Dover Corporation (DOV, Financial) is a collection of several businesses that develop engineered components and systems.

-Five year revenue growth rate: 6.3%

-Five year earnings growth rate: 10.3%

-Five year dividend growth rate: 7.0%

-Dividend Yield: 1.75%

-The balance sheet is modestly strong.

All things considered, I find Dover to be a reasonable company to invest in at the current price based on the consistency of their business model, but there isn’t much yield for dividend investors despite decades of dividend growth.

In 2010, 54% of revenue came from the US, 17% came from Europe, 9% came from other Americas, 17% came from Asia, and 3% came from elsewhere.

Tulsa Winch- winches, rotators, drives

De-Sta-Co- factory automation components

Texas Hydraulics- hydraulic cylinders

Paladin- various light and heavy construction components

Crenlo- cab enclosures

Heil Trailer- trailers, flatbeds

Environmental Solutions Group- waste and recycling equipment

Sargent- hydraulics, fasteners, bearings

Vehicle Service Group- vehicle repair equipment

Performance Motorsports- pistons, crankshafts, and related components

PDQ- car wash systems

Datamax O’Neil- product marking equipment

Hill Phoenix- refrigeration systems

Swep- heat exchangers

Unified Brands- food preparation equipment

Belvac- aluminum can production equipment

Tipper Tie- food packaging equipment

US Synthetic- diamond inserts for drilling tools

Quartzdyne- quartz downhole pressure transducers

Waukesha Bearings- magnetic and fluid film bearings

Cook Compression- compression products and monitoring systems

Pump Solutions Group- industrial pumps

OPW Fueling Components- fueling components and systems

OPW Fluid Transfer- high hazard, interconnects, monitoring systems

HydroSystems- liquid dispensing systems

Everett Charles Technologies- contacts, fixtures, interface boards

Ceramic and Microwave Products Group- RF and microwave filters, ceramic capacitors, switches

DEK- screen printers

Vectron- frequency control and sensor components

OK International- solder and liquid dispensing tools

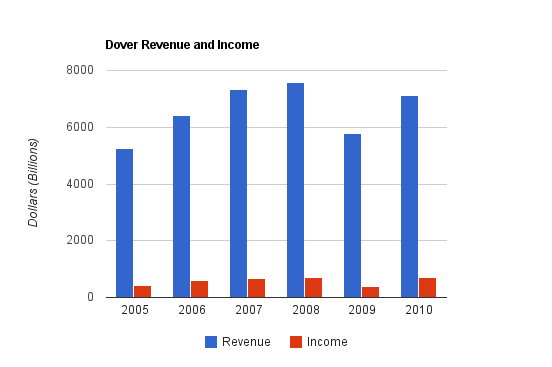

Dover has increased revenue by 6.3% compounded annually over this period. The company was hit hard in the financial crisis, but rebounded quickly.

Dover has grown income from continuing operations over this period at an average rate of 10.3%.

Dover grew EPS from $2.50 to $3.70 over this same period, which represents an 8.2% growth rate.

Dover grew operating cash flow by 7% compounded annually over this period.

Price to Book: 2.6

Return on Equity: 17%

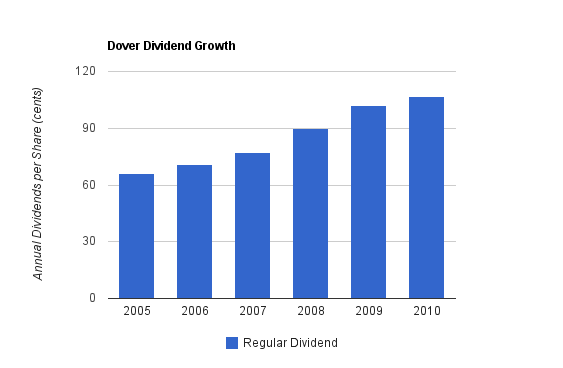

Dover has grown its dividend by an average of 10% annually over the past five years.

Acquisitions in 2010 included BSC Filters, Chemilizer, Intek Manufacturing, Dynalco Diagnostic Product Line, Gear Products, and KMC Inc.

Acquisitions in 2009 included Tyler Refrigeration, Mechanical Field Services, A La Cart, Barker Company, Extech Portable Printers, and Inpro/Seal Company.

Between 2008 and 2010, the company acquired 16 businesses for a total of approximately $436 million, and sold or discontinued 8 businesses for approximately $100 million.

Dover agreed to purchase Harbison-Fischer for $402 million in January 2011. The company is expected to close a deal to purchase Sound Solutions from NXP Semiconductors for $855 million in July 2011. 2011 is looking to be a very large acquisition year.

The upside of this acquisition approach is that growth is fairly expected and consistent as long as Dover can find good investments. Dover makes several acquisitions each year, and therefore continually purchases new streams of revenue and income to add to their existing streams. With the diversity of the businesses and the continued disciplined addition of new businesses, it’s difficult to go seriously wrong.

The downside of this approach is that acquisitions are expensive. Compared to organic growth, paying to buy companies is not as efficient in terms of capital. This is because owners of companies expect fair pay for their business and often demand a premium over what it’s really worth in order to agree to being bought. In addition, with a loose collection of businesses, it is difficult to develop a substantial economic moat. The acquisition approach also accumulates goodwill on the balance sheet.

One of the major problems with the acquisition approach is the effect it has on the dividend. In some years, acquisition costs exceeded income and cash flow. When a company with a large moat grows organically and easily, it can do so while simultaneously sending a lot of capital back to shareholders in the form of dividends or share buybacks. But for Dover that specializes in acquisitions, it must spend a lot of its free cash on acquiring new businesses. Plus, being a cyclical manufacturing company, if Dover wants to keep its impressive string of dividend increases intact, it must keep the payout ratio low or moderate so that it can maintain its dividend in a time of financial trouble. The strategy of Dover makes it fundamentally troublesome for meaningful dividend yields.

The Good

There are some oppositions between this business model and large dividends, but in terms of capital appreciation, this business has a lot going for it. The company has a solid track record of profitable growth.

-For the 2011-2013 period, the company is targeting 6-8% annual organic sales growth, 3-5% annual acquisition sales growth, 10-13% EPS growth, and to continue to grow its dividend.

-The company is highly diverse, serving businesses in automation, infrastructure, transportation, processing, energy, and electronics. Dover has thousands of customers, and no customer accounted for 10% or more of the sales of any business segment.

-The company has been focusing on international growth. Revenue from Asia is beginning to exceed revenue from Europe.

Full Disclosure:

As of this writing, I have no position in DOV.

-Five year revenue growth rate: 6.3%

-Five year earnings growth rate: 10.3%

-Five year dividend growth rate: 7.0%

-Dividend Yield: 1.75%

-The balance sheet is modestly strong.

All things considered, I find Dover to be a reasonable company to invest in at the current price based on the consistency of their business model, but there isn’t much yield for dividend investors despite decades of dividend growth.

Overview

Dover Corporation (NYSE: DOV) is a collection of several dozen companies divided into four segments: Industrial Products, Engineered Systems, Fluid Management, and Electronic Technologies.In 2010, 54% of revenue came from the US, 17% came from Europe, 9% came from other Americas, 17% came from Asia, and 3% came from elsewhere.

Companies

Dover contains a multitude of diversified companies grouped into four segments.Industrial Products

Warn Industries- winches, hoistsTulsa Winch- winches, rotators, drives

De-Sta-Co- factory automation components

Texas Hydraulics- hydraulic cylinders

Paladin- various light and heavy construction components

Crenlo- cab enclosures

Heil Trailer- trailers, flatbeds

Environmental Solutions Group- waste and recycling equipment

Sargent- hydraulics, fasteners, bearings

Vehicle Service Group- vehicle repair equipment

Performance Motorsports- pistons, crankshafts, and related components

PDQ- car wash systems

Engineered Systems

Markem-Imaje- product marking equipmentDatamax O’Neil- product marking equipment

Hill Phoenix- refrigeration systems

Swep- heat exchangers

Unified Brands- food preparation equipment

Belvac- aluminum can production equipment

Tipper Tie- food packaging equipment

Fluid Management

Norris Production Solutions- lifts, controls, analytic toolsUS Synthetic- diamond inserts for drilling tools

Quartzdyne- quartz downhole pressure transducers

Waukesha Bearings- magnetic and fluid film bearings

Cook Compression- compression products and monitoring systems

Pump Solutions Group- industrial pumps

OPW Fueling Components- fueling components and systems

OPW Fluid Transfer- high hazard, interconnects, monitoring systems

HydroSystems- liquid dispensing systems

Electronic Technologies

Knowles- microphones and audio componentsEverett Charles Technologies- contacts, fixtures, interface boards

Ceramic and Microwave Products Group- RF and microwave filters, ceramic capacitors, switches

DEK- screen printers

Vectron- frequency control and sensor components

OK International- solder and liquid dispensing tools

Revenue, Earnings, Cash Flow, and Metrics

Dover has shown growth, but has experienced a rough ride through the financial crisis.Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $7.133 billion |

| 2009 | $5.776 billion |

| 2008 | $7.569 billion |

| 2007 | $7.317 billion |

| 2006 | $6.420 billion |

| 2005 | $5.234 billion |

Income Growth

| Year | Income from Cont. Op. |

|---|---|

| 2010 | $708 million |

| 2009 | $372 million |

| 2008 | $695 million |

| 2007 | $670 million |

| 2006 | $596 million |

| 2005 | $433 million |

Dover grew EPS from $2.50 to $3.70 over this same period, which represents an 8.2% growth rate.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $951 million |

| 2009 | $802 million |

| 2008 | $1,010 million |

| 2007 | $875 million |

| 2006 | $895 million |

| 2005 | $676 million |

Metrics

Price to Earnings: 15.5Price to Book: 2.6

Return on Equity: 17%

Dividends

Dover is a dividend aristocrat that has increased its dividend for more than 50 consecutive years. The payout ratio is currently a bit under 30%. The current yield is only about 1.75%.Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $1.07 | 2.30% |

| 2009 | $1.02 | 2.90% |

| 2008 | $0.90 | 2.20% |

| 2007 | $0.77 | 1.70% |

| 2006 | $0.71 | 1.50% |

| 2005 | $0.66 | 1.60% |

Balance Sheet

Dover has a modestly strong balance sheet with a long-term debt/equity ratio of 46% and a current ratio of over 2.5, but goodwill makes up approximately 75% of their total shareholder equity. The interest coverage ratio is about 10, which is solid.Investment Thesis

The primary business approach of Dover is to make targeted acquisitions and then to use the size and scale of the company to develop additional efficiency and earnings. With its scale, the company can reduce duplication, standardize its processes, and increase volumes from its acquired companies.Acquisitions in 2010 included BSC Filters, Chemilizer, Intek Manufacturing, Dynalco Diagnostic Product Line, Gear Products, and KMC Inc.

Acquisitions in 2009 included Tyler Refrigeration, Mechanical Field Services, A La Cart, Barker Company, Extech Portable Printers, and Inpro/Seal Company.

Between 2008 and 2010, the company acquired 16 businesses for a total of approximately $436 million, and sold or discontinued 8 businesses for approximately $100 million.

| Year | Acquisitions | Capital Expenditure |

|---|---|---|

| 2010 | $104 million | $183 million |

| 2009 | $228 million | $120 million |

| 2008 | $104 million | $176 million |

| 2007 | $274 million | $174 million |

| 2006 | $1,117 million | $192 million |

| 2005 | $1,090 million | $128 million |

The upside of this acquisition approach is that growth is fairly expected and consistent as long as Dover can find good investments. Dover makes several acquisitions each year, and therefore continually purchases new streams of revenue and income to add to their existing streams. With the diversity of the businesses and the continued disciplined addition of new businesses, it’s difficult to go seriously wrong.

The downside of this approach is that acquisitions are expensive. Compared to organic growth, paying to buy companies is not as efficient in terms of capital. This is because owners of companies expect fair pay for their business and often demand a premium over what it’s really worth in order to agree to being bought. In addition, with a loose collection of businesses, it is difficult to develop a substantial economic moat. The acquisition approach also accumulates goodwill on the balance sheet.

One of the major problems with the acquisition approach is the effect it has on the dividend. In some years, acquisition costs exceeded income and cash flow. When a company with a large moat grows organically and easily, it can do so while simultaneously sending a lot of capital back to shareholders in the form of dividends or share buybacks. But for Dover that specializes in acquisitions, it must spend a lot of its free cash on acquiring new businesses. Plus, being a cyclical manufacturing company, if Dover wants to keep its impressive string of dividend increases intact, it must keep the payout ratio low or moderate so that it can maintain its dividend in a time of financial trouble. The strategy of Dover makes it fundamentally troublesome for meaningful dividend yields.

The Good

There are some oppositions between this business model and large dividends, but in terms of capital appreciation, this business has a lot going for it. The company has a solid track record of profitable growth.

-For the 2011-2013 period, the company is targeting 6-8% annual organic sales growth, 3-5% annual acquisition sales growth, 10-13% EPS growth, and to continue to grow its dividend.

-The company is highly diverse, serving businesses in automation, infrastructure, transportation, processing, energy, and electronics. Dover has thousands of customers, and no customer accounted for 10% or more of the sales of any business segment.

-The company has been focusing on international growth. Revenue from Asia is beginning to exceed revenue from Europe.

Risks

Dover is a cyclical company and therefore greatly depends on the conditions of the overall economy. Due to being a collection of several companies, Dover doesn’t seem to have any substantial economic moat, although the 50+ consecutive years of dividends might be reason to expect a reasonable degree of safety and consistency. In addition, there is currency risk.Conclusion and Valuation

In conclusion, I think Dover would make a fair investment at the current prices, but it leaves a lot to be desired for dividend investors. The valuation is appropriate in my opinion, and 2011 numbers look better than 2010 so far. In addition, the company has a fairly consistent business model and has more than 50 years of consecutively raised dividends to prove it. Detractors from this company include a fairly low dividend yield and a lack of any substantial economic advantage.Full Disclosure:

As of this writing, I have no position in DOV.