According to the All-in-One Screener, a Premium feature of GuruFocus, four predictable stocks that top-performing gurus David Tepper (Trades, Portfolio) and Andreas Halvorsen (Trades, Portfolio) agree on are Amazon.com Inc. (AMZN, Financial), Facebook Inc. (FB, Financial), Visa Inc. (V, Financial) and UnitedHealth Group Inc. (UNH, Financial).

Background

Tepper became interested in the stock market as a young boy watching his father trade stocks. The founder and leader of Appaloosa Management has received international acclaim for producing some of the highest returns among Wall Street Investors: GuruFocus’ Score Board shows that Tepper’s firm has returned approximately 26% since Appaloosa’s inception in 1993.

Prior to founding Viking Global in 1999, Halvorsen worked as senior managing director and director of equities at Julian Robertson (Trades, Portfolio)’s Tiger Global Management. GuruFocus’ Score Board shows that Halvorsen’s firm has returned approximately 22.26% since inception.

GuruFocus’ Most Broadly Held strategy, which tracks the performance of the stocks broadly owned by gurus, has returned 18.32% year to date, outperforming the S&P 500 benchmark return of 13.97% over the same period. The model portfolio has returned a cumulative 475.74% since inception in 2006 and an annualized return of 17.05% per year over the past 10 years.

As such, investors may find opportunities in stocks that both Tepper and Halvorsen agree on. GuruFocus’ All-in-One Screener, which allows Premium members to screen for stocks using fundamental data filters, guru trade filters, insider trade filters and customized fields, listed four stocks that also have a high financial strength rank and business predictability rank.

Amazon.com

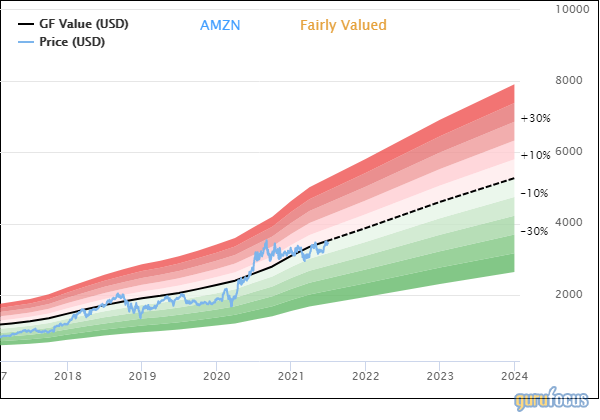

Shares of Amazon.com (AMZN, Financial) occupy 8.26% of Tepper’s equity portfolio and 1.67% of Halvorsen’s equity portfolio as of March 2021. The stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 0.98.

GuruFocus ranks the Seattle-based e-commerce giant’s financial strength 6 out of 10: Amazon has a strong Altman Z-score of 6.66 despite cash-to-debt and interest coverage ratios outperforming just over 60% of global competitors.

Amazon’s profitability ranks 7 out of 10 on the back of a five-star business predictability rank despite profit margins outperforming just over 65% of global competitors.

Other gurus with holdings in Amazon include Baillie Gifford (Trades, Portfolio), Ken Fisher (Trades, Portfolio), and Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial).

Shares of Facebook (FB, Financial) occupy 7.70% of Tepper’s equity portfolio and 2.06% of Halvorsen’s equity portfolio.

GuruFocus ranks the Menlo Park, California-based social media giant’s financial strength 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and a strong Altman Z-score of 22.80.

Facebook’s profitability ranks 9 out of 10, driven by a five-star business predictability rank and profit margins and returns outperforming more than 90% of global competitors.

Visa

Shares of Visa (V, Financial) occupy 1.26% of Tepper’s equity portfolio and 2.55% of Halvorsen’s equity portfolio.

GuruFocus ranks the San Francisco-based credit card company’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and an operating margin that outperforms more than 85% of global competitors.

Visa’s financial strength ranks 6 out of 10 on the back of debt ratios outperforming more than 64% of global competitors.

UnitedHealth Group

Shares of UnitedHealth Group (UNH, Financial) occupy1.48% of Tepper’s equity portfolio and 3.41% of Halvorsen’s equity portfolio.

GuruFocus ranks the Minnetonka, Minnesota-based health care company’s profitability 8 out of 10 on the back of a five-star business predictability rank despite operating margins and three-year revenue growth rates outperforming more than half of global competitors.

UnitedHealth’s financial strength ranks 6 out of 10: The company has a high Piotroski F-score of 7 and a strong Altman Z-score of 3.7 despite cash-to-debt ratios underperforming more than 70% of global competitors.