Bristol-Myers Squibb Co. (BMY, Financial) continues to face challenges associated with Covid-19 and had a strictly mediocre first quarter given the weak demand for its multiple myeloma (MM) drug Revlimid and immuno-oncology drug Opdivo.

The pharmaceutical company did have its share of positive updates given the success of its new immuno-oncology drug, Relatlimab, with skin cancer patients and positive Phase 3 data on the immunology drug Deucravacitinib for moderate-to-severe psoriasis. This drug could become a genuine threat to Amgen's (AMGN, Financial) Otezla. Overall, the company has had an interesting set of developments and deserves a more detailed analysis.

Recent financial performance

Bristol-Myers Squibb had a particularly disappointing first quarter. The company reported a top line of $11.07 billion, which grew 2.71% from revenue of $10.78 billion reported in the prior-year quarter. The company underperformed the analyst consensus estimate of $11.13 billion. Revenue translated into a gross margin of 78.11% and an operating margin of 20.27%, which were lower than in the same quarter of 2020.

The company reported net income of $2.02 billion and adjusted earnings per share of $1.74, which was 7 cents below the average Wall Street expectation of $1.81. Bristol-Myers generated $3.82 billion in operating cash flows and spent $143 million in investing activities, leaving it with significant free cash flow.

Segment performance

As of Wednesday, the thre top-performing drugs of Bristol-Myers Squibb are Revlimid (blood cancer drug), Opdivo (immuno-oncology drug) and Eliquis (oral anticoagulant).

Revlimid, coupled with the Celgene acquisition, contributed close to $2.9 billion to the topline and continues to be the top revenue generator for Bristol-Myers Squibb. The drug posted a nominal growth of 1% on account of inventory reversals. It is worth highlighting that Revlimid's sales have always been a prominent driver for revenue due to price increases, upgraded diagnostics technologies leading to early cancer detection, label expansion and a longer duration of use.

In the oncology space, Opdivo sales were down 3% year over year to $1.7 billion. The drug has first-line approval in gastric cancer and has a huge market in the form of metastatic and adjuvant oesophageal cancer. This provides a number of opportunities for the company to expand Opdivo's label in the future.

Finally, Eliquis maintained momentum for the company as sales increased 9% to $2.9 billion.

Collaboration with DarwinHealth

In May, Bristol-Myers Squibb entered into a scientific research collaboration with DarwinHealth, a New York City-based biotechnology company, for a novel cancer target discovery initiative. The collaboration employs quantitative systems, biology-based algorithms, proprietary databases and validated technologies to identify novel cancer targets across a broad range of tumor subtypes. The methodology is primarily based on an understanding of critical mechanisms linked to tumor dependencies and maintenance beyond genetic mutations.

DarwinHealth plans to provide proprietary information residing in its drug databases, including tumor context-specific analyses of master regulators of distinct tumor subtypes, as well as direct upstream modulators. The mechanism-based insights may significantly accelerate the development of drugs targeting non-oncogene dependencies that underpin and drive key cancer hallmarks. This collaboration could bring decent upside potential with respect to the long-term growth of the company.

Final thoughts

While Briston-Myers Squibb may have built a strong portfolio of drugs, it needs to make significant progress on its pipeline. The company loses its exclusivity for Revlimid in 2022, for Eliquis in 2026 and for Opdivo in 2028, which means it would be competing with a large number of biosimilars and generics.

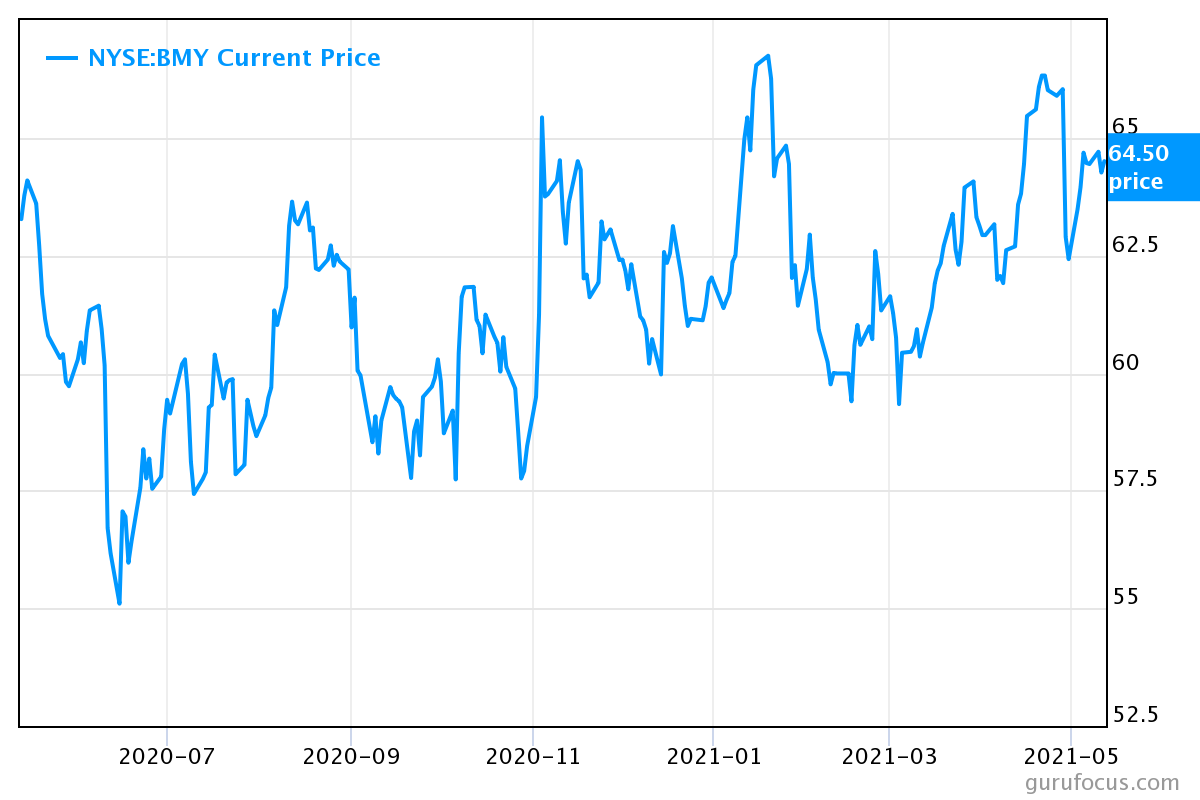

Given these concerns, the volatile trajectory of the stock appears to be justified. I agree with the GF Value indicator that points towards Bristol-Myers Squibb being fairly valued and its current enterprise value-to-revenue multiple of 4.16 is also reasonable. While the forward price-earnings ratio of 8.63 may appear to draw the attention of many pharma investors, the company still needs to show some excellent progress in terms of its pipeline in the coming quarters for investors to consider it a viable investment. Until then, it is a good watch-list candidate.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.