In the search for stocks trading at a discount to intrinsic value, one tool that investors can utilize is the earnings-based discounted cash flow calculator.

Under the “current portfolio” tab in each guru’s page, GuruFocus also has a section that shows all of that guru’s holdings that are undervalued based on the DCF model. This can help investors to identify potential value opportunities among the stocks that their favorite gurus own.

According to the undervalued sections in the pages for Ron Baron (Trades, Portfolio) and Spiros Segalas (Trades, Portfolio), two of the gurus that have achieved the best returns over the past decade according to GuruFocus’ Scoreboard, these famous investors both own shares of Goldman Sachs Group Inc. (GS, Financial), The Home Depot Inc. (HD, Financial) and Facebook Inc. (FB, Financial), which are currently trading at a discount to their intrinsic values as calculated by GuruFocus’ DCF model.

Goldman Sachs

Based in New York City, Goldman Sachs Group (GS, Financial) is an American multinational investment bank and financial services company. It operates through four major segments: Investment Banking, Global Markets, Asset Management and Consumer and Wealth Management.

Segalas’ Harbor Capital Appreciation Fund owns 610,809 shares of Goldman Sachs after increasing the holding by 47.71% in its second quarter of fiscal 2021, which ended on April 30. This holding currently makes up 0.53% of the fund’s equity portfolio.

Baron Funds seems less bullish on the stock as it owns only 800 shares that it purchased in the third quarter of 2016. The holding makes up less than 0.01% of the equity portfolio.

As of June 29, Goldman Sachs traded around $372.62 per share for a market cap of $126.60 billion and a price-earnings ratio of 9.27. The business predictability rating is 3.5 out of 5 stars. The DCF model estimates the intrinsic value of the stock to be around $805.34, which would imply it is undervalued by as much as 53.73%.

Home Depot

Home Depot (HD, Financial) is the largest home improvement retailer in the U.S., supplying a wide variety of tools, construction materials, pre-constructed home fixtures and related services. Based in Atlanta, the company has over 2,200 stores in the U.S., Canada and Mexico.

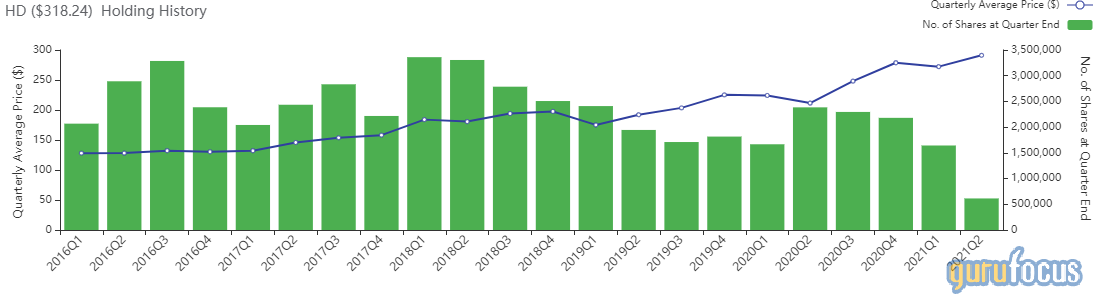

The Harbor Capital Appreciation Fund owns 613,666 shares of Home Depot after cutting the position by 62.66% in the recent quarter. The investment now makes up 0.49% of the equity portfolio.

Baron Funds owns 59,444 shares as of its most recent filings, giving it a 0.04% weight in the equity portfolio. The firm has been slowly reducing this position over the years as the price has grown, with the most recent change being a 7.79% reduction in the first quarter of 2021.

As of June 29, Home Depot traded around $318.24 per share for a market cap of $338.37 billion and a price-earnings ratio of 23.21. The business predictability rating is 5 out of 5 stars. The DCF model estimates the intrinsic value of the stock to be around $565.50, which would imply that it is undervalued by as much as 43.72%.

Facebook (FB, Financial) is a social media giant based in Menlo Park, California. It was founded by Mark Zuckerberg and several fellow Harvard students. Since its launch in 2004, it has become an icon of the social media industry and expanded into news, advertising, business, data collection and other avenues.

At 5,362,184 shares, Facebook makes up 4.31% of the Harbor Capital Appreciation Fund’s equity portfolio. Over the years, the fund has made several adjustments to the position, with the most recent being a 6.59% reduction in its second quarter of fiscal 2021.

Baron Funds, on the other hand, has been increasing its holding in Facebook over the past few years. In the first quarter of 2021, it added another 14.78% for a total holding of 628,964 shares, giving Facebook a 0.46% weight in the equity portfolio.

As of June 29, Facebook traded around $351.89 per share for a market cap of $997.77 billion and a price-earnings ratio of 30.08. The business predictability rating is 5 out of 5 stars. The DCF model estimates the intrinsic value of the stock to be around $492.39, which would imply that it is undervalued by as much as 28.53%.

Also check out: