Leon Cooperman (Trades, Portfolio), the CEO of Omega Advisors, believes the stock market will be lower in a year due to tax hikes, an increase in interest rates and inflation pressures. In an interview with CNBC last week, the guru said:

"Let's face it. The market is facing the fact that taxes are going up, interest rates are going up, and inflation is going up. And we have a reasonably richly appraised market. So cyclically I'm engaged. But I got an eye on the exit. Bear markets don't materialize out of immaculate conception. They come about for certain fundamental reasons."

This warning comes at a time when U.S. markets are continuing to hit new highs and, more importantly, when first-quarter corporate earnings are continuing to exceed analyst and investor expectations.

Will higher taxes result in lower stock prices?

President Biden proposed the American Jobs Plan on March 31, highlighting the need to increase taxes both on the corporate and personal level to help finance the $2.3 trillion infrastructure modernization plan. According to the terms of this proposal, the corporate tax rate will be raised to 28% from 21%, reversing the tax cuts introduced by the Trump administration. There will be a 10% tax penalty on companies that ship jobs abroad when those jobs could be filled by Americans as well. The new tax package will impose a 15% minimum tax on all companies with $100 million in book profits to ensure that all businesses pay some form of taxes.

Higher taxes are perceived as an ominous sign for stocks, but investors need to dig deep to understand the relationship between taxes and stock market performance. The government will likely be spending substantial amounts on improving and modernizing infrastructure, battling climate change and supporting social welfare programs in the coming years. The benefits of these investments have historically outweighed the negative effects of tax hikes. A recent study conducted by Fidelity shows that historically, stocks have exceeded performance expectations in years in which tax rates were increased.

According to this study, the S&P 500 has demonstrated higher average returns and higher chances of an advance during tax increases since 1950. Commenting on this observation, Fidelity sector strategist Denise Chisholm said:

"Economically sensitive sectors, like consumer discretionary, oddly have done better during years taxes increase. These counterintuitive odds suggest something else is going on—the market either discounts the increase in advance or the economy has received stimulus to offset it."

Exhibit 1: The performance of the S&P 500 Index in years taxes were increased

Source: Fidelity

Agreeing with the findings of Fidelity, David Lefkowitz, head of equities at UBS Financial Services, said:

"Investors should also bear in mind that tax increases will be used to at least partially pay for infrastructure spending, which would tend to boost economic growth and offset some of the drag from higher taxes."

The study also shows that U.S companies were able to generate strong profit growth despite tax hikes, which goes on to suggest that it would be irrational to assume taxes will eat into the profitability of high-growth business sectors to a meaningful degree.

Exhibit 2: Average tax rates and annualized corporate profit growth

Source: BMO Investment

Although many companies are richly valued in the market today, tax hikes are very unlikely to be the catalyst that would trigger a massive correction. Therefore, the best course of action would be to identify companies that are well positioned to deliver strong earnings growth even if macroeconomic conditions turn out to be challenging in the future.

How to prepare for tax hikes

Real estate investment trusts are unlikely to be impacted by the new tax proposal. REITs usually distribute 90% of their earnings to shareholders in the form of dividends to enjoy tax benefits. Strategically investing in high-quality REITs could help investors mitigate some of the negative impacts caused by higher tax rates.

Utilities might benefit from a tax increase as well since most utilities are regulated by the government and are in a position to request state public utility commissions for price increases to cover their increased tax-related expenses.

Companies in the health care sector could turn out to be big winners as well considering the fact that billions of dollars will be allocated out of the infrastructure development budget to improve hospitals and other facilities across the country. Drug and health care device developers with strong profit margins might be the ones least impacted by an increase in taxes, so investors should ideally keep an eye on these two subsectors.

According to Bank of America analysts, the biggest winners will be industrial and materials companies that will be tapped to carry out infrastructure development projects. Large-scale project management companies and steel giants appear to be good bets to mitigate the negative impact of tax hikes while gaining exposure to the positive outcomes of the trillion-dollar investment plan proposed by the Biden administration.

When it comes to the financial services sector, banks with strong capitalization profiles are more likely to have the financial flexibility to raise their leverage and, therefore, benefit from a larger tax shield, which is something financially constrained banks will not be able to do. Because financial health is a key factor in determining the performance of banks following a tax increase, investors should ideally look for national banks that are well ahead of common equity tier 1 capital requirements imposed by the Federal Reserve.

How to prepare for an inflation spike

Commenting on the inflation outlook, Cooperman said:

"I think that Mr. Powell will be surprised by inflation. It's not going to be as quiescent and transitory as he thinks. I think the Fed will be forced to say something before the end of 2022."

Bond yields have already risen sharply, causing concern among investors that fiscal stimulus and post-pandemic spending will fuel higher inflation. However, not all sectors are affected in the same way, and some sectors might benefit from an increase in the general price level of the country.

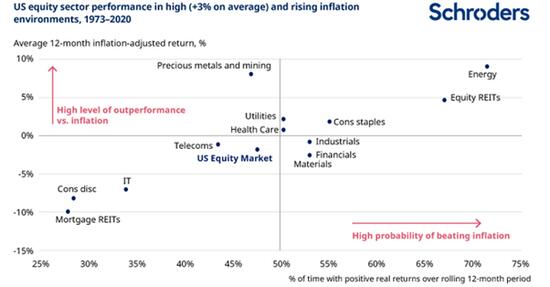

Real estate is one sector that can provide protection from rising inflation because property prices generally increase at the same rate as the general price level in a country. According to a study conducted by Schroders, equity REITs have outperformed inflation 67% of the time since 1973 with an average real return of 4.7%. The financial services sector tends to do well, but banks can still face problems because inflation reduces the present value of current loans that will be repaid in the future.

In summary, investors should look for companies that can pass on rising commodity costs to consumers. From this perspective, the consumer staples and energy sectors appear to have a good chance of keeping up with the rate of inflation as well.

Exhibit 3: U.S. equity sector performance in high and rising inflation environments

Takeaway

It is too early to predict how an increase in tax rates and rising inflation will play out and how the S&P 500 will react to such a phenomenon. Cooperman is bearish on the stock market for the next year, but avoiding stocks is not the best course of action as stocks have delivered very attractive returns in every 10-year cycle since 1900.

Commenting on the historical performance of equities, BMO Capital Markets equity strategist Brian Belski said:

"U.S. companies have been able to generate substantial earnings growth in different tax environments, including periods of high corporate tax rates. It is important to keep in mind that any increase in taxes and reduction to EPS for U.S. companies could also be offset to some degree by resulting positive factors of higher taxes, such as infrastructure spending and economic stimulus."

The next 12 months will be challenging for equities, but, as Peter Lynch said, getting frightened out of stocks will prove to be a costly mistake.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

Also check out: