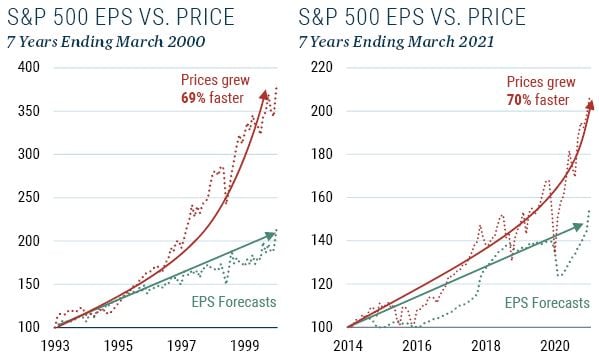

Source: GMO, I/B/E/S. EPS forecasts are 2-year forecasts. In the first chart, EPS forecasts grew at an annualized rate of 11.1%; in the second chart, EPS forecasts grew at an annualized rate of 6.4%.

- Traditional valuation metrics – Price to Earnings, Price to Sales, etc. – are backward-looking. The general complaint is that they don't give credit to today's high-growth companies that are the future "disruptors." Fair enough. So let's use forecasts from the street, which capture all that terrific growth (McKinsey has estimated that the street's earnings estimates are roughly 100% too high,1 but we'll ignore that inconvenient truth for now). Yet even great companies with great narratives can still experience price movements that are too great.

- This would not be the first time. The left chart above compares EPS forecasts with the S&P 500 price index in the 7-year period leading up to March 2000. Back then, the excitement of new technologies combined with growing confidence in the Fed had expectations running high. Wall Street EPS forecasts were rising healthily. Prices, unfortunately, moved even faster – 69% faster. This, as you know, did not end well.

- Today history is rhyming. The new business model narratives are compelling – high growth, asset-light, network effects, high switching costs, etc. Wall Street EPS forecasts are rising healthily. The problem is that prices are again growing 70% faster. This, as you suspect, cannot end well.

- Many of you have been frustrated by the bearishness of GMO's 7-Year Asset Class Forecasts and suggest that we are missing the bigger picture – that the S&P 500 is chock full of great companies with great prospects. It is. We don't dispute that. But that is missing the point. Our worry is the prices you are paying for that growth. Remember, there are no such things as bad assets, just bad prices.

1 McKinsey & Company. Marc H. Goedhart, Rishi Raj, and Abhishek Saxena. Equity Analysts: Still Too Bullish, Spring 2010.

Disclaimer: The views expressed are the views of the GMO Asset Allocation team through the period ending June 2021 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.