According to the All-in-One Guru Screener, a Premium feature of GuruFocus, four stocks with high financial strength and are commonly owned by Steve Mandel (Trades, Portfolio)’s Lone Pine Capital and Philippe Laffont (Trades, Portfolio)’s Coatue Management as of the March quarter are Facebook Inc. (FB, Financial), Shopify Inc. (SHOP, Financial), Snowflake Inc. (SNOW, Financial) and DoorDash Inc. (DASH, Financial).

Guru background and portfolio summary

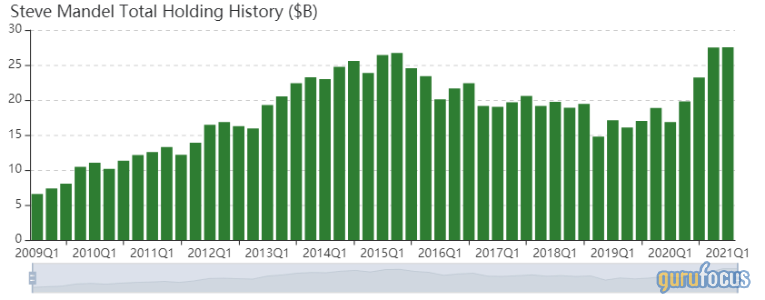

Mandel, a former senior managing director and consumer analyst at Julian Robertson (Trades, Portfolio)’s Tiger Management, founded Lone Pine as a long-and-short equity firm that seeks long-term capital appreciation through fundamental analysis and bottom-up stock picking.

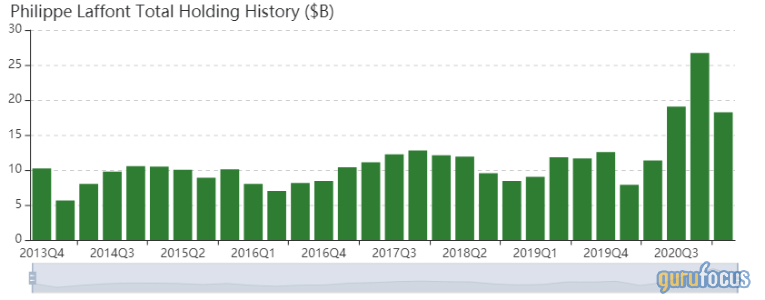

Likewise, Laffont, also a former employee of Tiger Management, founded Coatue as a technology-focused hedge fund, seeking long-term capital appreciation through fundamental analysts. Unlike Lone Pine, Coatue applies a top-down approach to stock picking.

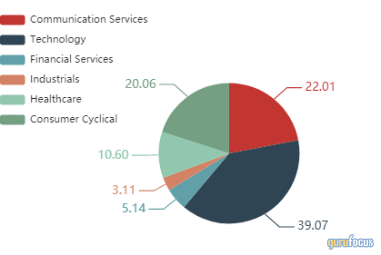

As of March, Lone Pine’s $27.53 billion equity portfolio contains 38 stocks, with four new positions and a turnover ratio of 19%. The top four sectors the firm is invested in are technology, communication services, consumer cyclical and health care, representing 39.07%, 22.01%, 20.06% and 10.60% of the equity portfolio.

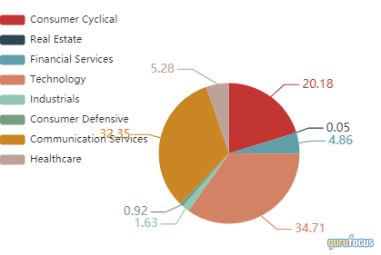

On the other hand, Coatue’s $18.24 billion equity portfolio contains 66 stocks as of March, with 20 new stocks and a turnover ratio of 13%. The top four sectors the firm is invested in are technology, communication services, consumer cyclical and health care, representing 34.71%, 32.35%, 20.18% and 5.28% of the equity portfolio.

Firms establish a holding in Confluent

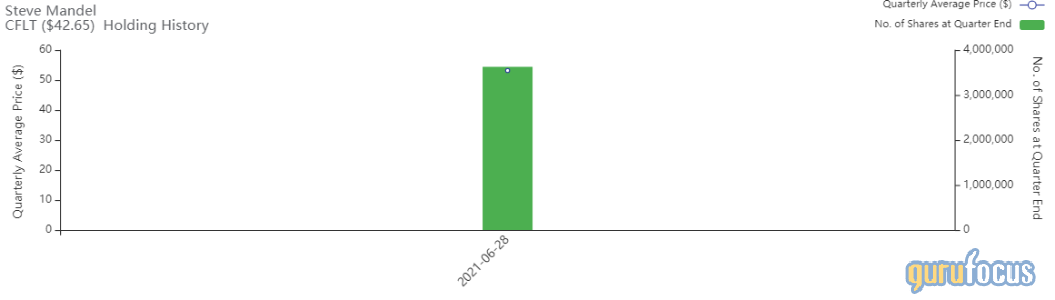

According to GuruFocus Real-Time Picks, a Premium feature, Lone Pine purchased 3,628,578 shares of Confluent Inc. (CFLT, Financial). The shares averaged $53.16 on the June 28 transaction date.

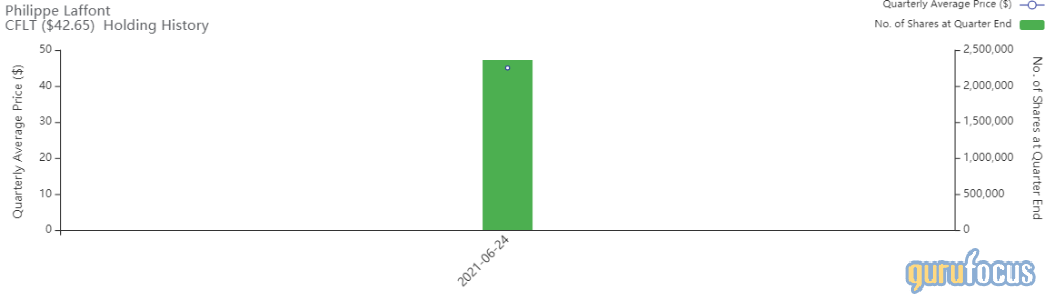

Likewise, Coatue purchased 2,361,262 shares of Confluent. Shares averaged $45.02 on June 24.

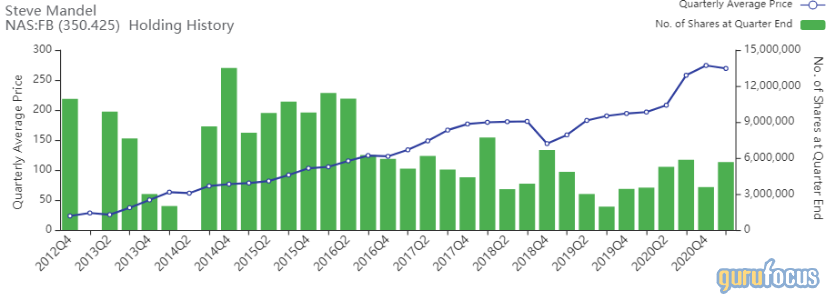

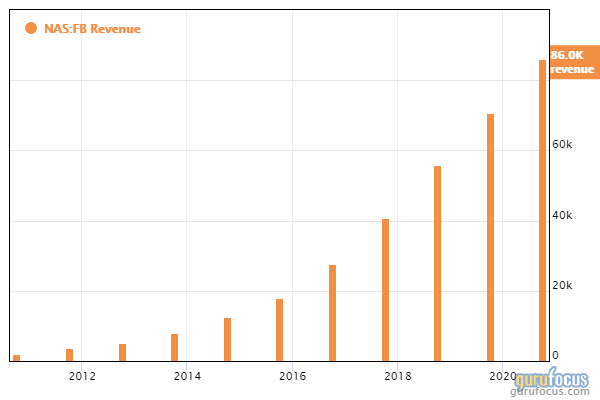

According to Aggregated Portfolio statistics, a Premium feature of GuruFocus, Lone Pine and Coatue have a combined weight of 9.50% in Facebook Inc. (FB, Financial).

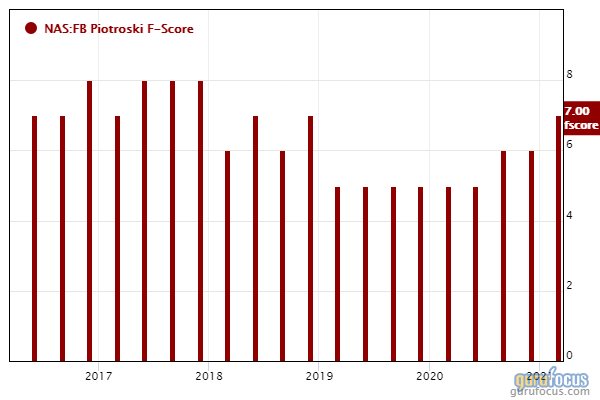

GuruFocus ranks the Menlo Park, California-based social media giant’s financial strength 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and a double-digit Altman Z-score.

Facebook’s profitability ranks 9 out of 10 on the back of a five-star business predictability rank and profit margins and returns outperforming more than 88% of global interactive media companies.

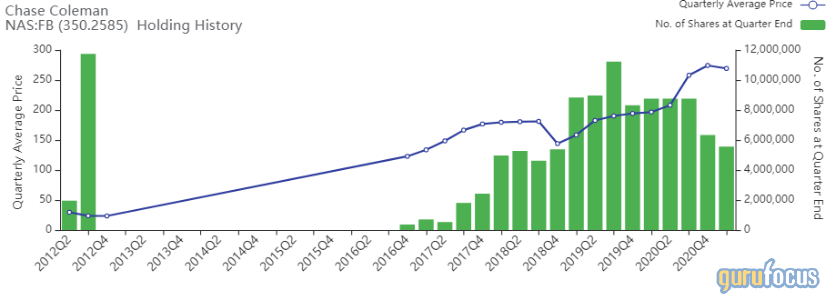

Other “tiger cubs” with holdings in Facebook include Chase Coleman (Trades, Portfolio)’s Tiger Global Management and Andreas Halvorsen (Trades, Portfolio)’s Viking Global Partners.

Shopify

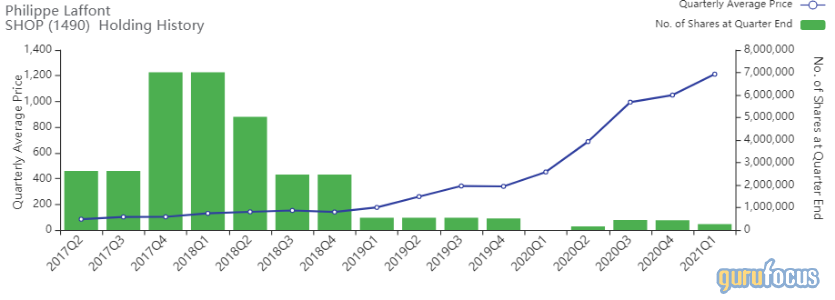

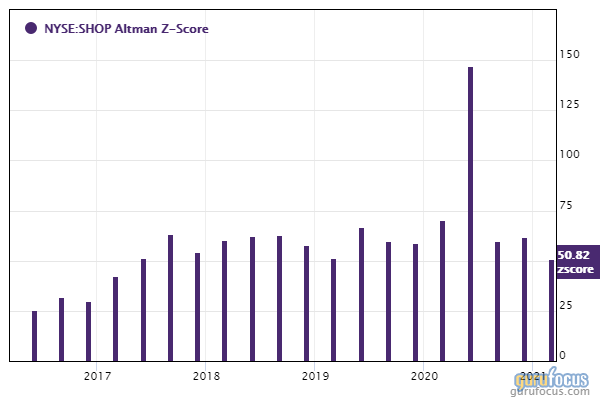

Lone Pine and Coatue have a combined weight of 8.45% in Shopify (SHOP, Financial).

GuruFocus ranks the Ottawa, Ontario-based e-commerce software company’s financial strength 8 out of 10 on several positive investing signs, which include a double-digit Altman Z-score and an equity-to-asset ratio that outperforms more than 88% of global competitors. Despite this, interest coverage ratios outperform just under half of global software companies.

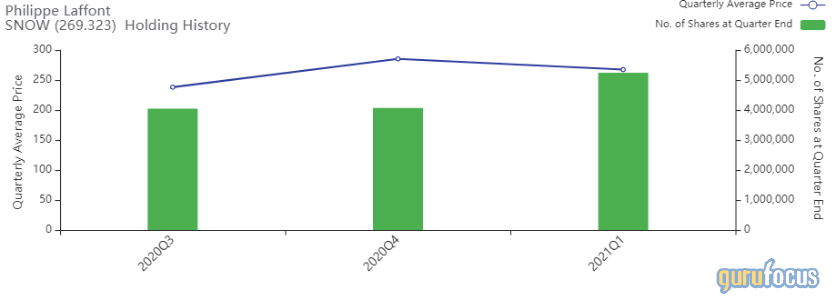

Snowflake

Lone Pine and Coatue have a combined weight of 7.65% in Snowflake (SNOW, Financial).

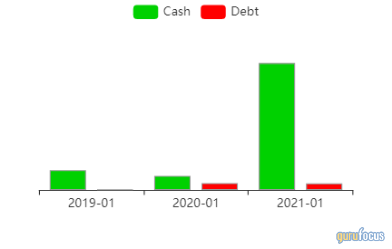

GuruFocus ranks the San Mateo, California-based data software company’s financial strength 7 out of 10 on several positive investing signs, which include a double-digit Altman Z-score and cash-to-debt, equity-to-asset, and debt-to-equity ratios outperforming more than 70% of global competitors.

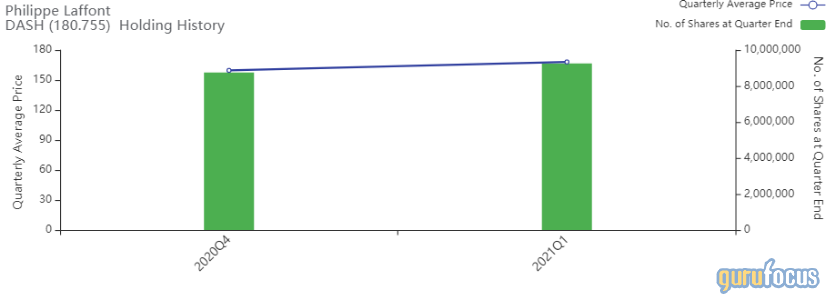

DoorDash

Lone Pine and Coatue have a combined weight of 9.86% in DoorDash (DASH, Financial).

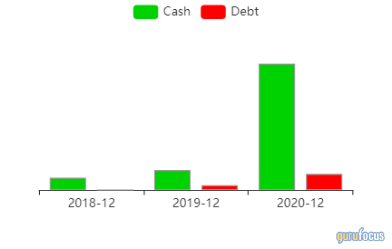

GuruFocus ranks the San Francisco-based online food ordering company’s financial strength 7 out of 10 on the back of a double-digit Altman Z-score and debt ratios outperforming more than 64% of global competitors.