As a dividend growth investor, I am drawn to companies with long histories of raising dividend payments to shareholders. Especially attractive are those companies with multiple decades of dividend growth as these companies have proven to operate a successful business model, even in recessionary times. Only the strongest of companies, backed by high demand and services, can grow dividends under adverse economic conditions.

One name that I have yet to own, but have watched for a long time, is Genuine Parts Company (GPC, Financial). A leader in its industry, Genuine Parts has raised its dividend every year for more than six decades and has one of the longest growth streaks in the market place.

Company background and historical performance

Genuine Parts has been in business since the late 1920s and now operates the largest global auto parts network in the world. The company produced $17 billion in revenue last year and is valued at more than $19 billion today. Genuine Parts is composed of four segments, including: Automotive Parts, which contains the company's automotive repair products, Industrial Parts Group, which markets products to industrial customers, Business Products, which sells office related products, and Electrical/Electronic Materials Group, which distributes electrical and electronic components.

Genuine Parts has been so successful for so long in large part because of the demand for its products. Vehicles need regular maintenance in order to work and the average repair costs increase as the car ages. More than two-thirds of U.S. cars have been in service for at least six years. This also happens to be the age of the vehicles where repairs tend to become more expensive. With consumers keeping their cars for longer, higher repair costs are a benefit to the automotive repair market in general and Genuine Parts in particular.

Though the company is a leader in its field, the total addressable market for automotive repair is estimated at more than $200 billion annually and Genuine Parts controls less than 10% of this market. Automotive repair is a highly fragmented market, but Genuine Parts has taken steps over the years to acquire a larger share.

Mostly, this is done through strategic acquisitions, something the company has engaged in quite a few times recently. Over the past few years, Genuine Parts has attempted to bolster its European foothold through the acquisitions of German based Hennig Fahrzeugteile and Netherlands based PartsPoint. The company also acquired Inenco in 2019 as a way to increase its business in South East Asia and Australia.

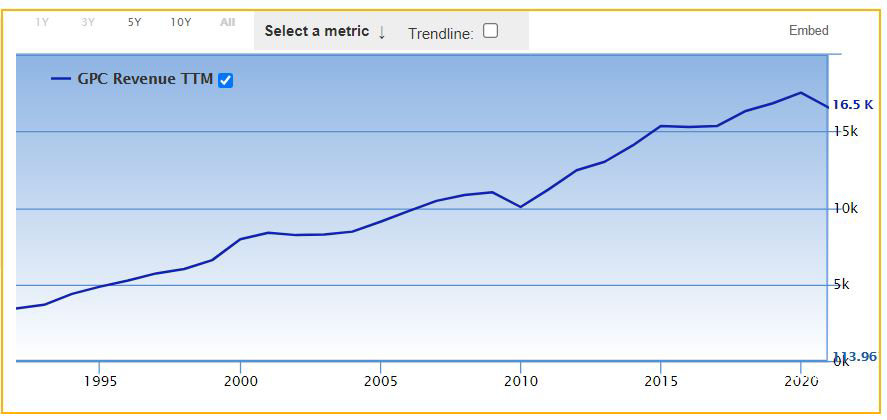

Organic growth combined with acquisitions-related gains have helped Genuine Parts grow its revenue over the long-term:

While there are the occasional years where revenue fails to advance, Genuine Parts, for the most part, has been very consistent. Consumers have a need for auto repair regardless of economic conditions and Genuine Parts is the largest name in the space, leading to solid growth rates.

Revenue has increased at an annual rate of 2.9% over the last decade. Of course, this period of time includes 2020, a year that saw lower demand for products as fewer consumers were driving due to the pandemic. Revenue fell almost 15% for the year. Using the 2010 to 2019 time frame, revenue had a compound annual growth rate of 5.6%.

Earnings per share have increased with a CAGR of 3.9% since 2011, partially aided by a reduction in share count. Using the 2010 to 2019 period, earnings per share grew almost 8% annually. Net profit margin of 4.6% last year nearly matched the 4.5% produced in 2011. Genuine Parts operates in a fairly low margin business, demonstrating why its leadership position and ability to make timely acquisitions is so important to its growth.

The company scores very well in terms of profitability:

Genuine Parts receives a 7 out of 10 from GuruFocus for profitability. The company's operating margin beats two-thirds of the 1,050 companies in the retail – cyclical industry. Compared to its own history, however, Genuine Parts is at the low end of its long-term range for operating margin. This is a theme seen throughout the different profitability categories, as Genuine Parts' current ratio is at the low end of its historical range. Still, the company tops more than 70%, 57% and 56% of its peers in return on capital, return on assets and return on equity, respectively. Three-year revenue growth is also superior to 56% of competitors.

Two areas where Genuine Parts doesn't hold up are the three-year growth rates for earnings per share and Ebitda. These ratios are likely to improve with the company expected to rebound in 2021.

Over the long haul, Genuine Parts has demonstrated higher growth rates on the top and bottom lines, something that has allowed the company to pay out a solid dividend.

Dividend analysis

With a 3.2% dividend increase for the April 1 payment, Genuine Parts' dividend growth streak has now reached 65 consecutive years. There are just two companies with a longer dividend growth streak.

According to The Dividend Investing Resource Center, which maintains a database of companies that have at least five consecutive years of dividend growth, Genuine Parts' dividend has increased by an average of:

- 5.3% over the past three years.

- 5.3% over the past five years.

- 6.8% over the past 10 years

The most recent raise is below any of the averages listed above, but likely a prudent increase given the impact of Covid-19.

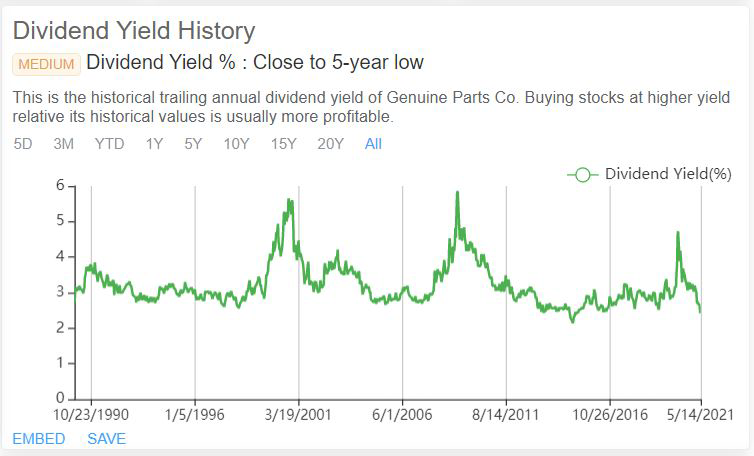

After averaging a dividend yield of 3.5% last year, Genuine Parts' dividend yield has declined to 2.5%. For context, Genuine Parts has averaged a 3% dividend yield for the last decade. Shares of the company have returned 32% year-to-date, sapping some of the generosity of the stock's yield. Still, the yield is better than 61% of peers. The forward growth rate also outshines almost two-thirds of those in its industry. The company's average share buyback ratio also outperforms the competition and is in the top half of the 10-year range.

Genuine Parts' dividend is below its 10-year average, but it is also at the low end of the last 30 years. Rarely has the stock ever yielded 3%.

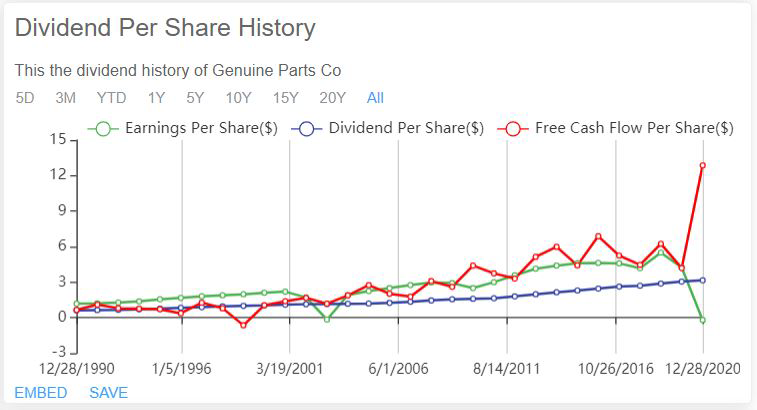

Since the turn of the century, Genuine Parts has usually had plenty of coverage for its dividend. Free cash flow coverage faced more pressure towards the beginning of the 30-year chart, but this has greatly improved to the point that it looks like the dividend is very safe using either payout ratio.

Reflecting this are the earnings per share and free cash flow payout ratios over the last year.

Over the past four quarters, where the company distributed dividends and reported earnings, Genuine Parts has paid out $3.19 of dividends per share while producing earnings per share of $5.39. This results in a payout ratio of 59%, just above the 10-year average payout ratio of 53%.

Free cash flow has the dividend looking even safer. The company distributed $456 million of dividends over the last year while generating $2.1 billion of free cash flow for a payout ratio of 22%. Genuine Parts' payout ratio is 42% since 2017. Even in a rough year for the business, Genuine Parts still produced a significant amount of free cash flow that more than covered its dividend payments.

I take this to be a sure sign of strength that the dividend is protected even under difficult circumstances. The company has shown that it can manage its dividend very effectively in the face of severe headwinds. This is one reason why Genuine Parts' dividend has survived and increased over the last eight recessions.

Recession Performance

This performance under duress reinforces the point of just how recession proof Genuine Parts tends to be. Listed below are the company's adjusted earnings results before, during and after the last recession:

- 2006 adjusted earnings per share: $2.76

- 2007 adjusted earnings per share: $2.98 (8% increase)

- 2008 adjusted earnings per share: $2.92 (2% decrease)

- 2009 adjusted earnings per share: $2.50 (14.4% decrease)

- 2010 adjusted earnings per share: $3.00 (20% increase)

- 2011 adjusted earnings per share: $3.58 (19.3% increase)

- 2012 adjusted earnings per share: $4.14 (15.6% increase)

Adjusted earnings per share did decline slightly more than 16% from 2007 to 2009, but the company responded with a new high the very next year. Since then, earnings per share have increased nearly every year outside of a less than 1% decline in 2016 and a 7.4% decrease last year.

How about the company's dividend? Listed below are the company's dividend per share totals for the same period of time.

- 2006 dividends: $1.35

- 2007 dividends: $1.46 (8.1% increase)

- 2008 dividends: $1.56 (6.8% increase)

- 2009 dividends: $1.60 (2.6% increase)

- 2010 dividends: $1.64 (2.5% increase)

- 2011 dividends: $1.76 (7.3% increase)

- 2012 dividends: $1.98 (12.5% increase)

Dividend growth did slow down in the aftermath of the Great Recession, but accelerated once business growth returned. This would likely be the case in the next recession as well. The company's dividend has proven resilient even in recessionary periods, something that is likely to occur again given the low payout ratios and Genuine Parts' historical performance.

Debt

It is always important to examine a company's financial strength in order to find any potential trouble spots. Too much debt or interest expense could result in lower future dividend growth or, worse, telegraph a potential dividend cut.

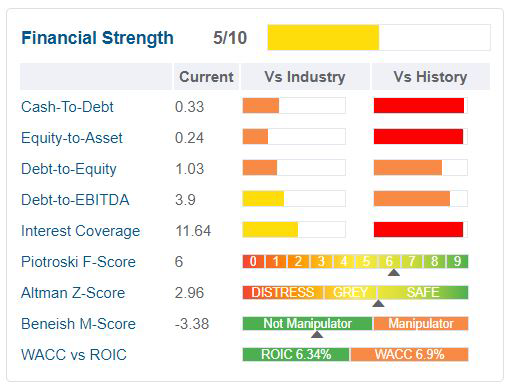

Currently, Genuine Parts receives a 5 out of 10 for financial strength. The company's best category in interest coverage, topping more than 54% of peers, though this is at the low end of its own historical range. The cash-debt ratio is worse than 64% of cyclical retail companies and is again near the bottom of the long-term range. Equity-to-asset and debt-to-equity also trail the industry.

While the financial rankings aren't that impressive, Genuine Parts' balance sheet does appear to be on solid footing. Total assets stood at $13.9 billion at the end of the first quarter of the year, with current assets numbering $7.6 billion. Included in this is $1.1 billion of cash and equivalents. Inventories of $3.6 billion were actually down slightly from the prior year and higher by 2.7% sequentially, showing that the company is managing its product well.

Total liabilities came to $10.6 billion, including $6.4 billion of current liabilities. Total debt stood at $3.4 billion, but just $160 million of debt is due within the next twelve months. Genuine Parts had interest expense of $91.8 million over the last four quarters, resulting in a weighted average interest rate of just 1.4%.

Genuine Parts may not have the best financial strength ranking from GuruFocus, but its debt obligations are manageable as cash on hand and free cash flow more than cover interest expense and short term debt. Therefore, it is highly unlikely that debt will be a headwind to future dividend growth.

Valuation analysis

Genuine Parts closed Monday's trading session at $132.35. According to Yahoo Finance, Wall Street analysts who cover the stock expect the company to earn $6.05 in 2021, which would be a 15% improvement from the previous year if achieved. Shares are trading with a forward price-earnings ratio of 21.9. The five- and 10-year average price-earnings ratios are 18.4 and 18, respectively.

Generally, shares have traded within a tight range over the medium- and long-term. By this measure, Genuine Parts appears overvalued.

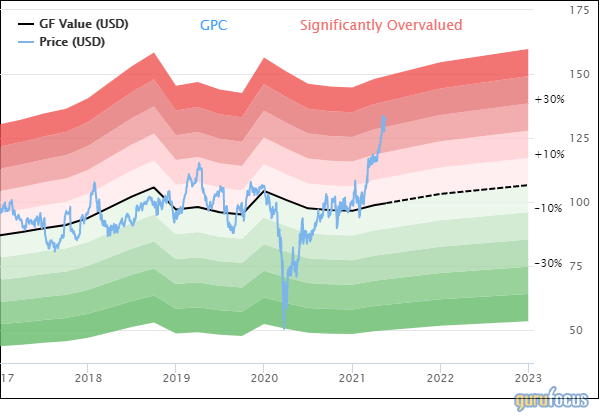

Using intrinsic value as measured by the GuruFocus Value chart, the stock seems to be expensive as well.

With a GF Value of $99.40, Genuine Parts has a price-to-GF-Value ratio of 1.33, earning shares a rating of significantly overvalued. The stock would have to retreat almost 25% to trade with its GF Value.

Final thoughts

For those looking for reliable and stable income, there is much to like about Genuine Parts. The company has one of the longest dividend growth streaks going, pays a market beating yield and appears to be very safe using either the earnings or free cash flow payout ratio.

Genuine Parts also has a long, successful history of growing its business, either organically or through acquisitions. The company also provides products and services that are needed, even in economic downturns. Genuine Parts also has potential for future growth given the fragmented nature of the industry that it operates in.

That being said, shares are expensive relative to the stock's history and intrinsic value. I don't mind overpaying for businesses that perform well in all economic conditions and have a recession tested dividend, but the current price is much richer than I am willing to pay. As much as I like the business and dividend history, I would wait for a pullback before adding Genuine Parts to my portfolio.

Author disclosure: the author has no position in any stock mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.