There are a wide variety of screeners on the GuruFocus site. Some of them apply general preset criteria to our All-in-One screener, allowing users to customize them, while others are based on a more well-defined strategy. Some even have model portfolios based on them, in which GuruFocus has tracked the performance of the screener’s top 25 stocks over the years.

In this series, I will be highlighting some of the most popular GuruFocus screeners. These are the screeners that many find to be particularly useful in searching the markets for potential investment opportunities. Each of them has their own uses depending on the criteria they look at, but they can all provide a good starting point for further research.

The High Quality screener

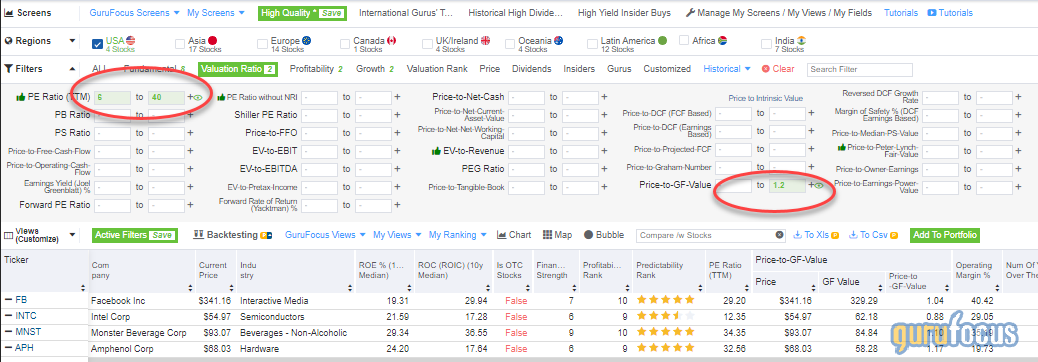

The High Quality screener is one of the screeners that applies a specific set of criteria to the All-in-One screener. This makes it easier for users to customize the screener by adding, deleting or changing the criteria according to their own preferences.

This screener aims to find companies that offer a combination of growth, profitability and financial strength. Companies that meet these criteria can often represent attractive investment opportunities with a reasonably low risk level.

By default, the High Quality screener searches for stocks that meet the following criteria:

- A GuruFocus Financial Strength rating of at least 6 out of 10.

- A GuruFocus Profitability rating of at least 7 out of 10.

- A Predictability rating of at least 3.5 out of 5 stars.

- A 10-year median return on equity of 15% or more.

- A 10-year median return on invested capital of 16% or more.

- A price-earnings ratio of at least 6.

- No net losses over the past 10 years.

- A five-year revenue growth rate of at least 5%.

- A five-year earnings per share (EPS) without non-recuring items (NRI) growth rate of at least 10%.

The High Quality screener also does not consider over-the-counter stocks or stocks in the following industries: basic materials, consumer cyclical, financial services, real estate, utilities, communications services or energy.

Uses and pitfalls

Giants such as Alphabet (GOOG, Financial) (GOOGL, Financial) appear on the High Quality screener, but so do names such as Intel (INTC, Financial) that have been struggling to live up to Wall Street’s expectations recently. The long-term focus looks at how companies have performed over the past five and 10-year periods, not putting much stock in headwinds that could easily turn out to be temporary.

That being said, that doesn’t mean all of the stocks that show up on the screener are stalwarts that are reaching their mature stage. Many of the companies that make it through the High Quality screener are names that analysts broadly consider to have many years of growth left in them.

This is a screener that prioritizes profit margins and financials just as much as growth, so the companies that make it onto the list typically have a high potential of being able to continue growing their earnings in the long term, even after facing difficult economic conditions or periods of underperforming the broader market.

One issue that some value investors might have with this screener is that it does not filter out stocks with high valuation multiples. In fact, the only requirement for earnings multiples is that the price-earnings ratio needs to be at least 6. However, since the High Quality screener is one of the screeners that operates within the framework of the All-in-One screener, it is a simple matter to add in one or more valuation criteria if you wish:

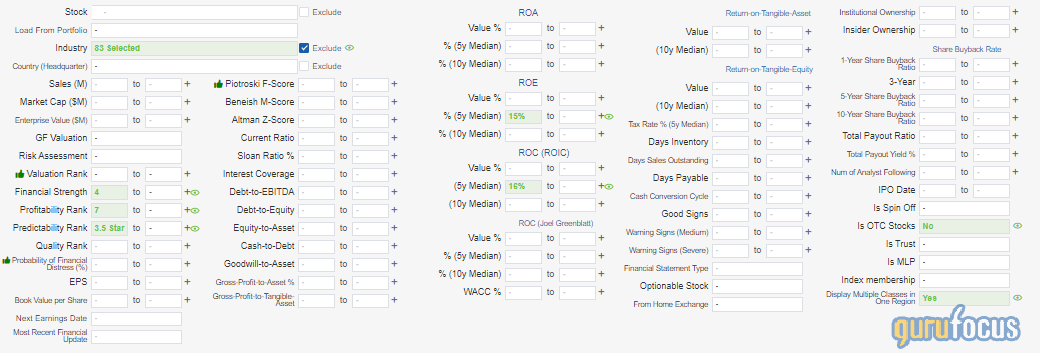

If you wish to expand this screener to allow for younger companies, or companies that only became profitable more recently, to have the potential to show up as well, you might choose to lower the duration requirements on the ratios that consider the 10-year averages. By default, the screener looks at the 10-year averages for return on equity and return on assets, but you can switch to the five-year averages instead, as shown below:

Backtesting performance

Unlike the Buffett-Munger screener, GuruFocus does not have a model portfolio based on the High Quality screener. However, we can get an estimate of how well the High Quality stocks have performed throughout history using GuruFocus’ backtesting feature.

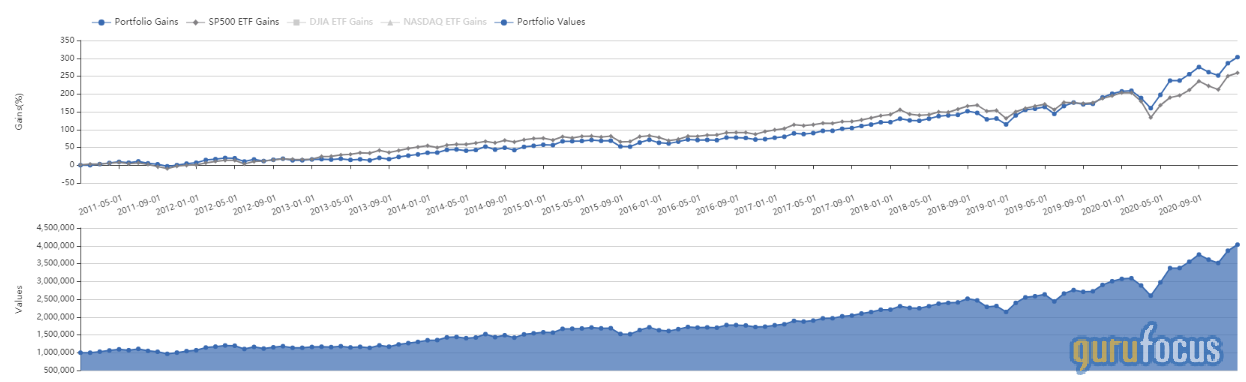

For this backtesting exercise, we will set the start date to Jan. 1, 2011 and the end date to Dec. 31, 2020, with a rebalance at the end of every 12-month period. The 20 stocks in the screener that have the highest profitability ratings at the beginning of the rebalancing period will be tracked (since this is the High Quality screener, I decided to sort based on profitability). Below are the results of the backtested portfolio compared to the S&P 500:

As we can see, this backtested portfolio underperformed the S&P 500 for most of the testing period, with the exceptions being parts of 2011 and 2019 and all of 2020.

These results are interesting because they seem to suggest the stocks in the High Quality screener perform better than the broader market during periods of economic distress or the recovery from recessionary conditions. However, this is just one backtest, so it does not constitute sufficient evidence to draw any sort of conclusion.

Another backtesting result for this screener, which tracked the High Quality stocks with the lowest price-earnings ratios from the beginning of 2006 to the present day, found that the High Quality stocks lost slightly less during the Financial Crisis and gained slightly more in the stock market recovery following the Covid crash.

Become a Premium Member to See This: (Free Trial):