Lone Pine Capital, the firm founded by Steve Mandel (Trades, Portfolio), disclosed in late June that it established a stake in Confluent Inc. (CFLT, Financial) according to GuruFocus Real-Time Picks, a Premium feature.

Prior to founding the Greenwich, Connecticut-based firm, Mandel worked as senior managing director and consumer analyst at Julian Robertson (Trades, Portfolio)’s Tiger Management. Mandel established Lone Pine as a long-and-short equity firm, seeking long-term capital appreciation through fundamental analysis and bottom-up stock picking to build the portfolio.

As of March, Lone Pine’s $27.53 billion equity portfolio contains 38 stocks, with four new positions and a turnover ratio of 19%. The top four sectors that the firm is invested in are technology, communication services, consumer cyclical and health care, with weights of 39.07%, 22.01%, 20.06% and 10.60%, respectively.

Transaction details

Lone Pine purchased 3,628,578 shares of Confluent (CFLT, Financial), giving the position a 0.70% weight in the equity portfolio. The stock traded around $42.65 on the June 28 transaction date.

Company background

The Mountain View, California-based company pioneered a new category of data infrastructure designed to connect applications, systems and data layers of a company around a real-time central nervous system.

As of March, Confluent had 561 clients with annual recurring revenues of over $100,000, compared to 374 such clients as of March 2020. The company reported revenues of $77 million during the first quarter, up 51% from the prior-year quarter.

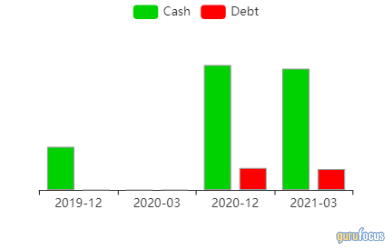

According to GuruFocus, Confluent’s cash-to-debt ratio of 5.78 outperforms more than 58% of global competitors.

Philippe Laffont (Trades, Portfolio)’s Coatue Asset Management also has a holding in Confluent.

Lone Pine’s top five technology holdings as of March are Shopify Inc. (SHOP, Financial), Microsoft Corp. (MSFT, Financial), Adobe Inc. (ADBE, Financial), Coupa Software Inc. (COUP, Financial) and ServiceNow Inc. (NOW, Financial).