According to the GuruFocus All-in-One Screener, a Premium feature, the following guru-owned defensive companies have grown their book value per share over the past decade through June 14.

Book value per share is calculated as total equity minus preferred stock, divided by shares outstanding. Theoretically, it is what shareholders will receive if a company is liquidated. Total equity is a balance sheet item and is equal to total assets minus total liabilities.

Since the book value per share may not reflect the company's true value, some investors check the tangible book value to confirm their investment ideas.

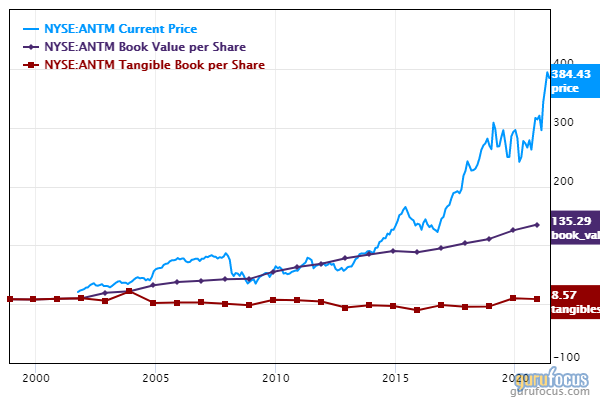

Anthem

The book value per share of Anthem Inc. (ANTM, Financial) has risen 7.30% over the past 10 years. The price-book ratio is 2.78 and the price-tangible book ratio is 33.72.

The company, which provides medical benefits, has a market cap of $94.12 billion and an enterprise value of $108.10 billion.

According to the discounted cash flow calculator, shares are undervalued and trading with a 6.23% margin of safety at $384.43. The share price has been as high as $405 and as low as $244 in the last 52 weeks. As of Monday, the stock was trading 5.31% below its 52-week high and 57.49% above its 52-week low. The price-earnings ratio is 20.58.

The Vanguard Health Care Fund (Trades, Portfolio) is the largest guru shareholder of the company with 1.75% of outstanding shares, followed by Baillie Gifford (Trades, Portfolio) with 1.60% and Hotchkis & Wiley with 1.07%.

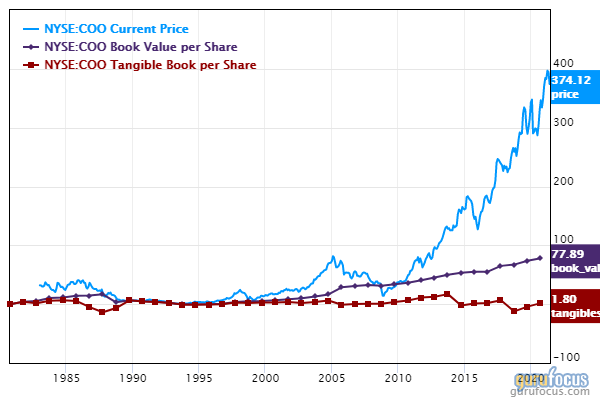

The Cooper Companies

The Cooper Companies Inc.'s (COO, Financial) book value per share has grown 7.50% over the past decade. The price-book ratio is 2.99 and the price-tangible book ratio is 8.43.

The company, which operates in the contact lens market, has a market cap of $18.42 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 48.37% margin of safety at $374.12. The share price has been as high as $415 and as low as $268 in the last 52 weeks. As of Monday, the stock was 10.06% below its 52-week high and 39.12% above its 52-week low. The price-earnings ratio is 7.89.

With 4.40% of outstanding shares, Al Gore (Trades, Portfolio) is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 1.37% and Ron Baron (Trades, Portfolio) with 0.49%.

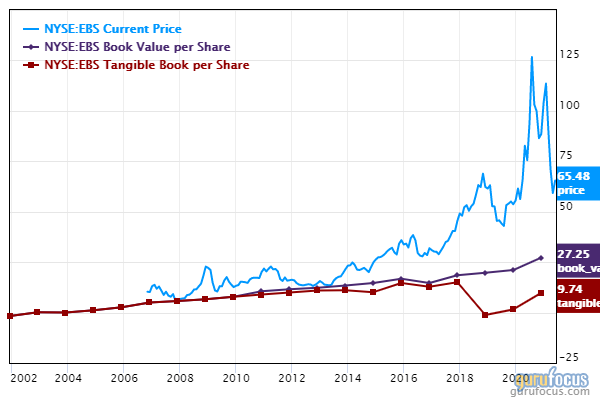

Emergent BioSolutions

Emergent BioSolutions Inc.'s (EBS, Financial) book value per share has grown 8.80% over the past decade. The price-book ratio is 2.30 and the price-tangible book ratio is 5.77.

The company, which provides public health products to government and health care providers, has a market cap of $3.51 billion and an enterprise value of $3.82 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 59.87% margin of safety at $65.48. The share price has been as high as $137.61 and as low as $55 in the last 52 weeks. As of Monday, the stock was trading 52.42% below its 52-week high and 18.90% above its 52-week low.

Ken Fisher (Trades, Portfolio) is the largest guru shareholder of the company with 0.90% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.44%, Baron with 0.42% and Joel Greenblatt (Trades, Portfolio) with 0.03%.

Humana

The book value per share of Humana Inc. (HUM, Financial) has grown 8.10% over the past 10 years. The price-book ratio is 3.83 the price-tangible book ratio is 5.87.

The U.S. private health insurer has a market cap of $54.31 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 38.59% margin of safety at $420.96. The share price has been as high as $475.44 and as low as $356.06 in the last 52 weeks. As of Monday, the stock was trading 11.46% below its 52-week high and 15.31% above its 52-week low. The price-earnings ratio is 14.97.

With 1.37% of outstanding shares, the Vanguard Health Care Fund (Trades, Portfolio) is the company's largest guru shareholder, followed by Diamond Hill Capital (Trades, Portfolio) with 0.87% and Pioneer Investments (Trades, Portfolio) with 0.63%.

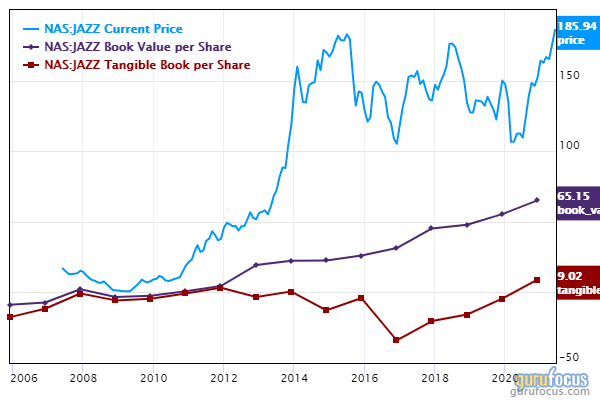

Jazz Pharmaceuticals

Jazz Pharmaceuticals PLC's (JAZZ, Financial) book value per share has grown 39.60% over the past decade. The price-book ratio is 2.78 and the price-tangible book ratio is 14.08.

The Ireland-domiciled biopharmaceutical company has a market cap of $11.29 billion and an enterprise value of $11.10 billion.

According to the DCF calculator, the stock is undervalued and is trading with a 44.33% margin of safety at $185.94. The share price has been as high as $186.75 and as low as $101.81 in the last 52 weeks. As of Monday, the stock was trading 0.43% below its 52-week high and 82.63% above its 52-week low. The price-earnings ratio is 20.39.

Jim Simons (Trades, Portfolio)’ Renaissance Technologies is the largest guru shareholder of the company with 4.39% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 0.19% and Pioneer Investments (Trades, Portfolio) with 0.16%.