On Monday, the joint venture between General Electric’s (GE, Financial) aviation unit and French aerospace company Safran SA (XPAR:SAF, Financial) announced they are developing new airplane engines focused on reducing emissions. The cleaner engines project aims to cut aircraft emissions by more than a fifth of today’s levels.

Through their joint venture, called CFM International, these two companies are the world’s leading producer of jet engines for commercial aircraft, including the Boeing (BA, Financial) 737 Max and the Airbus (XPAR:AIR, Financial) A320neo family. The new program is called CFM Rise, and the companies said the new technology could enter service by the mid-2030s.

CFM Rise

The Rise program (RISE stands for Revolutionary Innovation for Sustainable Engines) will work on technology that could reduce aircraft engine fuel consumption by more than 20%, while at the same time being compatible with sustainable aviation fuel and hydrogen.

Unlike the covered jet engines on commercial aircraft currently, the new engines would be open-fan, or unducted. The open fan demonstrator that the company released on Monday will also be a puller, or tractor, configuration with a single stage of rotating blades and a second nonrotating stage of active, variable-pitch stators.

The open fan concept increases bypass ratio by eliminating the fan duct and offers double-digit efficiency gains due to a lower fan pressure ratio. The current focus of the program is the next generation of single-aisle airliners, as this will be the easiest starting point for developing new engines using this technology.

Testing of the unducted (open) fan technology began in the 1980s, but CFM’s designs offer the most realistic development opportunity yet for this concept.

As for why the open fan demonstrator featured a puller configuration, the reality is that fundamental architectural changes will be required to keep next generation powerplants on track to meet internationally agreed targets of halving CO2 emissions by 2050. According to CFM:

“The switch to a puller versus the dual contra-rotating pusher open-rotor configuration of previous designs will enable flight-testing on existing testbed aircraft and allows for mechanically simpler integration on a potentially wider variety of future airliner concepts.”

Forward thinking

The decision to design cleaner engines now rather than waiting until they are required to do so shows the kind of forward thinking that is essential in keeping business growing. As an incumbent industry leader, the CFM joint venture has an advantage over competitors, but continuous research and development is needed in order to maintain that advantage.

Designing these engines to be compatible with multiple technologies also demonstrates forward thinking on the part of GE and Safran. The future of technology is uncertain, and while hydrogen is widely hailed as the future of aircraft engine technology, the easier and more attainable goal for now is sustainable aviation fuel.

"Our industry is in the midst of the most challenging times we have ever faced," Safran CEO Olivier Andriès said. "We have to act now to accelerate our efforts to reduce our impact on the environment.”

While CFM Rise is the most ambitious clean energy project the companies have taken on so far, they have already been making progress on reducing emissions and improving efficiency. For example, the latest LEAP engine delivers a 15% fuel improvement and 50% lower NOx emissions (versus CAEP/6 standards) in addition to a 75% reduction in noise.

While the research focus is more on electric and hybrid-electric systems for smaller aircraft, the higher power needs of larger aircraft will necessitate a slower transition to clean energy. Continued improvements to gas turbine-based engines will be needed, of which the open fan is one. Thus, a proactive approach is needed for CFM to stay on top of the industry.

Valuation

One could make the argument that, due to being at the forefront of cleaner aircraft engine technology, GE and Safran deserve to trade at higher earnings multiples. However, their aircraft engine joint venture is far from the full story for both of these businesses.

GE is an American multinational conglomerate that operates in aviation, health care, power, renewable energy, digital industry, additive manufacturing and venture capital and finance. Due to a deteriorating financial situation, among other factors, the company began a restructuring effort near the end of 2017, selling off non-core businesses to improve its balance sheet and prevent losses from accumulating.

Just as things were taking a turn for the better, Covid-19 hit, impacting the company’s aviation unit that contributes 34% of revenue.

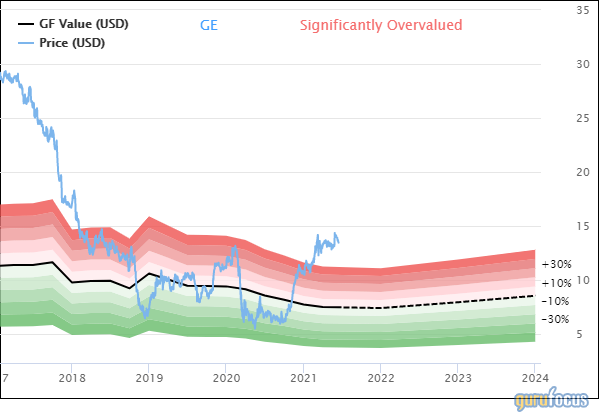

On June 14, shares of GE traded around $13.50 for a market cap of $118.66 billion. The GuruFocus Value chart rates the stock as significantly overvalued based on past returns and analysts' estimates for future earnings. Whether or not the stock is a good investment at the current level seems dependent on how successful its turnaround will be in the long run.

Safran, meanwhile, is a French multinational high-technology group and tier-1 supplier of systems and equipment to the aerospace and defense markets. With a solid Piotroski F-Score of 4 out of 9 and an interest coverage ratio of 12.37, its financial strength is high among industry peers.

Aerospace propulsion contributes about half of the company’s revenue, followed by aircraft equipment, defense and aerosystems with 37% and aircraft interiors with 12%. The higher exposure to the aircraft sector compared to GE means that Safran experienced a greater headwind from this segment the past year, but the company’s strong balance sheet put in in a good position to weather the storm without taking on too much debt.

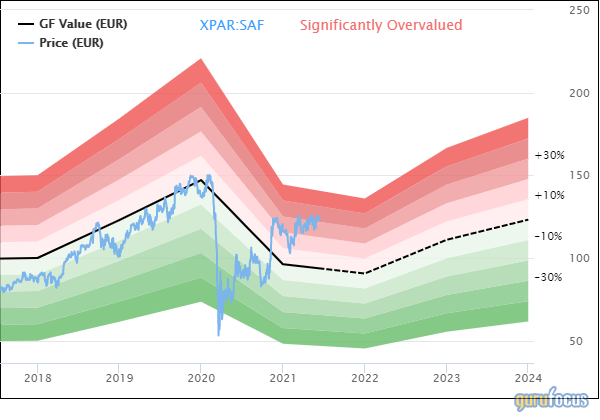

On June 14, shares of Safran traded around 123.64 euros ($149.82) for a market cap of 52.71 billion euros. The GF Value chart rates the stock as significantly overvalued. Factors such as the recovery of the travel industry post-Covid and greater government spending on defense could help the company grow its profits going forward, but much like with GE, continuous innovation is a necessary step for the company to maintain its status quo.