Assumptions. Assumptions. Assumptions. Our world is filled with them. Financially engineered exotic, black-box instruments generally have been modeled with assumptions. As the old adage goes, there are only two things that are certain in life: death and taxes. Ergo, to state everything else with certainty will be a buffoon’s guess.

One could faintly recall the debacle of Long Term Capital Management as a relatively low-risk arbitrage strategy, but the “hedging” of long emerging market debt and short position in U.S. Treasury debt was a double whammy when Russia defaulted on its debt and devalued its currency in the fall of 1998. The consequence was the “flight to quality” to U.S. Treasurys, taking the price of U.S. Treasurys up, whereas the price of emerging market debt fell due to panic.

Collateralized debt obligations (CDOs)

You may be familiar with the term collateralized default swap (CDS). It’s a form of insurance where a CDS buyer seeks protection from the outlier event happening (bankruptcy or debt restructuring), which the CDS seller provides in return for a premium. The latter is synonymous to an insurance seller.

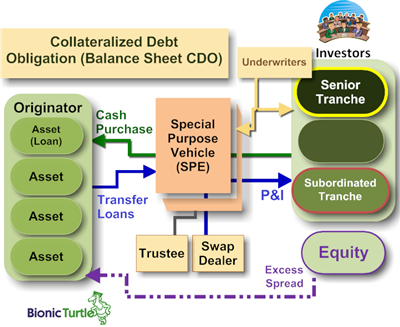

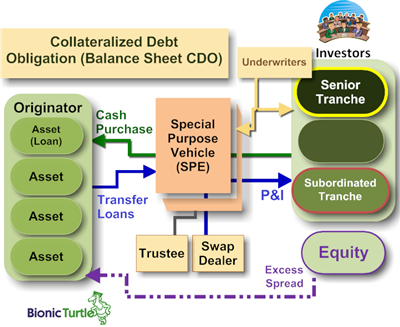

But one may wonder what are collateralized debt obligations (CDOs)? Below is a diagram depicting special purpose vehicles (SPV), a bankruptcy remote entity that owns the collateral and issues notes and equity according to the respective tranche. Each tranche has a different claim and different exposures to the default risk which an investor sought. The bulk of the risk lies in the equity tranche which is unrated at the lowest rung, and jazzed up with other “investment grade” tranches that cater to different investors' needs.

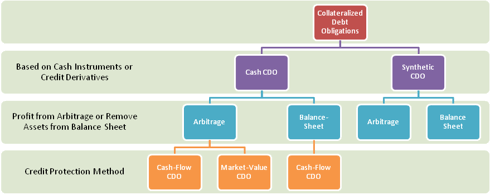

The picture below sums up nicely the various types of CDOs.

There are essentially two types of CDOs: 1) Cash funded CDO: there is an actual sale and transfer of assets to SPV, and 2) Synthetic CDO: utilizes credit derivatives to transfer the risk exposure without change in legal ownership of the assets.

The next level of CDO splits into two types: cash funded and synthetic. Balance sheet CDO: deployed by issuers to reduce regulatory requirements; or classified loans as off balance sheet to offload credit risk, and Arbitrage CDO: used by money managers to churn an arbitrage profit from the spread earned.

Both balance sheet and arbitrage CDO structures are essentially the same with the exception explained in the preceding paragraph.

Under Cash Funded CDO, the Cash Flow CDO's goal is to minimize default by managing credit quality of the held-to-maturity assets. Market Value CDOs are more actively traded to manage the cash flows to repay CDO investors.

A simple googling of the term CDO would churn out the latest news of how the fervor of these exotic instruments has yet to cool off. The full consequences of these instruments are still unknown but with the proposed regulations in Europe and the Dodd-Frank Act in the U.S., interests may wane. One wonders what will be the next novel invention of Wall Street.

Disclaimer: This material is provided for informational and/or entertainment purposes only, as of the date hereof, and is subject to change without notice.This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities.

One could faintly recall the debacle of Long Term Capital Management as a relatively low-risk arbitrage strategy, but the “hedging” of long emerging market debt and short position in U.S. Treasury debt was a double whammy when Russia defaulted on its debt and devalued its currency in the fall of 1998. The consequence was the “flight to quality” to U.S. Treasurys, taking the price of U.S. Treasurys up, whereas the price of emerging market debt fell due to panic.

Collateralized debt obligations (CDOs)

You may be familiar with the term collateralized default swap (CDS). It’s a form of insurance where a CDS buyer seeks protection from the outlier event happening (bankruptcy or debt restructuring), which the CDS seller provides in return for a premium. The latter is synonymous to an insurance seller.

But one may wonder what are collateralized debt obligations (CDOs)? Below is a diagram depicting special purpose vehicles (SPV), a bankruptcy remote entity that owns the collateral and issues notes and equity according to the respective tranche. Each tranche has a different claim and different exposures to the default risk which an investor sought. The bulk of the risk lies in the equity tranche which is unrated at the lowest rung, and jazzed up with other “investment grade” tranches that cater to different investors' needs.

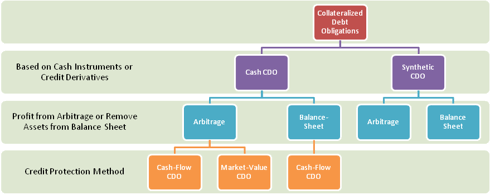

The picture below sums up nicely the various types of CDOs.

There are essentially two types of CDOs: 1) Cash funded CDO: there is an actual sale and transfer of assets to SPV, and 2) Synthetic CDO: utilizes credit derivatives to transfer the risk exposure without change in legal ownership of the assets.

The next level of CDO splits into two types: cash funded and synthetic. Balance sheet CDO: deployed by issuers to reduce regulatory requirements; or classified loans as off balance sheet to offload credit risk, and Arbitrage CDO: used by money managers to churn an arbitrage profit from the spread earned.

Both balance sheet and arbitrage CDO structures are essentially the same with the exception explained in the preceding paragraph.

Under Cash Funded CDO, the Cash Flow CDO's goal is to minimize default by managing credit quality of the held-to-maturity assets. Market Value CDOs are more actively traded to manage the cash flows to repay CDO investors.

A simple googling of the term CDO would churn out the latest news of how the fervor of these exotic instruments has yet to cool off. The full consequences of these instruments are still unknown but with the proposed regulations in Europe and the Dodd-Frank Act in the U.S., interests may wane. One wonders what will be the next novel invention of Wall Street.

Disclaimer: This material is provided for informational and/or entertainment purposes only, as of the date hereof, and is subject to change without notice.This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities.