In this week’s market commentary, John Hussman “focuses on the current, unstable stance of monetary policy.” It is rather lengthy and detailed, if you like hard core econometrics, here is the link.

According to Hussman, :

But, at the completion of QE2, liquidity preference will pass the historical high:

This paragraph concludes his long thesis on the state of equilibrium engineered by the current Fed:

Read the complete Hussman Weekly Market Commentary here.

According to Hussman, :

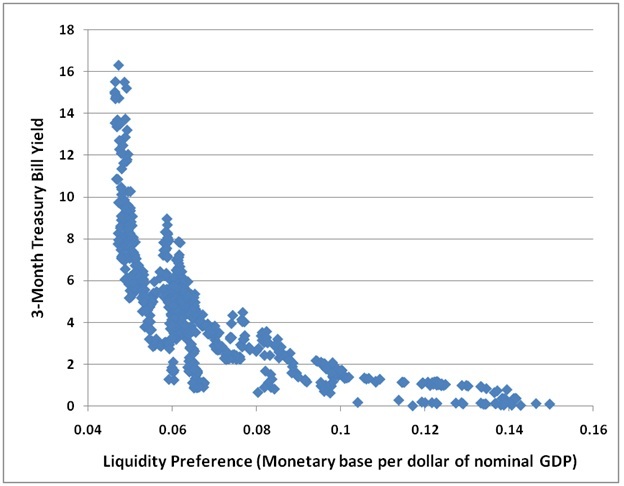

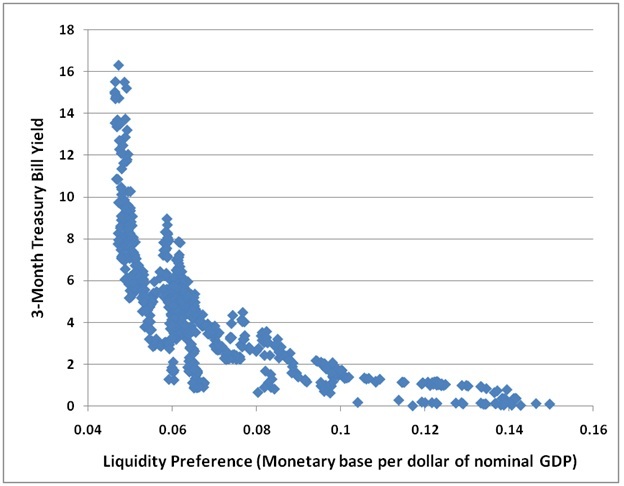

In post-war data, the lower bound for liquidity preference has been roughly 5 cents of base money holdings for every dollar of nominal GDP. With interest rates nearly zero at present, people are directly and indirectly holding much larger amounts of base money, currently slightly more than 13 cents for every dollar of GDP. The cluster of points at the extreme right of the graph are recent data. In a panic to hold cash, liquidity preference hit 15 cents at the height of the 2009 credit crisis.

But, at the completion of QE2, liquidity preference will pass the historical high:

In terms of liquidity preference, a completion of QE2 requires liquidity preference to increase to 16 cents per dollar of nominal GDP - easily the highest level in history. We hit 15 cents at the peak of the credit crisis. To get past that, short-term interest rates will have to decline to the point where there is no competition from interest rates at all, but where the slightest amount of interest rate pressure would either drive inflation higher or force a massive contraction in the Fed's balance sheet to avoid that outcome. Then what?

This paragraph concludes his long thesis on the state of equilibrium engineered by the current Fed:

In any event, completing the Fed's planned purchases under QE2 will require a decline in 3-month Treasury bill yields to just 0.05% in order to avoid inflationary pressure. Otherwise, liquidity preference will not expand sufficiently to absorb the addition to base money, even if we assume real GDP growth at a 4% rate. Given the extreme stance of monetary policy, the avoidance of inflationary pressures increasingly relies on a very persistent willingness by the public to directly or indirectly hold the outstanding quantity of base money in the financial system. Small errors will have surprisingly large consequences. This is not a stable equilibrium.

Read the complete Hussman Weekly Market Commentary here.