In light of the several European markets offering positive implied returns based on Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) Warren Buffett (Trades, Portfolio)’s market indicator, five European companies with high profitability potential as of Tuesday are Hermes International SA (XPAR:RMS, Financial), Nolato AB (OSTO:NOLA B, Financial), Fenix Outdoor International Ltd. (OSTO:FOI B, Financial), OEM International AB (OSTO:OEM B) and Biofarm SA (BSE:BIO) according to the Good Companies Screen, a Premium feature of GuruFocus.

European Union reopens doors to fully-vaccinated U.S. travelers

On June 16, the European Union announced that it added the U.S. to the “safe travel” list, enabling nonessential travel to European countries to fully-vaccinated U.S. travelers. The news comes as approximately 65% of U.S. adults have received at least one Covid-19 vaccine shot as of Monday according to the Centers of Disease Control and Prevention, with approximately 144 million Americans fully vaccinated.

As such, investors may find opportunities in profitable European companies. GuruFocus’ Global Market Valuation pages listed several European markets that have positive implied market returns based on the modified version of Buffett’s market valuation ratio: the ratio of total market cap to the sum of gross domestic product and total assets of the central government bank.

Hermes International

Hermes International (XPAR:RMS, Financial) manufactures and sells a wide range of luxury Birkin and Kelly bags. GuruFocus ranks the French retail company’s profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank and profit margins that outperform more than 96% of global competitors.

Jean Jacques Guinoy, chief financial officer of fellow French luxury retail giant LVMH Moet Hennessy Louis Vuitton SE (XPAR:MC), said in a CNBC interview on Monday that the future of retail entails mostly brick-and-mortar retail stores, with online content enriching the experience of physical shopping in stores. Guinoy said that although consumers may still receive information about products online, consumers still come to the store “because the store experience is something that cannot be matched on the internet.”

Gurus with holdings in LVMH Moet Hennessy include Spiros Segalas (Trades, Portfolio), the MS Global Franchise Fund and the Invesco European Growth Fund (Trades, Portfolio).

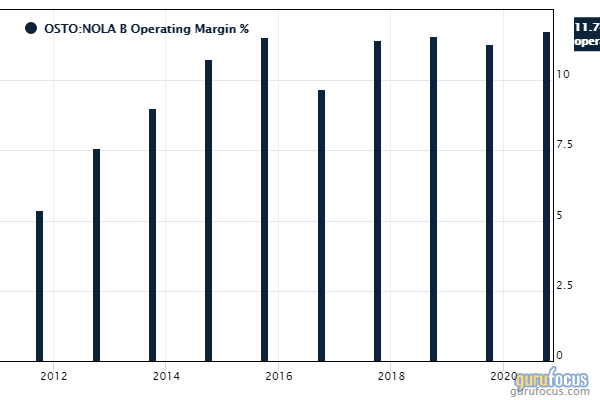

Nolato

Nolato (OSTO:NOLA B, Financial) develops and manufactures plastic, silicone and thermoplastic elastomer products. GuruFocus ranks the Swedish industrial conglomerate’s profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and an operating margin that has increased approximately 1.6% per year on average over the past five years and is outperforming more than 79% of global competitors.

Fenix Outdoor

Fenix Outdoor (OSTO:FOI B, Financial) designs and sells products for a wide range of outdoor activities. GuruFocus ranks the Swedish leisure company’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and an operating margin that has increased approximately 8.9% per year on average over the past five years and is outperforming over 82% of global competitors.

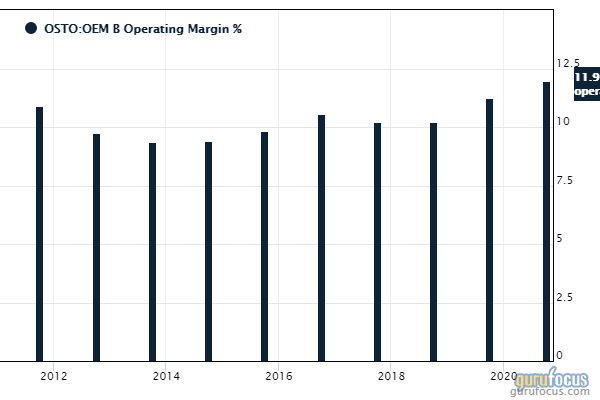

OEM International

OEM International (OSTO:OEM B) offers a trading medium between customers and merchants of several industrial products, including electrical components, flow components, motors and transmissions. GuruFocus ranks the Swedish industrial product company’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 7 and an operating margin that has increased approximately 3.4% per year on average over the past five years and is outperforming more than 77% of global competitors.

Biofarm

Biofarm (BSE:BIO) manufactures and wholesales over-the-counter drugs, prescription medicines and dietary supplements. GuruFocus ranks the Romanian drug manufacturer’s profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and an operating margin that has increased approximately 7.2% per year on average over the past five years and is outperforming over 93% of global competitors.

Become a Premium Member to See This: (Free Trial):