After topping $75 per barrel for the first time in three years earlier this month, West Texas Intermediate crude futures fell below $70 for the first time in over a month on Monday as OPEC and its allies agreed to raise output amid the delta variant of the Covid-19 virus threatening global demand.

The group of 23 nations agreed on Sunday to increase production by 400,000 barrels each month beginning in August. The output hike will continue through September 2022.

U.S. oil tumbled more than 6% to hit a session low of $66.81, which marked its biggest one-day decline since March. International benchmark crude slumped 5.9% to trade at $69.23 per barrel.

In conjunction with the decline in oil prices, shares of U.S. energy giants fell on Monday as well, creating a potential buying opportunity. Among the biggest decliners on the S&P 500 were Diamondback Energy Inc. (FANG, Financial), Marathon Oil Corp. (MRO, Financial), EOG Resources Inc. (EOG, Financial), Schlumberger Ltd. (SLB, Financial) and Occidental Petroleum Corp. (OXY, Financial).

Diamondback Energy

With the stock down 7.78%, Diamondback Energy (FANG, Financial) has a $13.23 billion market cap; its shares were trading around $72.26 on Monday with a price-book ratio of 1.25 and a price-sales ratio of 3.79.

The GF Value Line shows the stock is modestly undervalued based on historical ratios, past performance and future earnings projections.

The Midland, Texas-based oil company has a GuruFocus financial strength rating of 3 out of 10. As a result of issuing approximately $3.2 billion in new long-term debt over the past three years, the company has insufficient interest coverage. In addition to a Sloan ratio indicating it has poor earnings quality, the Altman Z-Score of -0.07 warns the company could be in danger of going bankrupt as assets are building up at a faster rate than revenue is growing. The return on invested capital has also fallen below the weighted average cost of capital, indicating struggles with creating value.

The company’s profitability scored a 6 out of 10 rating, driven by an expanding operating margin. Its returns on equity, assets and capital, however, are negative and underperform a majority of competitors. Diamondback also has a low Piotroski F-Score of 2, indicating business conditions are in poor shape, and the predictability rank of one out of five stars is on watch as a result of recording losses in operating income and declines in revenue per share over the past several years. According to GuruFocus, companies with this rank return an average of 1.1% annually over a 10-year period.

Bill Nygren (Trades, Portfolio) is Diamondback Energy’s largest guru shareholder with a 1.44% stake. Other gurus who have positions in the stock are Pioneer Investments (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Scott Black (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Chuck Royce (Trades, Portfolio) and azValor Managers FI (Trades, Portfolio).

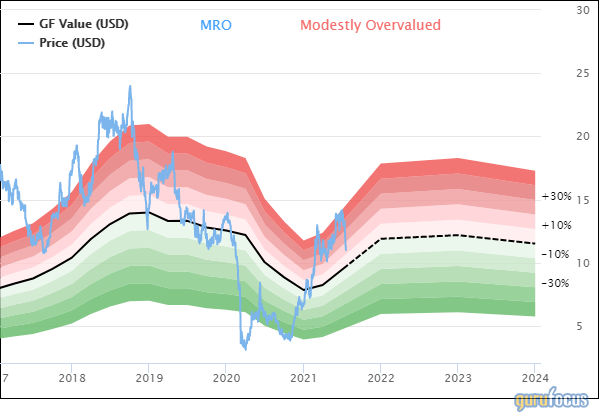

Marathon Oil

Posting a 6.26% decline, Marathon Oil (MRO, Financial) has a market cap of $8.69 billion; its shares were trading around $11.02 on Mondaywith a price-book ratio of 0.82 and a price-sales ratio of 2.68.

According to the GF Value Line, the stock is modestly overvalued currently. The valuation rank of 4 out of 10 supports this assessment.

The oil and gas producer based in Houston has a GuruFocus financial strength rating of 4 out of 10 on the back of an Altman Z-Score of 1.24, which indicates it could be at risk of bankruptcy.

The company’s profitability did not fare much better, scoring a 5 out of 10 rating as a result of negative margins and returns that underperform over half of industry peers. Marathon Oil also has a moderate Piotroski F-Score of 4, indicating operations are stable. Due to declining revenue per share over the past several years, the one-star predictability rank is on watch.

Of the gurus invested in Marathon Oil, Hotchkis & Wiley has the largest stake with 7.52% of outstanding shares. Fisher, Pioneer, Steven Cohen (Trades, Portfolio), Greenblatt and Paul Tudor Jones (Trades, Portfolio) also own the stock.

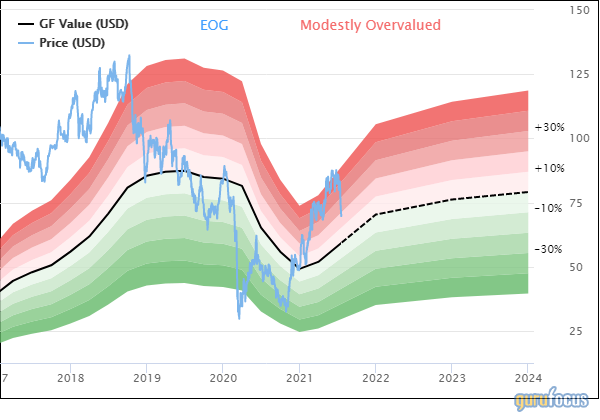

EOG Resources

Decreasing 3.55%, EOG Resources (EG) has a $40.6 billion market cap; its shares were trading around $69.374 on Monday with a price-earnings ratio of 695.7, a price-book ratio of 1.95 and a price-sales ratio of 3.87.

Based on the GF Value Line, the stock appears to be modestly overvalued. The valuation rank of 3 out of 10 supports this assessment.

The exploration and production company, which is headquartered in Houston, has a GuruFocus financial strength rating of 5 out of 10. Despite having adequate interest coverage, the Altman Z-Score of 2.66 also suggests the company is under some pressure since. The WACC also eclipses the ROIC, indicating poor value creation.

The company’s profitability scored a 6 out of 10 rating as its margins and returns outperform over half of its competitors. EOG also has a moderate Piotroski F-Score of 4, but the one-star predictability rank is on watch since revenue per share has declined over the past three years.

With a 1.2% stake, Baillie Gifford (Trades, Portfolio) is the company’s largest guru shareholder. Nygren, PRIMECAP Management (Trades, Portfolio), the T Rowe Price Equity Income Fund (Trades, Portfolio), Pioneer, Grantham, Fisher, Greenblatt, Lee Ainslie (Trades, Portfolio), Murray Stahl (Trades, Portfolio) and Ray Dalio (Trades, Portfolio) also have positions in EOG.

Schlumberger

Falling 5.35%, Schlumberger (SLB, Financial) has a market cap of $36.87 billion; its shares were trading around $26.38 on Monday with a price-book ratio of 2.94 and a price-sales ratio of 1.73.

The GF Value Line indicates the stock is fairly valued currently. The GuruFocus valuation rank of 8 out of 10, however, favors undervaluation.

On the back of insufficient interest coverage, GuruFocus rated the Houston-based oilfield services company’s financial strength 4 out of 10. The Altman Z-Score of 1.46 also warns the company could be in danger of bankruptcy if it does not improve its liquidity position. Additionally, the company’s Sloan ratio is indicative of poor earnings quality and the WACC surpasses the ROIC, implying poor value creation.

The company’s profitability did not fare much better, scoring a 5 out of 10 rating as a result of declining margins and negative returns that underperform a majority of industry peers. Schlumberger also has a moderate Piotroski F-Score of 4 and a five-year decline in revenue per share led to a one-star predictability rank.

Dodge & Cox is Schlumberger’s largest guru shareholder with a 4.91% stake. Other top guru investors include Pioneer, First Eagle Investment (Trades, Portfolio), Fisher, Hotchkis & Wiley, Elfun Trusts (Trades, Portfolio), Cohen and azValor Internacional FI (Trades, Portfolio).

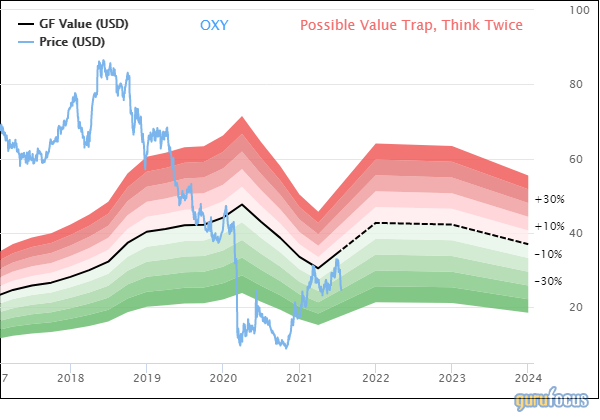

Occidental Petroleum

Recording a decline of 4.93%, Occidental Petroleum (OXY, Financial) has a $22.96 billion market cap; its shares were trading around $24.66 on Monday with a price-book ratio of 2.68 and a price-sales ratio of 1.4.

While the GF Value Line shows the stock has fallen so far that it is a potential value trap, the valuation rank of 8 out of 10 leans more toward undervaluation

The oil and gas producer, which is headquartered in Houston, has a GuruFocus financial strength rating of 2 out of 10. The weak Altman Z-Score of 0.01 warns the company could be in danger of going bankrupt. In addition, assets are building up at a faster rate than revenue is growing, indicating it may be becoming less efficient.

The company’s profitability scored a 6 out of 10 rating on the back of negative margins and returns that underperform a majority of its competitors. Occidental also has a low Piotroski F-Score of 3 and the one-star predictability rank is on watch as a result of revenue per share declining over the past 12 months.

With a 12.42% stake, Dodge & Cox is Occidental’s largest guru shareholder. Carl Icahn (Trades, Portfolio), David Tepper (Trades, Portfolio), Pioneer, John Paulson (Trades, Portfolio), Caxton, Cohen and the T. Rowe Price Equity Income Fund also have significant holdings in the stock.