The approach of earnings season often leads to companies declaring dividend increases. As a dividend growth investor, the income I am currently receiving from my holdings is important. Of parallel importance is the rate that the dividend increases.

We will examine three companies that just delivered very generous dividend increases for investors.

Conagra

Conagra Brands Inc. (CAG, Financial) supplies branded food products to individuals through grocery stores as well as to restaurants and other foodservice locations. The company’s brands include Healthy Choice, Slim Jim and Hunt’s. Conagra has a market capitalization of $16.4 billion and generated revenue of $11.2 billion in fiscal year 2021, which ended May 30.

The company raised its quarterly dividend 13.6% to 31.25 cents per share for the Sept. 2 payment date, extending the company’s dividend growth streak to two years and follows last year’s 29.4% raise. The company has cut its dividend twice this century, first in 2007 and then again in 2017. While two dividend cuts in a relatively short period of time isn’t a positive sign, shareholders should see more in dividends per share in fiscal year 2022 than any other year since at least 2005.

Using the annualized dividend of $1.25, Conagra has a yield of 3.6%. This compares favorably to the stock’s 10-year average yield of 3.2%. If Conagra averaged this yield for the year, then it would be the highest since 2012. Conagra’s yield also compares favorably to the S&P 500 index, which has an average yield of 1.3%.

Conagra’s payout ratio is in good shape. According to Yahoo Finance, Wall Street analysts expect the company will earn $2.63 in fiscal year 2022, equating to a projected payout ratio of 48%. This is just above the 10-year average payout ratio of 45%

With the stock closing the trading week at $34.86, Conagra has a forward price-earnings ratio of 13.3. The average price-earnings ratio is just over 16 for the last decade, causing shares to look undervalued relative to the historical average.

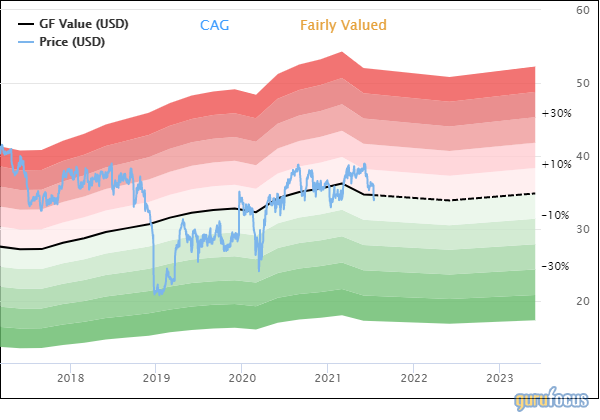

Using GuruFocus’ estimate of intrinsic value, called the GF Value, Conagra looks more fairly valued.

Conagra has a GF Value of $34.64, giving shares a price-to-GF Value of 1.01. The stock is rated as fairly valued by GuruFocus.

Conagra isn’t the most consistent dividend grower in the consumer staples industry and the company does have two dividend cuts this century. That said, the company’s last two dividend raises have been very strong and the stock offers a yield above what shareholders have been accustomed to in recent years. Shares also trade with a low double-digit multiple. Investors looking for consumer staple exposure might want to consider Conagra and its high yield.

Marsh & McLennan

Marsh & McLennanCompanies Inc. (MMC, Financial) is a leading professional services company that offers a variety of products and services, including insurance for brokers, reinsurance, capital strategies, human resources and economic and brand consulting. The company is valued at $71.7 billion and generated revenue of $17.2 billion last year.

Marsh & McLennan raised its quarterly dividend 15.1% to 53.50 cents for the Aug. 13 distribution date, giving the company 12 years of dividend growth. The company paused its dividend growth from 2008 to 2009, but did not reduce its distributions. Marsh & McLennan’s dividend has a compound annual growth rate of 7.9% since 2011, so the most recent raise is nearly twice the long-term average and a much better showing than last year’s 2.1% increase.

The stock’s new annualized dividend is $2.14. At current prices, Marsh & McLennan yields 1.5%. This is below the long-term average yield of 2.1%, but still ahead of the average yield of the market index by a slight margin.

Marsh & McLennan may not offer a high yield, but it does offer a dividend that looks well protected. The company is expected to earn $5.63 this year. If achieved, this would mean a payout ratio of 38%, beating the 10-year average payout ratio of 42%.

Marsh & McLennan closed Friday’s trading session at $141.33. Using analysts' estimates for the year, shares have a forward price-earnings ratio of 25.1. The stock has often traded with a multiple in the high teens range, but the valuation has expanded to the upper 20s over the past two years. The average multiple dating back to 2011 is 20.2. The current forward price-earnings ratio is at a premium to this long-term average, but below the valuations for the past two years.

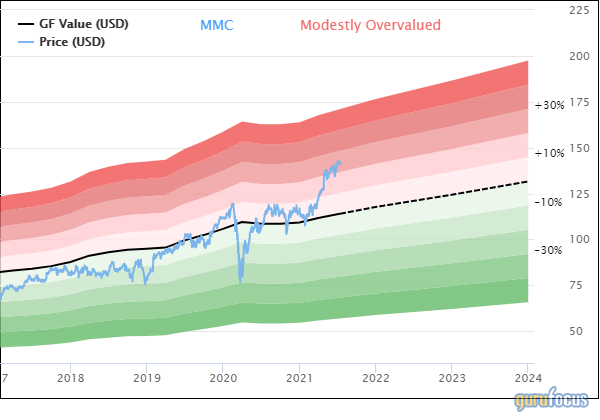

The stock isn’t cheap using the GF Value either.

Marsh & McLennan has a GF Value of $114.08. Considering the most recent share price, the stock has a price-to-GF Value of 1.24. The stock would have to decrease more than 19% to reach its GF Value.

I don’t mind paying a premium for a high-quality company, but Marsh & McLennan is quite expensive compared to either the 10-year average valuation or the GF Value. Marsh & McLennan’s most recent increase was well above its long-term CAGR and an improvement from the prior year. That said, the valuation gives me pause as does the lower-than-usual dividend yield. I would wait for a pullback before adding shares of Marsh & McLennan to my portfolio.

PPG Industries

PPG Industries, Inc. (PPG, Financial) is the largest paint and coating company in the world. The company’s products are used in many end markets, including industry, automotive and architecture. PPG Industries has a market capitalization of $40.3 billion and produced revenue of nearly $14 billion in 2021.

The company announced a 9.3% dividend increase to 59 cents for the upcoming Sep. 10 payment date. This latest raise gives PPG Industries 50 consecutive years of dividend growth and allows the company to join the exclusive Dividend Kings index. There are only 32 companies in the entire market place with the necessary five decades of dividend growth to qualify as a Dividend King. PPG Industries’ dividend has grown at an annual rate of 6.4% over the last decade.

With a new annualized dividend of $2.36, PPG Industries has a yield of 1.4%. This is just ahead of the average yield of the S&P 500 and not too far off the stock’s 10-year average yield of 1.7%.

PPG Industries is projected to earn $8.07 per share this year. Using the annualized dividend, the company has an expected payout ratio of just 29%. The company has a long-term average payout ratio of just 34%.

As I discussed in April, PPG Industries isn’t cheap. The stock closed at $170.20 on Friday, which gives shares a price-earnings ratio of 21.1. Excluding 2016 when earnings per share fell significantly, PPG Industries has an average price-earnings ratio of 19.9.

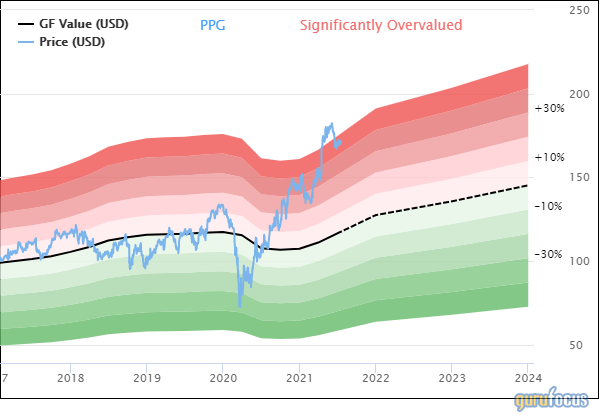

Using the GF Value, PPG Industries looks even more expensive.

PPG Industries has a GF Value of $117.36. The stock has a price-to-GF Value of 1.45 using the recent price. Shares would have to decline 31% to reach their GF Value. As such, the stock is rated as significantly overvalued.

PPG Industries’ latest dividend increase places it in rarefied air amongst dividend paying stocks. The company has now amassed an enviable track record for dividend growth, which is made even more impressive by its operation in a very cyclical business. Shares may not offer a high yield, but the dividend is very safe looking at the low payout ratio. Where PPG Industries losses some of its luster is when considering its valuation. Though slightly above its long-term average price-earnings ratio, the stock is well ahead of its intrinsic value as calculated by GuruFocus. As much as I am a fan of the dividend growth track record, the valuation gives me pause. I would wait for a pullback before adding the name to my portfolio.