- It gives us no pleasure to remind clients that U.S. stocks’ valuations, by almost any measure we can come up with --- backward or forward looking ---are at levels that concern us.

- Many have wondered aloud whether GMO is not giving enough credit to some of these high growth new-business-model “disruptors.” First, we have all sorts of models that take current optimistic growth forecasts into account. Many are deserving of their current high multiples --- we absolutely concede that somewhere in the Global Growth basket sits “the next Amazon.” Unfortunately, they’re ALL being priced that way, and that is a bridge too far.

- We also remind ourselves that during the month of May, the S&P 500’s real earnings yield (the inverse of P/E minus inflation) dipped into negative territory, the lowest in 40 years. Even at the height of tech bubble mania this scary event did not occur.

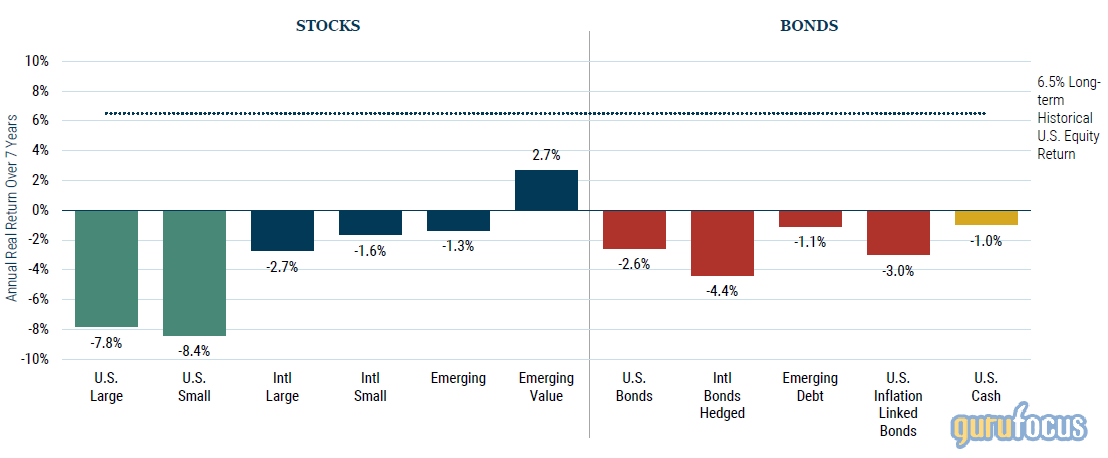

- Combine that sober statistic with the negative real yields being offered by sovereign bonds, and you may come to see why we are loathe to recommend a traditional 60/40 mix. There will come a day when global equities and government bonds are fairly valued and should deliver a “normal” real rate of return. Today, however, is not that day.

- But May’s forecast is not all doom and gloom, in fact far from it. Emerging Markets Value, which has rallied strongly in the past year, with the MSCI EM Value index up 49%, is still priced to deliver quite decent relative and absolute returns. Japan small value stocks are also quite attractive.

- Further, the valuation spread between global Value and Growth remains at some of the widest levels we have seen in our working careers, and there are all sorts of interesting ways to exploit this dislocation. Importantly, valuation spreads across asset classes more broadly in rates and FX and commodities, represent huge opportunities in non-traditional long/short space.

- In a global Growth bubble, we are advising clients to do three things: exploit the bubble (via equity long/short), avoid the bubble (via alts), and concentrate assets where the bubble ain’t (EM Value, Japan small Value, Cyclicals, and Quality).

The chart represents local, real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward-looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward-looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forwardlooking statements. U.S. inflation is assumed to mean revert to long-term inflation of 2.2% over 15 years.