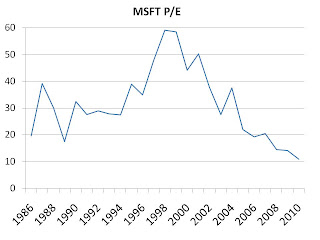

For many years, Microsoft (MSFT, Financial) has been an investor favourite, making it an expensive purchase for value investors. Today, however, that is no longer the case. Consider the following chart depicting Microsoft's P/E over the last 25 years:

If you remove the company's net cash position of $33 billion from its market cap, the current P/E (based on the company's last 12 months of earnings) is about 9.

Despite efforts at product proliferation and diversification, Microsoft still makes most of its money from two main products, its Windows operating system and its Office family of applications. The stock's low P/E tells you that investors are rather bearish on the combined future of these two products, as well as Microsoft's future position in potential growth areas such as tablets and mobile phones.

On the Windows front, Microsoft continues to dominate share in PCs and maintain a healthy share in servers. But the use of tablet computers is expected to take a bite out of PC sales. Furthermore, continued market share gains by MacIntosh computers could be a threat to Windows' market share in the future.

With respect to Office, Microsoft now competes with a very high profile player in Google. Some enterprises are moving or have moved to Google Docs, having shunned the high fees associated with Office.

In other areas, Microsoft continues to profit from entertainment products/services such as the Xbox console and software, but these just barely make enough money to cover losses in the company's online division, as Microsoft is losing badly to Google in the area of online search.

While all of the above-mentioned challenges represent threats to Microsoft's future profits, it is extremely difficult to predict the future. For example, even if Microsoft loses share in both Windows and Office, has no success in tablets or mobile phones (or any other new products for that matter), and continues to lose money online, Microsoft's share of growth in global PC sales may more than offset any profit declines. For example, Gartner estimates PC shipment growth next year of 15.9% (the vast majority of which will likely run Windows and Office), despite "growing user interest in media tablets such as the iPad".

So while the future is extremely difficult to predict, Mr. Market is nevertheless making a bold prediction. At a P/E of 9, he appears to believe that Microsoft's profits are in decline. This is in stark contrast to the company's latest quarter, which saw earnings growth in the high teens on an apples-to-apples comparison with last year.

Like Cisco, which was discussed yesterday, Microsoft also returns a lot of money to shareholders in the form of buybacks. At the current P/E, further buybacks could turn out to be a terrific investment on behalf of shareholders.

When Mr. Market boldly predicts a high-return company's decline, investors are offered an opportunity to buy an asset for cheap. In the case of Microsoft, investors are offered a company with a dominant position in a growing field, at the price of a company in decline.

Disclosure: Author has a long position in shares of MSFT

Saj Karsan

http://www.barelkarsan.com

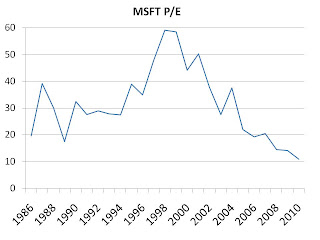

If you remove the company's net cash position of $33 billion from its market cap, the current P/E (based on the company's last 12 months of earnings) is about 9.

Despite efforts at product proliferation and diversification, Microsoft still makes most of its money from two main products, its Windows operating system and its Office family of applications. The stock's low P/E tells you that investors are rather bearish on the combined future of these two products, as well as Microsoft's future position in potential growth areas such as tablets and mobile phones.

On the Windows front, Microsoft continues to dominate share in PCs and maintain a healthy share in servers. But the use of tablet computers is expected to take a bite out of PC sales. Furthermore, continued market share gains by MacIntosh computers could be a threat to Windows' market share in the future.

With respect to Office, Microsoft now competes with a very high profile player in Google. Some enterprises are moving or have moved to Google Docs, having shunned the high fees associated with Office.

In other areas, Microsoft continues to profit from entertainment products/services such as the Xbox console and software, but these just barely make enough money to cover losses in the company's online division, as Microsoft is losing badly to Google in the area of online search.

While all of the above-mentioned challenges represent threats to Microsoft's future profits, it is extremely difficult to predict the future. For example, even if Microsoft loses share in both Windows and Office, has no success in tablets or mobile phones (or any other new products for that matter), and continues to lose money online, Microsoft's share of growth in global PC sales may more than offset any profit declines. For example, Gartner estimates PC shipment growth next year of 15.9% (the vast majority of which will likely run Windows and Office), despite "growing user interest in media tablets such as the iPad".

So while the future is extremely difficult to predict, Mr. Market is nevertheless making a bold prediction. At a P/E of 9, he appears to believe that Microsoft's profits are in decline. This is in stark contrast to the company's latest quarter, which saw earnings growth in the high teens on an apples-to-apples comparison with last year.

Like Cisco, which was discussed yesterday, Microsoft also returns a lot of money to shareholders in the form of buybacks. At the current P/E, further buybacks could turn out to be a terrific investment on behalf of shareholders.

When Mr. Market boldly predicts a high-return company's decline, investors are offered an opportunity to buy an asset for cheap. In the case of Microsoft, investors are offered a company with a dominant position in a growing field, at the price of a company in decline.

Disclosure: Author has a long position in shares of MSFT

Saj Karsan

http://www.barelkarsan.com