Williams-Sonoma Inc. (WSM, Financial), the venerable seller of home furnishings and decor through seven retail chains, had to close some of its brick-and-mortar stores during the pandemic. But it more than made up for those losses through its online channel; indeed, it had an outstanding year as homebound consumers updated their living spaces.

About Williams-Sonoma

The company was founded by Chuck Williams in Sonoma, California in 1956. An avid fan of food and cooking, he started the business to import and sell French cookware that could not be found in America.

Since then, the company has grown into what it calls “an omni-channel specialty retailer of high-quality products for the home." In its 10-K for the year ended Jan. 31, Williams-Sonoma noted it operates through multiple brands and retail channels. They are:

- Williams Sonoma: The original company has expanded to offer more products, including furniture, tabletops and bars, outdoor furniture and more. It also encompasses Williams Sonoma Home, which provides products for lifestyles beyond the kitchen.

- Pottery Barn: This brand includes furniture, bedding, lighting, rugs and decorative accessories. This segment was the single largest contributor to net revenue in fiscal 2020.

- Pottery Barn Kids: Established in 1999, this company specializes in products for the rooms of children.

- West Elm: It is described as, “West Elm creates unique, modern and affordable home decor and curate a global selection of local, ethically-sourced and Fair Trade Certified products, available online and in our stores worldwide.”

- Pottery Barn Teen: As the name suggests, a source of products designed for teens.

- Rejuvenation: Purchased in 2011, this company sells made-to-order lighting, hardware and furniture.

- Mark and Graham: Personalized gift products, including women’s and men’s accessories, small leather goods and jewelry.

- Outward: Acquired in 2017, it is a 3-D imaging and augmented reality platform for the home furnishings and décor industry.

Williams-Sonoma’s main areas of operation are the U.S., Puerto Rico, Canada, Australia and the United Kingdom. In addition, it has secondary operations in the Middle East, the Philippines, Mexico, South Korea and India.

The Covid-19 pandemic did have an effect on the company’s retail operations, but as noted in the 10-K, “the impact of our store closures on our retail store revenues has been more than offset by growth in our e-commerce business.”

Altogether, this is an $11.94 billion company with a predictability score of five out of five. Its quality as a stock shows up through its inclusion on two elite GuruFocus screeners: the Buffett-Munger and the Undervalued Predictable.

Competition

According to its 10-K, competition in both specialty ecommerce and retail is high. And it explained the context of this competition:

“We compete on the basis of our brand authority, the quality of our merchandise, our customer service, our proprietary customer list, our e-commerce websites and marketing capabilities, the location and appearance of our stores, as well as our in-house design, our digital-first channel strategy, and our values, which we believe have become increasingly relevant and set us apart from our competitors. Our in-house teams design our own products and work with our talented vendors to bring quality, sustainable products to market through our high-touch multichannel platform.”

Competitors in the furniture and home furnishings area include luxury retailer RH (RH, Financial) and Wayfair (W, Financial), an e-commerce site that claims it offers more than 22 million products for the home. RH has a market capitalization of $13.88 billion, while Wayfair’s cap is $31.03 billion.

Williams-Sonoma provided this comparison with its retail peers and the S&P 500 in this five-year comparison chart:

Financial strength

Based on the information in this table, we can classify Williams-Sonoma as being financially strong. That includes the company’s debt situation; the interest coverage ratio of 71.33 indicates the company generates operating income of $71.33 for every dollar of interest expense.

We learn from the following cash-to-debt chart that the company has only recently become a borrower and its cash position roughly matches its debt position (cash-to-debt ratio of 0.53):

High scores appear on both the Piotroski F-Score and Altman Z-Score charts, suggesting the company is well managed and in good financial condition.

Perhaps the best ratio on this table is the one measuring how much income the company makes in relation to the average cost of its debt and equity. The return on invested capital is 28.49%, nearly triple the weighted average cost of capital at 10.40%.

Profitability

Williams-Sonoma earns an even more substantial rating for profitability.

Part of that strength comes from its margins, both of which are in the double digits and better than those of its peers and competitors in the retail – cyclical industry:

But keep in mind its margins were challenged earlier in the past decade.

Regarding return on equity, the data show it does better than 97.22% of the 1,008 companies in the industry. Similarly, it outperforms 96.92% of its peers for return on assets.

There are also solid numbers on the three growth lines at the bottom of the table. While the margins may have dipped in the middle of the last decade, revenue, Ebitda and earnings per share either kept growing or at least kept trending upward:

Dividends and share buybacks

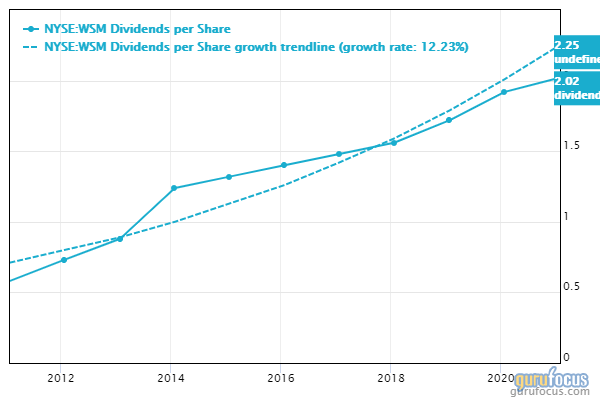

Dividends per share have risen by an average of 12.23% per year over the past nine years, from 73 cents per share to $2.02:

Share price increases since March 2020 have driven down the dividend yield:

The company also rewarded shareholders by consistently repurchasing shares—at least until the pandemic hit in 2020:

Valuation

Given that many of us spent much more time at home in 2020, it should be no surprise that Williams-Sonoma did well operationally, and the share price reflected those improvements:

The GF Value Line picks up on the price growth, as well as historical multiples and future growth expectations, to conclude the stock is significantly overvalued:

However, the overvaluation is somewhat muted when Ebitda growth is factored in, an average of 11.40% per year over the past five years. That leads to a PEG ratio of 1.26, which is only modestly above the fair value mark of 1.

The PEG, or PEPG, ratio explains how Williams-Sonoma made it through the Buffett-Munger Screener. This screener is designed to identify what it calls good companies at fair or undervalued prices. Its other criteria include (1) companies with a high predictability rank, (2) companies with competitive advantages or moats and (3) firms that have taken on a relatively small amount of debt while growing their businesses.

As you will recall, this furniture and home furnishings retailer is also an Undervalued Predictable stock. To qualify for that list, a company must have a margin of safety as determined by a discounted cash flow, or DCF, calculation. Williams-Sonoma has a good margin of safety (that is, its intrinsic value is greater than its market value):

The other qualification for Undervalued Predictable status is a predictability rating of at least four out of five stars. As we see at the bottom of the DCF calculation, the company enjoys a full five-star rating.

Gurus

The gurus have been buying selling Williams-Sonoma stock, but no trend has surfaced over the past two years:

At the end of March, the end of the first calendar quarter, nine gurus had stakes in the company. The three largest holdings were those of:

- Jim Simons (Trades, Portfolio)' Renaissance Technologies with 189,278 shares, representing 0.25% of Williams-Sonoma’s shares outstanding and 0.04% of the fund’s holdings. The fund reduced its exposure to the stock by 2.08% during the quarter.

- Ken Heebner (Trades, Portfolio) of Capital Growth Management, for whom this was a new investment. He ended the quarter with 95,000 shares.

- Pioneer Investments (Trades, Portfolio) held 76,043 shares at the end of the quarter, a reduction of 14.34%.

Conclusion

With its solid balance sheet and high profitability, we can conclude that Williams-Sonoma is a quality stock, one that is quite unlikely to disappoint its owners in the next five to 10 years. Inclusion in the Buffett-Munger and Undervalued Predictable screeners gives us confidence that this is a stock worth holding for the long term.

But is it really undervalued, as the name of the second screener suggests? Yes, it appears a strong case can be made for its margin of safety because of the strength of its Ebitda growth rate.

Value investors who believe Williams-Sonoma is undervalued, and that its debt is insignificant, may wish to examine the stock more closely. Growth investors will be more focused on the share price, and either bullish or bearish depending on what they see in coming quarters or even years. It’s not much of stock for income investors; on the basis of just dividends, there are better possibilities available.

Also check out: