Trian Fund Management, the firm co-founded by Nelson Peltz (Trades, Portfolio), Peter May and Edward Green, disclosed this week that the firm's top trades during the first quarter included a new position in Ferguson PLC (FERG, Financial) and reductions to its holdings in Proctor & Gamble Co. (PG, Financial) and Mondelez International Inc. (MDLZ, Financial). The firm also disclosed that it boosted in May its position in Janus Henderson Group PLC (JHG, Financial) according to GuruFocus Real-Time Picks, a Premium feature.

The New York-based firm invests in a wide range of public equity and alternative securities using fundamental analysis, focusing on undervalued securities.

As of March 31, Trian's $8.46 billion equity portfolio contains nine stocks, with one new position and a turnover ratio of 19%. The top five sectors in terms of weight are consumer staples, industrials, financial services, communication services and consumer discretionary, representing 39.90%, 23.68%, 17.33%, 12.71% and 6.38% of the equity portfolio.

Real-time trade: Janus Henderson Group

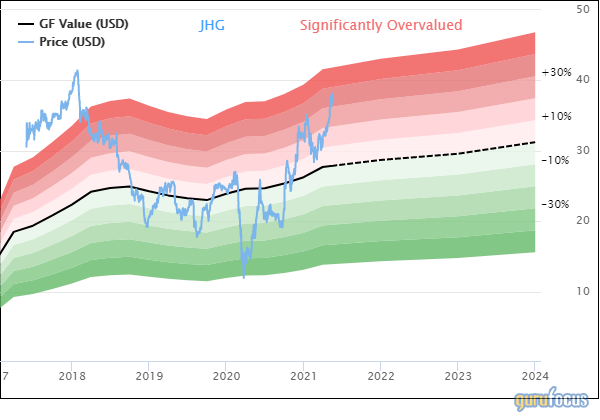

Trian disclosed on Tuesday that it owns 20,667,628 shares of Janus Henderson Group (JHG, Financial), up 0.32% from the May 11 holding of 20,601,246 shares and 26.51% from the December 2020-quarter holding of 16,366,612. The shares traded around $36.99 on Tuesday; the stock is significantly overvalued based on Thursday's price-to-GF Value ratio of 1.33.

GuruFocus ranks the U.K.-based asset management company's financial strength and profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a strong Altman Z-score of 8, debt ratios that outperform over 70% of global competitors and an operating margin that is near a 10-year high and has increased approximately 2.3% per year on average over the past five years.

New buy during March quarter: Ferguson PLC

Trian purchased 13,212,239 shares of Ferguson (FERG, Financial), giving the stake 18.38% weight in its equity portfolio. Shares averaged $121.04 during the first quarter; the stock is significantly overvalued based on Thursday's price-to-GF Value ratio of 1.53.

GuruFocus ranks the U.K.-based industrial distribution company's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins and returns outperforming over 83% of global competitors.

Other gurus with positions in Ferguson include Chris Davis (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

Proctor & Gamble

Trian disclosed on May 6 that it owns 5,791,751 shares of Proctor & Gamble (PG, Financial), down 34.81% from the March-quarter holding of 8,884,877 shares. The real-time pick follows the selling of 938,847 shares during the first quarter, impacting the position -9.56% and the equity portfolio -1.93%. The May 6 trade impacted the equity portfolio -4.92%.

GuruFocus ranks the Cincinnati-based consumer goods giant's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and an operating margin that has increased approximately 2.4% per year on average over the past five years and is outperforming more than 93% of global competitors.

Mondelez

Trian sold 2,857,861 shares of Mondelez (MDLZ, Financial), trimming the position 23.35% and the equity portfolio 2.47%.

GuruFocus ranks the Chicago-based snack producer's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins that outperform over 87% of global competitors.

Disclosure: Long Proctor & Gamble.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.