This past weekend, American Airlines Group Inc. (AAL, Financial) surprised customers with a stunning number of flight cancellations. The company dropped 123 flights on Saturday, 178 on Sunday and 97 on Monday, citing various staffing and maintenance issues, and it also plans to reduce its flight schedule by 1% through at least mid-July.

American isn’t the only U.S. airline major that is finding itself unable to keep up with the increase in demand for air travel, but it seems to be the one that is currently overestimating itself the most by scheduling so many flights that it later has to cancel. Near the end of 2020, Delta Air Lines (DAL, Financial) had to cancel over 300 flights during Thanksgiving weekend and a few dozen more during Christmas due to pilot shortages.

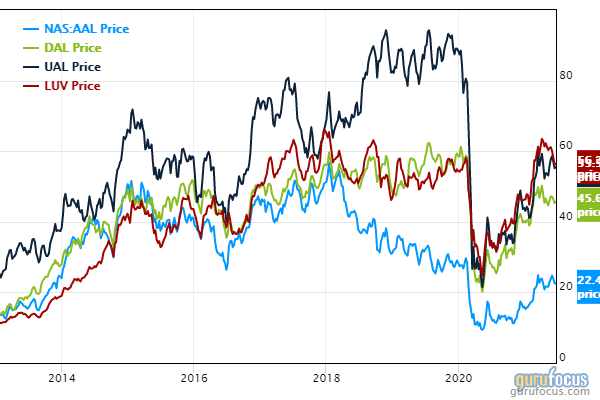

Throughout the Covid-19 pandemic, the airlines and investors who are bullish on their stocks have maintained that once demand for air travel increased again, their businesses would recover and they could begin to pay down their massive debt burdens and grant higher returns to shareholders. So far, the prediction of capital gains has played out well, and far in advance of the companies themselves recovering. Since their March 2020 lows, American, Delta, United Airlines (UAL, Financial) and Southwest Airlines (LUV, Financial) have all returned more than 50%.

However, American’s recent pullback on flight capacity brings up an important question: is there anyone that can pick up the slack and meet the increasing demand for commercial flights, thus taking market share from competitors, or are all the major players too busy trying to avoid bankruptcy?

Flight capacity projections

To get an idea of how the major U.S. airlines are faring compared to each other in terms of having retained, grown or lost market share over the past couple of years, let’s take a look at their flight capacity projections.

Earlier in June, American said that it expects its second-quarter 2021 capacity to be down 20% to 25% from 2019 levels. This is better than United, which expects capacity to be down 46%, and Delta, which predicts that it will record a 32% drop over the same timeframe. Southwest, on the other hand, projects a that its flight capacity this June will be down only 7% compared to June of 2019, with the two-year decline dropping to just 3% in July.

Thus, in terms of market share, United seems to be faring the worst, followed by Delta and then American. Southwest seems to have performed the best, but it also has the advantage of operating shorter flights to high-volume destinations on its home turf. As a domestic airline, Southwest has benefitted from domestic air traffic recovering faster than international air traffic.

Employees needed

So why is American cancelling flights when sufficient demand is clearly present and there are profits to be made? The airline blamed the problem on “a high number of sick calls, combined with maintenance and other staffing issues.”

However, while the first grievance on the list was sick calls and the second was maintenance, it seems highly unlikely that either of these was the main factor. The company also cited disruptions from bad weather as being part of the issue, but the only reason bad weather would have an effect on future flights would be if the money lost due to disruptions was enough to cause further financial struggles.

American Airlines spokeswoman Sarah Jantz commented the following about the issues:

“The bad weather, combined with the labor shortages some of our vendors are contending with and the incredibly quick ramp up of customer demand, has led us to build in additional resilience and certainty to our operation by adjusting a fraction of our scheduled flying through mid-July.”

The comment on “additional resilience and certainty” indicates that if the company does not cut back on its flight capacity now, it risks having to make more sudden and inconvenient cancellations going forward, which would cost the company even more.

Digging a little deeper, it also becomes clear that regardless of whether it’s flight cancellations, maintenance issues, sick employees, weather setbacks or poor financials, American’s problems all boil down to not being able to hire enough employees.

The labor shortages experienced by American’s vendors would cause issues with not enough maintenance staff. The fact that sick employees and weather disruptions would cause the need for mass cancellations indicates that overtime and calling additional employees in to work was not enough to make up the gap.

Indeed, American said that “bad weather can mean that crews can fall outside of the hours they are federally allowed to work.” The company is also still working to bring back the pilots it furloughed during the pandemic and get them caught up on recurrent training, but the use of buyouts and early retirement packages that it used to get employees off of the payroll quickly, combined with the fact that some found other jobs to pay the bills, means that this is still an ongoing effort.

Volunteers needed

Due to desperate shortages of staff in key positions needed for airlines to operate, some of the airlines and TSA have even begun asking for their office staff members to volunteer to work at airports instead.

Appearing in The Points Guy’s “Return of Travel” webinar in April, Delta CEO Ed Bastian committed to reopening all Sky Club airport lounges by summer, but the company didn’t have enough contractors to make it happen.

In a memo to employees, the airline stated that it’s currently “severely understaffed in the ATL Sky Club.” Continuing with a plea for help, the memo read, “Just come to the ATL airport for a few hours to help with cleaning, wiping tables, running food, restocking food buffets, etc.”

In early June, acting TSA Administrator Darby LaJoye asked office employees to volunteer at airports for up to 45 days to handle non-screening functions such as on-boarding for new hires and management of security lines.

Following in Delta’s footsteps, American also launched volunteer programs in June to try and convince corporate employees who typically sit in offices all day to pitch in at airports.

American explained its volunteer program as follows in a statement:

“As we look forward to welcoming back more of our customers this summer, we know they’re counting on us to deliver a reliable operation and help them feel comfortable as they return after many months away from traveling. That’s something our frontline teams are experts on as they regularly go above and beyond to take care of our customers. To ensure they have the support they need this summer and beyond, our corporate support teams will provide additional support at DFW.”

Neither United nor Southwest have made headlines calling for volunteers to take on different job duties to make up for staff shortages, but United is also expecting the worst capacity reductions among the four major U.S. airlines compared to 2019, and Southwest is benefitting from a healthier balance sheet and steadier demand recovery in domestic markets.

Financials and valuations

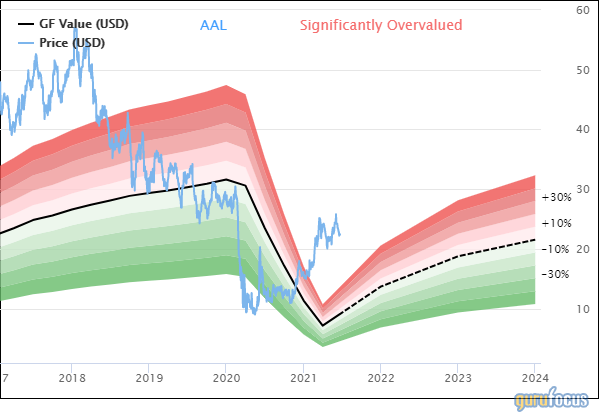

As of June 21, shares of American Airlines traded around $22.45 for a market cap of $14.37 billion. According to the GuruFocus Value chart, the stock is significantly overvalued. The company’s intrinsic value is not expected to catch up with its current stock price until at least 2024.

The company has a financial strength rating of 2 out of 10 and a profitability rating of 5 out of 10. The Altman Z-Score of -0.27 and Piotroski F-Score of 2 out of 9 indicate the company is in danger of bankruptcy in the next two years. The operating margin of -98.46% and net margin of -61.52% are underperforming 96% of industry peers.

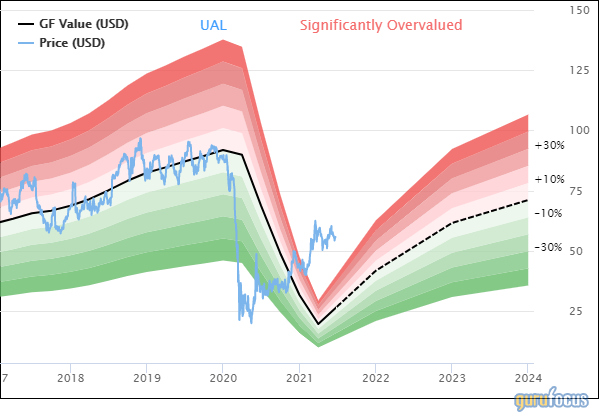

Meanwhile, United Airlines shares are trading around $55.69 apiece for a market cap of $17.96 billion. According to the GF Value chart, the stock is significantly overvalued. The company’s intrinsic value is not expected to catch up with its current stock price until 2022.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. The Altman Z-Score of 0.04 and Piotroski F-Score of 2 out of 9 indicate the company is in danger of bankruptcy in the next two years. The operating margin of -51.69% and net margin of -63.43% are underperforming 91% of industry peers.

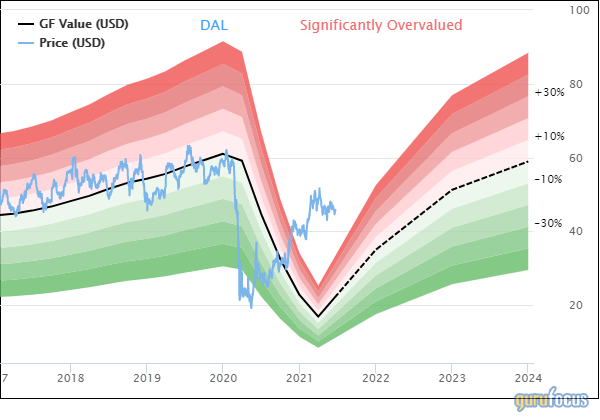

At $45.77 per share, Delta Air Lines has a market cap of $29.14 billion. According to the GF Value chart, the stock is significantly overvalued. The company’s intrinsic value is not expected to catch up with its current stock price until 2022.

Despite being financially stronger than American and United at the onset of the pandemic, Delta is now in similar financial shape due to taking less government aid money and more precautions to protect customers from Covid-19. Its financial strength rating is 3 out of 10 while the profitability rating is 6 out of 10. The Altman Z-Score of -0.36 and Piotroski F-Score of 3 out of 10 indicate a danger of bankruptcy. The operating margin of -41.74% and net margin of -102.96% are underperforming 94% of industry peers.

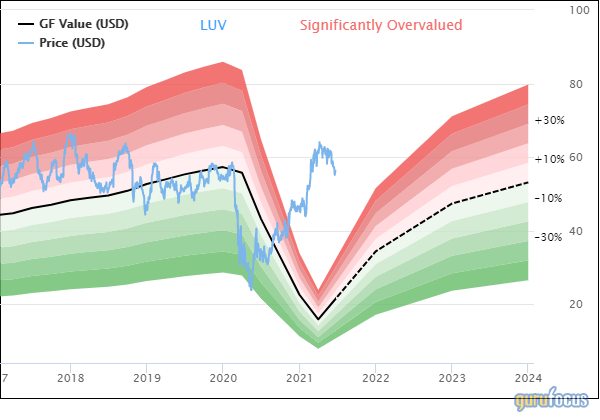

On June 21, shares of Southwest Airlines traded around $56.30 for a market cap of $33.26 billion. According to the GF Value chart, the stock is significantly overvalued. The company’s intrinsic value is not expected to catch up with its current stock price until at least 2024.

Out of the four U.S. airline majors, Southwest is in the best financial shape. The company has a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. With an Altman Z-Score of 1.46 and a Piotroski F-Score of 2 out of 9, the bankruptcy danger is still there, just not as high. The operating margin of -51.08% and net margin of -41.71% are underperforming 91% of industry peers.

Conclusion

As demand for air travel returns in the U.S., the major airlines are struggling to increase their operating capacity following the measures they took to avoid insolvency during the Covid-19 pandemic, including taking on more debt and furloughing a significant number of employees. The road to pre-pandemic levels won’t be easy, and even once commercial air traffic makes a full recovery, profits will be slow to follow due to the additional debt burdens and operating inefficiencies.

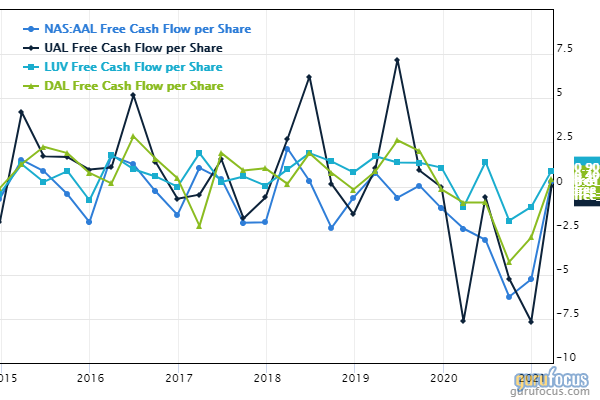

Things do seem to be looking up on some metrics. For example, in the first quarter of 2021, all four airline majors reported positive free cash flow per share.

However, anyone wanting to purchase airline shares now would be relying on the market to continue valuing them far above what their earnings are worth for years to come. These companies have also become increasingly indebted and inefficient over time as their competitive “race to the bottom” has met a couple of extraordinarily expensive recessions. One more major recession and they might all go belly-up or be bought by the government.