Mario Cibelli (Trades, Portfolio), leader of Marathon Capital Management, disclosed in May that his firm's top trades during the first quarter included reductions in its Worldwide Wrestling Entertainment Inc. (WWE, Financial) and e.l.f. Beauty Inc. (ELF, Financial) holdings, a boost to its Stitch Fix Inc. (SFIX, Financial) position and new buys in SmileDirectClub Inc. (SDC, Financial) and Whole Earth Brands Inc. (FREE, Financial).

A former partner of Mario Gabelli (Trades, Portfolio)'s GAMCO Investors Inc. (GBL, Financial), Cibelli invests in stocks that have the potential to double in value within the next three to five years regardless of current market conditions. Marathon Capital also focuses on the less efficient segments of the market.

As of March 31, Marathon Capital's $240 million equity portfolio contains 13 stocks, with two new positions and a turnover ratio of 10%. The top four sectors in terms of weight are communication services, technology, consumer cyclical and consumer defensive, representating 39.90%, 19.28%, 15.09% and 13.57% of the equity portfolio.

Worldwide Wrestling Entertainment

Marathon Capital sold 455,000 shares of Worldwide Wrestling Entertainment (WWE, Financial), knocking out 43.33% of the stake and 9.60% of the equity portfolio. Shares averaged $52.49 during the first quarter; the stock is modestly undervalued based on Tuesday's price-to-GF Value ratio of 0.82.

GuruFocus ranks the Stamford, Connecticut-based wrestling event programming company's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins and returns outperforming more than 91% of global competitors.

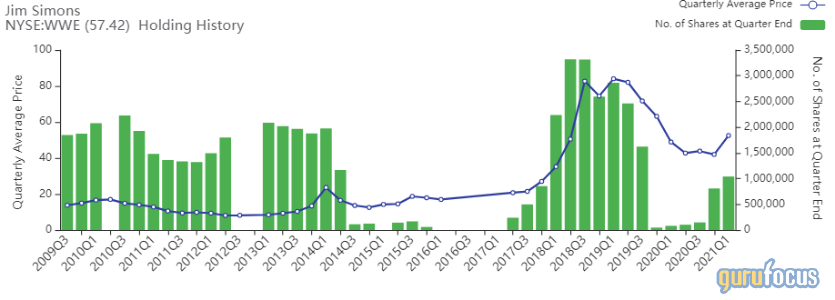

Other gurus with holdings in Worldwide Wrestling Entertainment include Jim Simons (Trades, Portfolio)' Renaissance Technologies and Chuck Royce (Trades, Portfolio)'s Royce Investment Partners.

E.l.f Beauty

Marathon Capital sold 340,000 shares of e.l.f. Beauty (ELF, Financial), slashing 51.91% of the stake and 3.76% of the equity portfolio. Shares averaged $24.94 during the first quarter; the stock is significantly overvalued based on Tuesday's price-to-GF Value ratio of 1.61.

GuruFocus ranks the Oakland, California-based cosmetics company's financial strength 5 out of 10: Although the company has a high Piotroski F-score of 7 and a strong Altman Z-score of 3.6, interest coverage and debt ratios are underperforming more than 65% of global competitors.

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management and Lee Ainslie (Trades, Portfolio)'s Maverick Capital also have positions in e.l.f. Beauty.

Stitch Fix

Marathon Capital purchased 207,500 shares of Stitch Fix (SFIX, Financial), expanding the position 52.2% and the equity portfolio 4.29%. Shares averaged $70.65 during the first quarter; the stock is significantly overvalued based on Tuesday's price-to-GF Value ratio of 1.33.

GuruFocus ranks the San Francisco-based personalized retail company's financial strength 6 out of 10 on the back of debt ratios outperforming over 64% of global competitors.

SmileDirectClub

The firm purchased 575,000 shares of SmileDirectClub (SDC, Financial), giving the position 2.47% weight in its equity portfolio. Shares averaged $11.86 during the first quarter.

According to GuruFocus, the Nashville, Tennessee-based orthodontics company's cash-to-debt ratio of 0.56 underperforms over 75% of global competitors, suggesting low financial strength.

Whole Earth Brands

Marathon Capital purchased 250,000 shares of Whole Earth Brands (FREE, Financial), giving the position 1.36% weight in the equity portfolio.

The Chicago-based company produces low-sugar alternatives and reduced-sugar products. According to GuruFocus, the company's debt-to-equity ratio underperforms more than 80% of global competitors, suggesting low financial strength.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.