Coca-Cola Co. (KO, Financial) has been under much speculation of late due to Cristiano Ronaldo's snub of one of its soft drinks during a press conference. Reports were that the stock lost $1.4 billion in market value, and many based investment decisions on the news.

We outline recent performance and the current state of the stock from a capital gains perspective and a dividend perspective.

Stock performance

Coca-Cola used to outperform the index before the pandemic, but has since lagged due to market inefficiencies. Much liquidity has shifted into high multiple assets due to expected earnings, and it's time for quality stocks to return to prominence.

Adaptation

Let's start by how Coca-Cola has adapted to the current business climate. Coke has expanded throughout Asia with 4% year-over-year sales. The company has also seen an uptick of 8% in sugar-free sales. The beverage space is slow to adapt, but Coca-Cola has always stayed ahead of the competition.

Relative value

Relative value only speaks volumes when the fundamentals are consistent, which it does. The free cash flow yield is currently at 3.4%. Furthermore, year-over-year growth in operating cash flow is 6.69%.

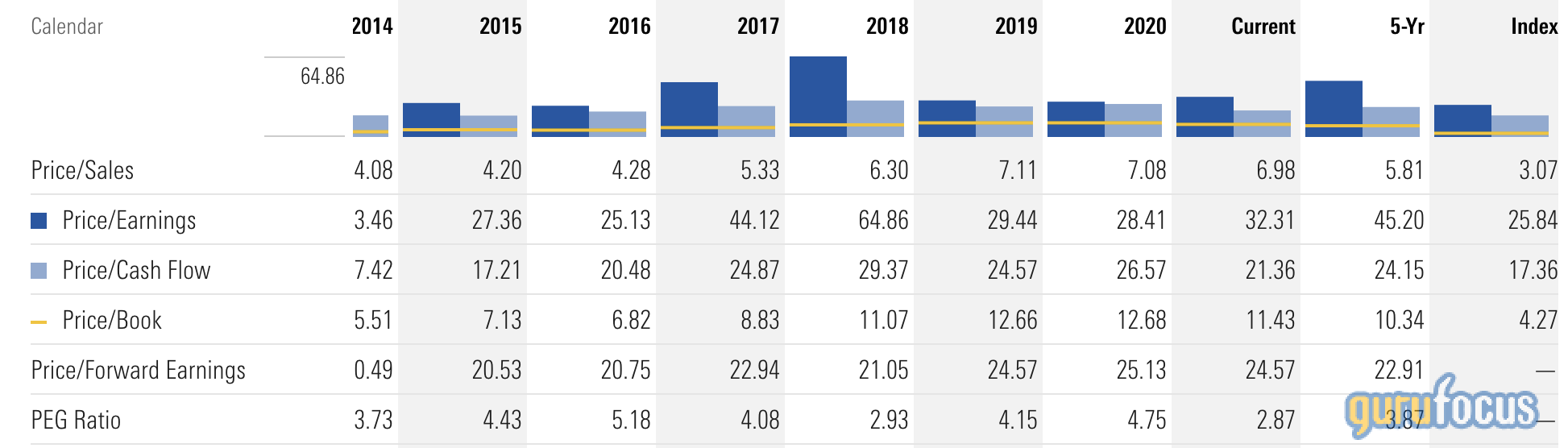

Source: Morningstar

The stock indicates relative value versus the index based on both price-earnings and price-to-cash flow multiples. Price-sales took a hit of late due to pandemic drawbacks, but streamlining sales channels between away-from-home and at-home sales should resurrect the inefficiency.

A current PEG ratio of 2.87 versus a five-year average PEG of 3.87 indicated value. PEG measures the price-earnings relative to growth, and the lower the PEG, the better.

Dividends

The real value in this stock lies within its dividends. Cocoa-Cola has long been a dividend aristocrat. A forward yield of 3.11% in combination with 58 years of consecutive payouts makes it attractive, to say the least.

Takeaway

Coca-Cola still remains a good stock. Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial) bought most of the company in 1988 because of the strong cash flow. I think that any investor could benefit from the same characteristics through dividends and possible capital gains as the stock's currently undervalued.