Ken Heebner (Trades, Portfolio)'s Capital Growth Management sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

The Michaels Companies

The guru's The Michaels Companies Inc. (MIK) position was closed, impacting the portfolio by -3.64%.

The arts and crafts specialty retailer has a market cap of $3.14 billion and an enterprise value of $6.15 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on assets of 7.07% is outperforming 79% of companies in the retail, cyclical industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.28.

The largest guru shareholder of the company is John Paulson (Trades, Portfolio) with 1.40% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.48% and Jeremy Grantham (Trades, Portfolio) with 0.32%.

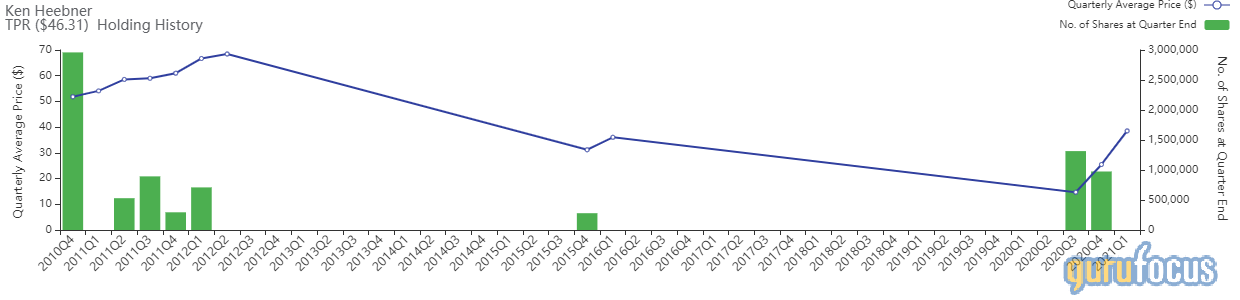

Tapestry

The guru exited the position in Tapestry Inc. (TPR), impacting the portfolio by -3.05%.

The company has a market cap of $12.91 billion and an enterprise value of $14.78 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 12.84% and return on assets of 4.27% are outperforming 68% of companies in the retail, cyclical industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.47 is blow the industry median of 0.54.

The largest guru shareholders of the company include Steven Cohen (Trades, Portfolio) with 0.51% of outstanding shares, John Rogers (Trades, Portfolio) with 0.28% and Pioneer Investments (Trades, Portfolio) with 0.17%.

Group 1 Automotive

The firm trimmed its position in Group 1 Automotive Inc. (GPI) by 88.24%. The trade had an impact of -2.97% on the portfolio.

The company has a market cap of $3.04 billion and an enterprise value of $5.47 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 25.62% and return on assets of 7.05% are underperforming 82% of companies in the vehicles and parts industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.03.

The largest guru shareholder of the company is Grantham with 0.83% of outstanding shares, followed by HOTCHKIS & WILEY with 0.30% and Louis Moore Bacon (Trades, Portfolio) with 0.21%.

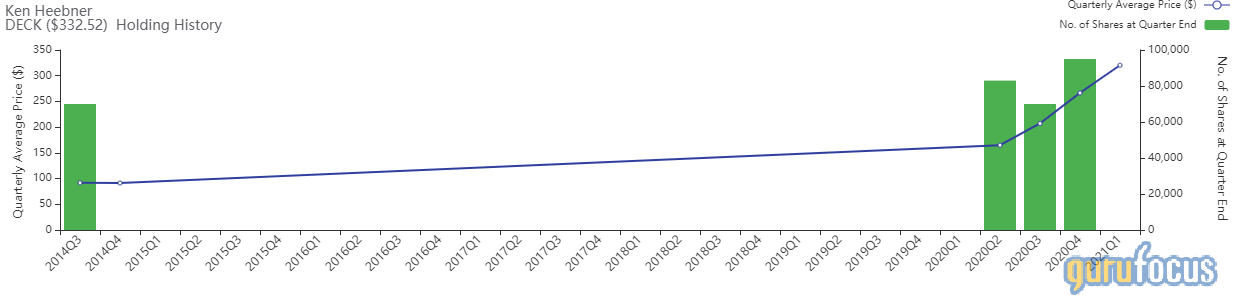

Deckers Outdoor

The guru exited the position in Deckers Outdoor Corp. (DECK), impacting the portfolio by -2.74%.

The company, which designs and sells casual and performance footwear, apparel and accessories, has a market cap of $9.37 billion and an enterprise value of $8.48 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 29.62% and return on assets of 18.37% are outperforming 97% of companies in the manufacturing - apparel & accessories industry. Its financial strength is rated 8 out of 10 with a cash-debt ratio of 4.36.

The largest guru shareholders of the company include Steven Scruggs (Trades, Portfolio) with 0.11% of outstanding shares, Paul Tudor Jones (Trades, Portfolio) with 0.08% and Simons with 0.07%.

Alcoa

The firm exited its position in Alcoa Corp. (AA), impacting the portfolio by -2.51%.

The vertically integrated aluminum company has a market cap of $7.44 billion and an enterprise value of $9.48 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -2.09% and return on assets of -0.53% are outperforming 71% of companies in the metals and mining industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.86.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 3.71% of outstanding shares, followed by Simons' firm with 1.52% and Donald Smith & Co with 0.79%.

Kimco Realty

The guru closed the position in Kimco Realty Corp. (KIM), impacting the portfolio by -2.39%.

The U.S. real estate investment trust has a market cap of $9.01 billion and an enterprise value of $13.49 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 18.68% and return on assets of 9.09% are outperforming 93% of companies in the REITs industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.19.

The largest guru shareholders of the company include Pioneer Investments (Trades, Portfolio) with 0.33% of outstanding shares, Chuck Royce (Trades, Portfolio) with 0.25% and George Soros (Trades, Portfolio) with 0.05%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.