Michael Price (Trades, Portfolio) ’s MFP Investors LLC recently disclosed its portfolio updates for the first quarter of 2021, which ended on March 21.

MFP Investors is a New York-based investment firm founded by Price in 1998. It utilizes a long-term value-based investing style to find out-of-favor stocks that trade at an attractive valuation. Price has been known to take an activist approach to investing in the past, seeking to unlock value by influencing the decisions of company management.

Based on its investing criteria, the firm’s top buys for the quarter were Laboratory Corp of America Holdings (LH, Financial) and W R Grace & Co. (GRA, Financial), while its most notable sells were Investors Bancorp Inc. (ISBC, Financial) and Ruth's Hospitality Group Inc. (RUTH, Financial).

Laboratory Corp of America Holdings

The firm established a new holding of 100,000 shares in Laboratory Corp of America Holdings (LH, Financial), which had a 3.06% impact on the equity portfolio. During the quarter, shares traded for an average price of $233.67.

Laboratory Corp of America Holdings, commonly known as Labcorp, is a laboratory testing company headquartered in Burlington, North Carolina. It operates one of the largest clinical laboratory networks in the U.S., providing vital testing results to doctors and patients.

On June 3, shares of Labcorp traded around $266.21 for a market cap of $26.00 billion and a price-earnings ratio of 9.90. According to the GuruFocus Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 0.3 is lower than 83% of industry peers, but the Piotroski F-Score of 8 out of 9 indicates a very healthy financial situation. The return on invested capital is typically higher than the weighted average cost of capital, indicating the company is creating value as it grows.

W.R. Grace

The firm increased its stake in W.R. Grace (GRA, Financial) by 226,600 shares, or 113.3%, for a total of 426,600 shares. The trade had a 1.63% impact on the equity portfolio. Shares traded for an average price of $59.66 during the quarter.

Based in Columbia, Maryland, W.R. Grace is a chemicals and materials company that operates in two segments: Grace Catalysts Technologies and Grace Materials and Chemicals. It primarily focuses on silica products, specialty construction chemicals and container protection products.

On June 3, shares of W.R. Grace traded around $68.74 for a market cap of $4.55 billion and a price-earnings ratio of 185.77. According to the GF Value chart, the stock is fairly valued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10. The Altman Z-Score of 1.72 is in the grey area, meaning the company could face liquidity issues, but the Piotroski F-Score of 6 out of 9 is typical of a financially stable company. The operating margin of 15.48% is above the industry median of 8.46%, but the net margin of -0.10% is below the industry median of 5.97%.

Investors Bancorp

The firm reduced its stake in Investors Bancorp (ISBC, Financial) by 610,000 shares, or 46.74%, leaving a remaining holding of 695,000 shares. The trade had a -0.99% impact on the equity portfolio. During the quarter, shares traded for an average price of $12.92.

Investors Bancorp is the holding company for Investors Bank, a full-service community bank based in Short Hills, New Jersey that operates over 150 branches across New Jersey and New York.

On June 3, shares of Investors Bancorp traded around $14.88 for a market cap of $3.68 billion and a price-earnings ratio of 13.76. According to the GF Value chart, the stock is fairly valued.

The company has a financial strength rating of 2 out of 10 and a profitability rating of 5 out of 10. The cash-debt ratio of 0.05 is lower than 96% of industry peers, but the debt-to-equity ratio of 1.36 is higher than the industry median of 0.57. The return on equity of 8.31% and return on assets of 0.84% have been in an uptrend in recent years and are both about average.

Ruth's Hospitality Group

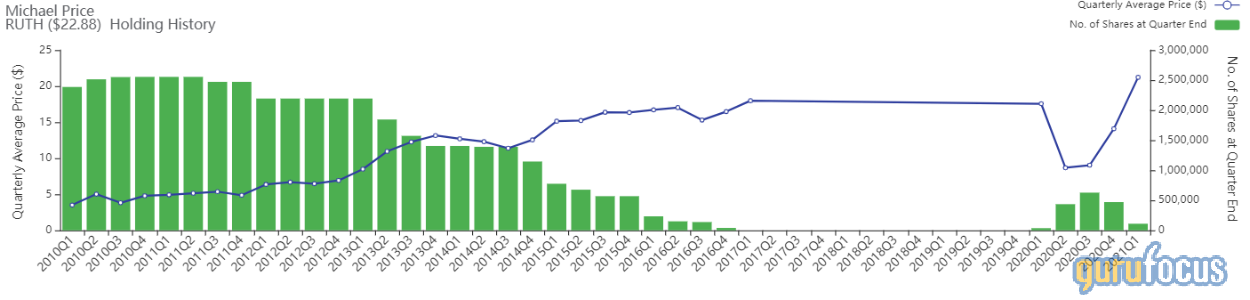

The firm also cut its investment in Ruth's Hospitality Group (RUTH, Financial) by 360,200 shares, or 76.64%, leaving a remaining holding of 109,800 shares. The trade had a -0.98% impact on the equity portfolio. Shares traded for an average price of $21.22 during the quarter.

Ruth’s Hospitality Group is the publicly owned company behind Ruth’s Chris Steak House, a chain of more than 100 upscale steakhouses located across the U.S., Canada and Mexico.

On June 3, shares of Ruth’s Hospitality Group traded around $22.88 for a market cap of $788.04 million. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. The Piotroski F-Score of 4 out of 9 and Altman Z-Score of 1.68 indicate a low chance of liquidity issues. The ROIC has recently dropped below the WACC, indicating that operations are not currently profitable.

Portfolio overview

As of the quarter’s end, the firm held common stock positions in 137 stocks valued at a total of $835 million. The top holdings were Intel Corp. (INTC) with 15.66% of the equity portfolio, S&W Seed Company (SANW) with 7% and Bunge Ltd. (BG) with 4.13%.

In terms of sector weighting, the firm was most invested in financial services, technology and consumer defensive.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Also check out: