Frank Sands (Trades, Portfolio)' Sands Capital Management sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

Adobe

The guru curbed the position in Adobe Inc. (ADBE) by 96.82%, impacting the portfolio by -1.98%.

The company, which provides content creation, document management and digital marketing and advertising software and services, has a market cap of $235.02 billion and an enterprise value of $234.76 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 46.48% and return on assets of 24.31% are outperforming 96% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.05 is above the industry median of 2.85.

The largest guru shareholders of the company include PRIMECAP Management (Trades, Portfolio) with 1.61% of outstanding shares, Ken Fisher (Trades, Portfolio) with 1.25% and Spiros Segalas (Trades, Portfolio) with 0.56%.

Abiomed

The guru's Abiomed Inc. (ABMD) position was closed, impacting the portfolio by -0.91%.

The company, which provides temporary mechanical circulatory support devices, has a market cap of $12.51 billion and an enterprise value of $12.03 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 18.98% and return on assets of 16.79% are outperforming 84% of companies in the industry. Its financial strength is rated 9 out of 10 with no debt.

The largest guru shareholder of the company is BAILLIE GIFFORD & CO with 7.60% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 4.24% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 3.93%.

Amazon

The firm trimmed its position in Amazon.com Inc. (AMZN) by 14.76%. The trade had an impact of -0.74% on the portfolio.

One of the world's largest online retailers, Amazon has a market cap of $1.64 trillion and an enterprise value of $1.65 trillion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 32.14% and return on assets of 9.57% are outperforming 88% of companies in the retail, cyclical industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.86 is below the industry median of 0.55.

The largest guru shareholders of the company include Baillie Gifford (Trades, Portfolio) with 0.58% of outstanding shares, Fisher with 0.36%, Pioneer Investments (Trades, Portfolio) with 0.22%, Segalas with 0.19% and Sands with 0.32%.

Zoetis

The guru trimmed the position in Zoetis Inc. (ZTS) by 27.53%, impacting the portfolio by -0.42%.

The company, which provides anti-infectives, vaccines, parasiticides, diagnostics and other health products for animals, has a market cap of $83.46 billion and an enterprise value of $87.21 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 51.58% and return on assets of 13.5% are outperforming 90% of companies in the drug manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.49 is below the industry median of 1.02.

The largest guru shareholders of the company include Sands with 0.75% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.25% and Simons' firm with 0.14%.

bluebird bio

The firm closed its position in bluebird bio Inc. (BLUE), impacting the portfolio by -0.26%.

The clinical-stage biotechnology company has a market cap of $2.07 billion and an enterprise value of $1.27 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of -45.19% and return on assets of -34.55% are underperforming 53% of companies in the biotechnology industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 4.92.

The largest guru shareholder of the company is the Vanguard Health Care Fund (Trades, Portfolio) with 9.10% of outstanding shares, followed by Paul Tudor Jones (Trades, Portfolio) with 0.27%.

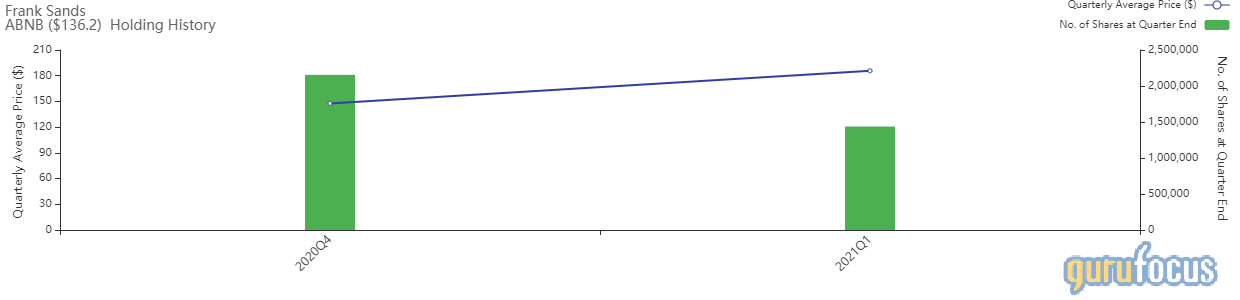

Airbnb

The guru trimmed the position in Airbnb Inc. (ABNB) by 33.32%, impacting the portfolio by -0.20%.

The online alternative accommodation travel agency has a market cap of $84.11 billion and an enterprise value of $79.99 billion.

GuruFocus gives the company a profitability and growth rating of 1 out of 10. The return on equity of -387.51% and return on assets of -54.18% are underperforming 98% of companies in the interactive media industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 2.67.

Other notable guru shareholders of the company include Chase Coleman (Trades, Portfolio) with 0.11% of outstanding shares and Jones with 0.05%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.