as of September 1st, 2010:

[url=http://dshort.com/charts/SP-Composite-PE10.html?SP-and-ttm-PE-nominal][/url]

The current P/E TTM is 15.8 , which is lower than the TTM P/E of 18.2 from last month.

Click to View

Click to View

This data comes from my colleague Doug Short of dshort.com.

Based on this data the market is fairly valued. However I do not think this is a fair way of valuing the market when considering the significant decrease in earnings over the past year. To get an accurate picture of whether the market is fair valued based on P/E ratio it is more accurate to take several years of earnings.

Numbers from Previous Market lows:

Mar 2009 110.37

Mar 2003 27.92

Oct 1990 14.21

Nov 1987 14.45

Aug 1982 7.97

Oct 1974 7.68

Oct 1966 13.96

Oct 1957 12.67

Jun 1949 5.82

Apr 1942 7.69

Mar 1938 10.63

Feb 1933 14.92

July 1932 10.16

Aug 1921 14.02

Dec 1917 5.31

Oct 1914 14.27

Nov 1907 9.35

Nov 1903 11.67

Historic data courtesy of [www.multpl.com]

Current P/E 10 Year Average 19.84

The current ten year[b] P/E is 19.84 ; this is lower than the PE of 20.05 from the previous month. This number is based on Robert Shiller’s data evaluating the average inflation-adjusted earnings from the previous 10 years. Based on my colleague, Rob Bennett’s market return calculator, the returns of the market should be as follows:

My colleague Doug Short thinks this numbers are a bit inaccurate, because the number I used does not include the past several months of earnings, nor revisions. Doug calculates P/E 10 at 20.00.

Median: 15.76

Min: 4.78 (Dec 1920)

Max: 44.20 (Dec 1999)

Numbers from Previous Market lows:

Mar 2009 13.32

Mar 2003 21.32

Oct 1990 14.82

Nov1987 13.59

Aug 1982 6.64

Oct 1974 8.29

Oct 1966 18.83

Oct 1957 14.15

June 1949 9.07

April 1942 8.54

Mar 1938 12.38

Feb 1933 7.83

July 1932 5.84

Aug 1921 5.16

Dec 1917 6.41

Oct 1914 10.61

Nov 1907 10.59

Nov 1903 16.04

Data and chart courtesy of [www.multpl.com]

This is moderately over valued from the average P/E as shown above.

Current P/BV 2.07

This is a very rough estimate, it is nearly impossible to get an exact number for P/B on a specific date to my knowledge.

The current P/BV is 2.07; this is below P/B of 2.09 I measured in my previous article.

The average Price over book value of the S&P over the past 30 years has been 2.41. This indicates the market is undervalued. Book value is considered a better measure of valuation than earnings by many investors including legendary investor Martin Whitman. He states that book value is harder to fudge than earnings. In addition book value is less affected by economic cycles than one year earnings are. P/BV therefore provides a longer term accurate picture of a company’s value, than a TTM P/E.

Current Dividend Yield 2.04

The current dividend yield of the S&P is 2.04. This number is higher than the 1.99 yield from last month.

It is hard to determine on this basis whether the market is overpriced. The dividend yield for stocks was much higher in the begging of this century than the later half. The dividend yield on the S&P fell below the yield on Ten-Year treasuries for the first time in 1958. Many analysts at the time argued that the market was overpriced and the dividend yield should be higher than bond yields to compensate for stock market risk. For the next 50 years the dividend yield remained below the treasury yield and the market rallied significantly. In addition the dividend yield has been below 3% since the early 1990s. While I personally favor individual stocks with high dividend yields, I must admit that the current tax code makes it far favorable for companies to retain earnings than to pay out dividends. Finally, as I noted above the current economic environment has zero percent interest rates and low bond yields. During periods where yields are low it is logical for income oriented investors hungry for yield to be bid up the market, and dividend yields to decrease. I think it is hard to claim the market is overbought based on the low dividend yield.

Median: 4.29%

Min: 1.11% (Aug 2000)

Max: 13.84% (Jun 1932)

Numbers from Previous Market lows:

Mar 2009 3.60

Mar 2003 1.92

Oct 1990 3.88

Nov1987 3.58

Aug 1982 6.24

Oct 1974 5.17

Oct 1966 3.73

Oct 1957 4.29

Jun 1949 7.30

Apr 1942 8.67

Mar 1938 7.57

Feb 1933 7.84

July 1932 12.57

Aug 1921 7.44

Dec 1917 10.15

Oct 1914 5.60

Nov 1907 7.04

Nov 1903 5.57

Data and chart courtesy of [www.multpl.com]

Market Cap/GDP 74.9%

valuations on a monthly basis. The point of this article is to measure the stock market based on six different metrics. This article does not look at the macro picture and try to predict where the economy is headed. It only uses these six metrics which have been very good past indicators of whether the market is fairly valued.

valuations on a monthly basis. The point of this article is to measure the stock market based on six different metrics. This article does not look at the macro picture and try to predict where the economy is headed. It only uses these six metrics which have been very good past indicators of whether the market is fairly valued.I collaborate with my colleague Doug Short for some of the data in the article. Doug is an expert on market valuations, and I encourage readers to visit his site dshort.com

As always, I must mention that just because the market is over or undervalued does not mean that future returns will be high or low. From the mid to late 1990s the market was extremely overvalued and equities kept increasing year after year. However, as I note at the end of the article I expect low returns over the next ten years based on current valuations.

To see my previous market valuation article from last month click here.

Below are six different market valuation metrics as of September 1st, 2010:

[url=http://dshort.com/charts/SP-Composite-PE10.html?SP-and-ttm-PE-nominal][/url]

The current P/E TTM is 15.8 , which is lower than the TTM P/E of 18.2 from last month.

Click to View

Click to ViewThis data comes from my colleague Doug Short of dshort.com.

Based on this data the market is fairly valued. However I do not think this is a fair way of valuing the market when considering the significant decrease in earnings over the past year. To get an accurate picture of whether the market is fair valued based on P/E ratio it is more accurate to take several years of earnings.

Numbers from Previous Market lows:

Mar 2009 110.37

Mar 2003 27.92

Oct 1990 14.21

Nov 1987 14.45

Aug 1982 7.97

Oct 1974 7.68

Oct 1966 13.96

Oct 1957 12.67

Jun 1949 5.82

Apr 1942 7.69

Mar 1938 10.63

Feb 1933 14.92

July 1932 10.16

Aug 1921 14.02

Dec 1917 5.31

Oct 1914 14.27

Nov 1907 9.35

Nov 1903 11.67

Historic data courtesy of [www.multpl.com]

Current P/E 10 Year Average 19.84

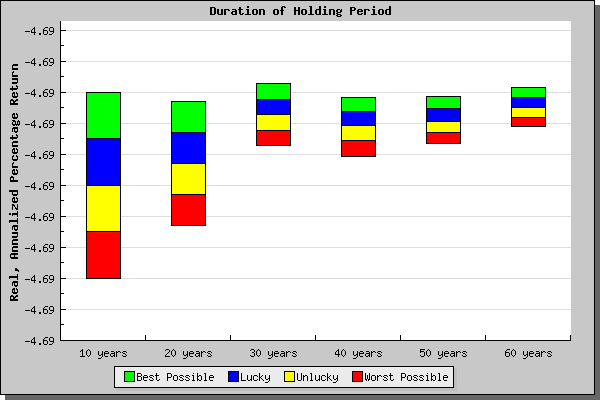

The current ten year[b] P/E is 19.84 ; this is lower than the PE of 20.05 from the previous month. This number is based on Robert Shiller’s data evaluating the average inflation-adjusted earnings from the previous 10 years. Based on my colleague, Rob Bennett’s market return calculator, the returns of the market should be as follows:

| Stock Market | Best Possible | Lucky | Most Likely | Unlucky | Worst Possible |

| 10-Year Percentage Returns | 9.15 | 6.15 | 3.15 | 0.15 | -2.85 |

| 20-Year Percentage Returns | 8.03 | 6.03 | 4.03 | 2.03 | 0.03 |

| 30-Year Percentage Returns | 8.54 | 7.54 | 6.54 | 5.54 | 4.54 |

| 40-Year Percentage Returns | 7.38 | 6.48 | 5.58 | 4.58 | 3.58 |

| 50-Year Percentage Returns | 7.37 | 6.57 | 5.77 | 5.07 | 4.37 |

| 60-Year Percentage Returns | 7.69 | 7.04 | 6.39 | 5.79 | 5.19 |

My colleague Doug Short thinks this numbers are a bit inaccurate, because the number I used does not include the past several months of earnings, nor revisions. Doug calculates P/E 10 at 20.00.

Median: 15.76

Min: 4.78 (Dec 1920)

Max: 44.20 (Dec 1999)

Numbers from Previous Market lows:

Mar 2009 13.32

Mar 2003 21.32

Oct 1990 14.82

Nov1987 13.59

Aug 1982 6.64

Oct 1974 8.29

Oct 1966 18.83

Oct 1957 14.15

June 1949 9.07

April 1942 8.54

Mar 1938 12.38

Feb 1933 7.83

July 1932 5.84

Aug 1921 5.16

Dec 1917 6.41

Oct 1914 10.61

Nov 1907 10.59

Nov 1903 16.04

Data and chart courtesy of [www.multpl.com]

This is moderately over valued from the average P/E as shown above.

Current P/BV 2.07

This is a very rough estimate, it is nearly impossible to get an exact number for P/B on a specific date to my knowledge.

The current P/BV is 2.07; this is below P/B of 2.09 I measured in my previous article.

The average Price over book value of the S&P over the past 30 years has been 2.41. This indicates the market is undervalued. Book value is considered a better measure of valuation than earnings by many investors including legendary investor Martin Whitman. He states that book value is harder to fudge than earnings. In addition book value is less affected by economic cycles than one year earnings are. P/BV therefore provides a longer term accurate picture of a company’s value, than a TTM P/E.

Current Dividend Yield 2.04

The current dividend yield of the S&P is 2.04. This number is higher than the 1.99 yield from last month.

It is hard to determine on this basis whether the market is overpriced. The dividend yield for stocks was much higher in the begging of this century than the later half. The dividend yield on the S&P fell below the yield on Ten-Year treasuries for the first time in 1958. Many analysts at the time argued that the market was overpriced and the dividend yield should be higher than bond yields to compensate for stock market risk. For the next 50 years the dividend yield remained below the treasury yield and the market rallied significantly. In addition the dividend yield has been below 3% since the early 1990s. While I personally favor individual stocks with high dividend yields, I must admit that the current tax code makes it far favorable for companies to retain earnings than to pay out dividends. Finally, as I noted above the current economic environment has zero percent interest rates and low bond yields. During periods where yields are low it is logical for income oriented investors hungry for yield to be bid up the market, and dividend yields to decrease. I think it is hard to claim the market is overbought based on the low dividend yield.

Median: 4.29%

Min: 1.11% (Aug 2000)

Max: 13.84% (Jun 1932)

Numbers from Previous Market lows:

Mar 2009 3.60

Mar 2003 1.92

Oct 1990 3.88

Nov1987 3.58

Aug 1982 6.24

Oct 1974 5.17

Oct 1966 3.73

Oct 1957 4.29

Jun 1949 7.30

Apr 1942 8.67

Mar 1938 7.57

Feb 1933 7.84

July 1932 12.57

Aug 1921 7.44

Dec 1917 10.15

Oct 1914 5.60

Nov 1907 7.04

Nov 1903 5.57

Data and chart courtesy of [www.multpl.com]

Market Cap/GDP 74.9%