The last time I looked at Digital Realty Trust Inc. (DLR, Financial) the stock was trading nearly 20% off of its 52-week high. I liked the business so much, especially with Covid-19 requiring so many to transition their work and school life online, that I felt the sell-off was likely nearing the end.

Shares of Digital Realty are up 13% since my last article on it. Thus, it's time to evaluate again - is there still time for those not in the name yet to buy and take andvantage of further upside potential, or has the stock become too pricey?

Recent earnings results

Digital Realty reported its first-quarter earnings results on April 29. Revenue grew 32.4% to $1.1 billion, beating Wall Street analysts' estimates by $38 million. As with the three previous quarters, much of this growth was a result of the trust's purchase of Interxion, a European data center company. This acquisition closed last March. Sequentially, revenue increased 2.8%.

Core funds from operation of $482 million, or $1.67 per share, was a significant improvement from core funds from operation of $355 million, or $1.53 per share, in the same period a year ago. Compared to Q4 2020, funds from operation improved 3.6%. Core funds from operation were 9 cents ahead of both Digital Realty's guidance and analysts' expectations.

Less than 5% of Digital Realty's total business, which includes retail, energy, travel and lodging, faced serious risk from Covid-19. The pandemic actually acted as a tailwind for the vast majority of the trust's business.

Digital Realty had $117.1 million of total bookings in the first quarter, the third-best quarter in its history. This trails only Q2 2020 and Q4 2020 in terms of total bookings, so the trust has seen much higher than usual volumes over the last year or so, a sign that Digital Realty's business is accelerating. The average weighted lease is over seven years. The breakdown of bookings included $69.5 million for projects of at least 1 megawatt, $32.6 million for projects below 1 megawatt and $13.3 million for interconnection. Digital Realty added 100 new customers during the quarter.

Digital Realty continues to expand its presence worldwide. The trust now has 167,000 cross-connections, more than 4,000 customers and covers nearly 50 metro areas around the globe. Almost 60% of total bookings were from customers located outside of the Americas region, providing for diversification in the trust's business. International bookings were split down the middle from the APAC and EMEA regions.

Including joint ventures, the trust's backlog grew $38 million, or 14.1%, to an all-time high of $307 million. Digital Realty also signed lease renewals totaling $193 of annualized GAAP rental revenue with a weighted average lease term of just under three years. On a cash basis, rental rates were down 2.1%, but on a GAAP basis rates increased 3.2%. The trust has now signed renewal agreements with three-quarters of expiring leases. This is below Digital Realty's average, so this could be something to watch. Nevertheless, the trust does now have most of its expiring leases under contract.

As usual, Digital Realty remains very active on the investment front. During the quarter, the trust closed on a deal to acquire 11 European data centers for $680 million. This acquisition should generate $45 million of operating income for the year, resulting in a cap rate of 6.7%. Digital Realty also added a 66,4000-square foot building in Belgium that will be used to conjunction with an already planned 13.6-megawatt facility. The trust has 44 projects currently in development that total 300 megawatts of capacity that should come online over the next 18 months.

One of the more attractive attributes of Digital Realty is its balance sheet. The trust has $35.5 billion of total assets, $878 million of current assets and $221 million of cash and equivalents. This is against total liabilities of $17.2 billion and current liabilities of $1.8 billion.

Total debt stands at $14.8 billion, but the trust's debt maturities are fairly spread out. The average weighted maturity of debt is 6.7 years and the weighted average coupon is just 2.3%. Digital Realty has no debt due in 2021 and only $1 billion total due over the next two years. Approximately 94% of loans are at fixed rates.

Guidance

Digital Realty also issued revised guidance for the year. For full fiscal 2021, the trust expects revenue of $4.3 billion to $4.4 billion, up from $4.25 billion to $4.35 billion. Core funds from operations are projected in a range of $6.50 to $6.55, up from $6.40 to $6.50. At the midpoint, this would be 5% growth from the previous year and above Digital Realty's 10-year average funds from operation growth rate of 4.4%. The occupancy rate target remains at 84% to 85% with rental rate increases on a GAAP basis expected to remain slightly positive.

Valuation analysis

With shares of Digital Realty trading at around $151, the stock trades with a forward price-FFO ratio of 23.1. The average price-FFO ratio since 2011 is 18.2, showing shares to be expensive on a historical basis.

With an annualized dividend of $4.64, Digital Realty has a yield of 3.1% at the moment. This is more than twice the average yield of the S&P 500 index, but below the stock's 10-year average yield of 4.2%. Digital Realty does sport a very low payout ratio (for a REIT) of 71%, which should provide enough coverage for continued dividend growth. The trust has increased its dividend for 17 consecutive years.

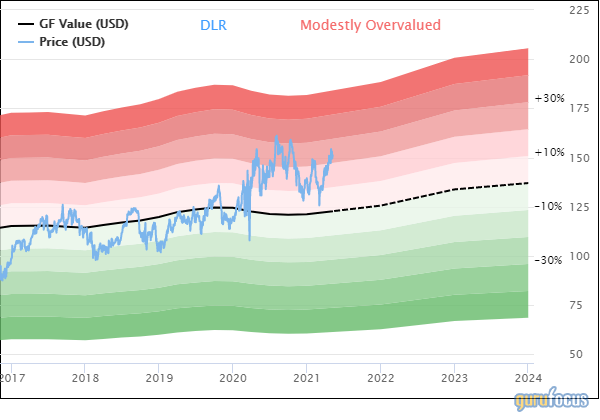

According to the GuruFocus Value chart, Digital Realty appears to be ahead of its intrinsic value as well:

Digital Realty has a GF Value of $122.73, resulting in a price-to-GF-Value ratio of 1.23. For context, the stock had a price-to-GF-Value ratio of 1.09 the last time I discussed the trust. Shares would have to decrease almost 19%% to reach the GF Value. Digital Realty is rated as modestly overvalued.

Final thoughts

Digital Realty has several positive tailwinds going for it. The trust performed very well last year at a time when many REITs struggled. Digital Realty's Covid-19 sensitive business is very small, which enabled its business to hold up much better than many of its sector peers.

The trust also continues to enjoy a high-level number of new bookings. The past four quarters have included Digital Realty's three best totals for bookings. Even better, much of the new bookings come from new customers, allowing for an expansion of the customer base. The trust also has most of its expiring leases renewed and the weighted average lease term for the entire portfolio is more than seven years. This gives Digital Realty much clarity into the future. Digital Realty also offers a solid dividend that it has increased for nearly two decades.

That said, shares have had a solid return over the last two months, resulting in a much higher than usual valuation. I remain a fan of the trust's business, but would prefer a lower entry point than what is currently offered.

Author disclosure: the author has no position in any stock mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.