We had a host of housing/credit data come out on Tuesday. They all pointed to the same thing. Housing is bouncing along a bottom, the consumer’s balance sheet continues to improve and the rate at which they are defaulting on loans continues to fall. All those metrics clash with the “double dip recession” or “housing won’t recover for a decade” crowd’s group think. Now, by no means am I calling for 4% GDP or a bull market in housing for the rest of the year. What I am saying is that the statistics we see coming out point to continued improvement, not deterioration.

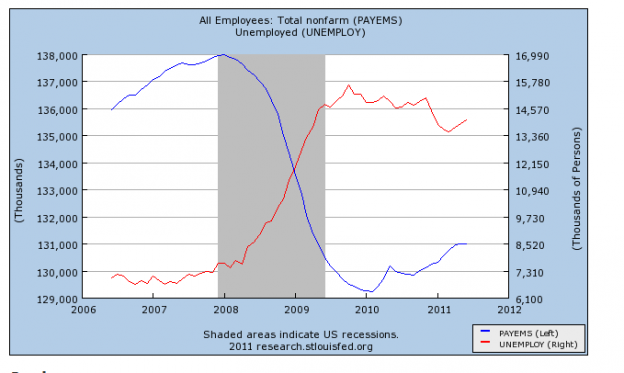

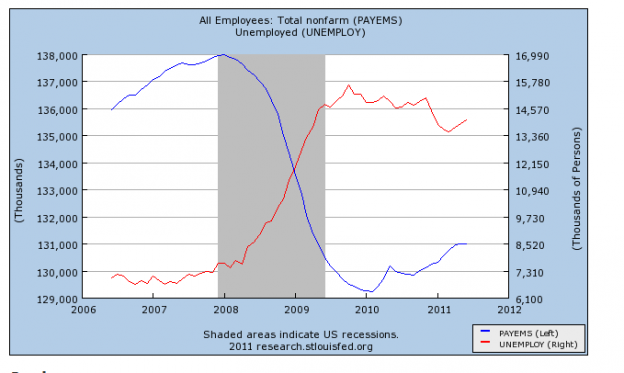

But, what about unemployment? I know it is falling (total unemployed) and the number of employed is rising. No, neither are moving in the direction we want fast enough but they are moving in the direction we want and have been for some time now (see below).

S&P Reported:

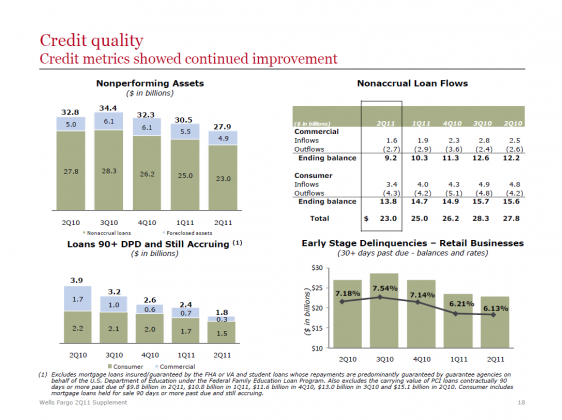

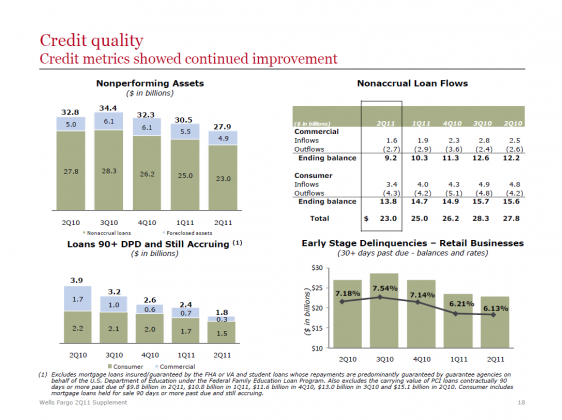

This was further bolstered by comments from Wells Fargo (WFC, Financial) that said consumer credit continued to improve. Here is the applicable slide:

As Scott Grannis put it:

But, what about unemployment? I know it is falling (total unemployed) and the number of employed is rising. No, neither are moving in the direction we want fast enough but they are moving in the direction we want and have been for some time now (see below).

S&P Reported:

June housing starts, in an unexpected sign of hope and strength, jumped 14.6% from May 2011 and are 16.7% above their level of June 2010. Total starts were 629,000 compared to most expectations of about 575,000 and the revised May 2010 level of 549,000. Single family home starts in June were 453,000, up 9.4% from May’s revised 414,000 pace. Permits — seen by some as a leading indicator — were 524,000 in June, up 2.5% from May. Privately owned housing completions were 535,000, down 1.7% from May.S&P also release June default data for Home (1st and 2nd liens), Auto and bank cards:

Up 16.7% is better than flat or down but it is probably much too early to celebrate any rebound or revival. The best description of the last two and a half years of housing starts is bouncing along a bit over 500,000 units — nothing in today’s numbers changes that. In the run-up to this morning’s report there were stories that apartments are over taking single family homes and that household formation is falling across the US so that housing will never recover. While such ideas are over stated, today’s report reflects short term economic conditions much more than any long term trends. Apartment starts — actually five or more units in a structure — did grow much faster than single family homes. However, this is typical of periods of slow economic activity or high interest rates. Household formation did slow in recent years and this too is the economy more than long term demographics. In short, enjoy the better news on starts, don’t believe housing is about to rebound to over one million starts but don’t write it off for the next fifty years either.

Data through June 2011, released today by S&P Indices and Experian for the S&P/Experian Consumer Credit Default Indices, a comprehensive measure of changes in consumer credit defaults, showed first and second mortgages default rates decreased in June to 2.02% and 1.40%, respectively, from May rates of 2.09% and 1.42%. Auto loans default rate went down from 1.34% in May to 1.29% in June; and bank cards experienced the largest decrease in June from 5.93% to 5.69%.S&P June Default Full Report (click to open .pdf)

This was further bolstered by comments from Wells Fargo (WFC, Financial) that said consumer credit continued to improve. Here is the applicable slide:

As Scott Grannis put it:

Housing starts have been incredibly weak for the past 2 1/2 years, much weaker than at any time since records were first kept beginning back in 1959. As a result, residential construction has fallen to a record-low 2% of GDP, after averaging around 5% since WWII. During this extended and bitterly painful construction collapse, the economy has recovered from a severe recession, personal income has grown 8%, retail sales are up 15%, after-tax corporate profits have surged 38%, Apple stock has more than tripled, household’s net worth has risen by over $8 trillion, and the U.S. population has increased by about 6 million, among a host of other notable milestones. Housing starts are almost certainly well below the rate of new household formations, so every month that starts remain at currently depressed levels puts us one month closer to an inevitable boom in new home construction, since the excess inventory of homes is shrinking daily. The outlook for housing is thus likely to be stable at the least, and eventually extremely positive.Want first hand evidence? Ask your contractor, furniture salesman, window treatment lady etc, they will all say the same thing. Things are definitely getting better and are MUCH better that last summer. None of it means a boom. But it does mean a consistant improvement.