Market Perspectives

For the first half of 2021, the broader equity markets delivered solid positive performance, with the S&P 500 Index returning 15.25%. Fixed income markets were more challenged understandably, with the Bloomberg Barclays U.S. Aggregate Bond Index returning −1.60% over the same period, much in response to the recent rise in intermediate and longer-dated interest rates.

The financial resiliency and health of most major economies have been tested, but one by one, they are beginning to show the green shoots of recovery. Meanwhile, unlike the financial crisis of 2008–2009, the recent recessionary conditions did not stem from, nor cause, excessive leverage or other balance sheet problems for the U.S. economy. With relatively healthy credit conditions (which are rare after most recessions) and the important support of both fiscal and monetary stimulus, we are seeing evidence that the U.S. economy is healing and even growing again.

Aiding the resumption of economic activity and expansion is the fact that the major banking institutions in the U.S. are, by and large, holding excess capital with which, as COVID subsides, they can increase return of capital through higher dividends and share buybacks; they can also redeploy large amounts of money into loans at significantly higher net interest margins than what they endured in the recent years of compressed spreads. The main point is that we have a relatively strong foundation underpinning this economy from a balance sheet and financing perspective, coupled with signs of stirring economic activity, significant spend at both the consumer and business levels and a healing employment picture.

In certain spots, speculative valuations have bubbled up. That does not describe the whole market. The stock market is just a market of individual stocks, and when we sift through the landscape of hundreds of companies, we believe there are well-priced investment opportunities. On the subject of hype and manias in the markets, our more than 50-year history as a firm has taught us not to be lured into such risky situations.

We are not optimists nor are we pessimists. We try to be realists, and our sense of reality is grounded in history. Every decade has its iconic examples of excessively priced, speculation-driven momentum stocks. Relatively few of those stocks, from their peak levels, delivered competitive returns against the broader market over subsequent periods that in many cases lasted a half decade or more.

In short, the existence of some overvalued situations in the market is commonplace, but does not mean there is a dearth of things to buy. On the contrary, we own today some of the finest businesses in the world, and through true active management and stock-picking, we are concentrating on a portfolio of stocks that we believe are well-priced. Every business we hold presently has the potential in our estimation to generate, over a business cycle, attractive returns on capital, which is an important input when our investment discipline relies to a large degree on compounding shareholder wealth through the businesses we own. It is not always necessary nor advisable, in our opinion, to jettison good businesses in the short term in search of all-new businesses. If the businesses we have identified can compound their internal free cash flow at high rates, then theoretically we could do well by simply holding these financial locomotives, with some changes at the margin as truly warranted.

In the year-to-date period through June 30, Davis Appreciation and Income Fund returned 20.65%, outperforming the balanced 60/40 Index’s 8.30% return as well as the Endowment Index’s return of 10.88%.1

We manage the portfolio in a way that seeks to achieve a competitive total return relative to the risk-free rate and inflation, while maintaining a degree of diversification by always holding a mix of stocks and bonds.

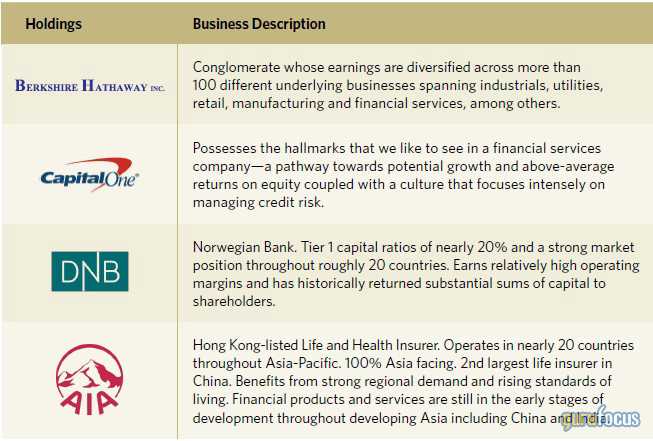

The drivers of performance this year include many businesses that had negative stock price trends just a year or so ago, as the effects of COVID were being felt much more. The Fund’s largest sector allocation—a byproduct of individually chosen stocks that each have their own merits in our analysis—is financial services, which saw performance hurt in 2020, but has been a tailwind this year. Rather than jump to a conclusion that this is synonymous with concentration risk, we note that some of our largest positions include:

These four businesses are all lumped into the same sector even though each one is tied to very different drivers and risk factors. In most scenarios, the credit profile of a Norwegian bank would likely not be directly or immediately correlated with life insurance claims—a function of mortality rates—in many countries, referring to DNB Bank and AIA Group by way of example, respectively. Hence when we look at the portfolio in detail, we would note the eclectic and diverse business models making up the whole, and that is done intentionally to build in a degree of durability.

Last year around this time, the share prices for many of our holdings declined dramatically in the face of the COVID outbreak. We sharpened our collective pencils, and after some significant investment of time studying the direct and indirect implications of COVID, we took a few notable actions.

The first was to compare the relative opportunities, since prices had changed significantly in virtually every group in the market, with some being buoyed by investors favoring so-called “COVID trades”— i.e., internet-related businesses and food delivery, by and large.

We pared some of our larger technology-related holdings (including, for this purpose, the e-commerce and broader online space), some of which had held up better than other parts of the portfolio.

We exited energy entirely. Despite the rebound that has occurred in oil and gas since our sale, our view was that the longer-term outlook for the fossil fuel industry could become far more difficult both operationally and, even more, financially over the coming decade and perhaps beyond. Between regulation, taxation, and changing social and political attitudes towards drilling, it is yet to be seen whether the recent run in this sector has a sustainable path looking out years, and we have decided for now to avoid the area for fundamental reasons, rather than any outlook on the commodity price.

In terms of what we purchased, we added to a number of our financial positions that, based on both our internal stress tests and the Federal Reserve’s years of stress tests for banks, seemed to us like a very attractive risk/reward opportunity set. Our view was that the amount of capital required to foot the bill, even in the case of a deep economic crisis scenario, was in place precisely as a counter-cyclical buffer. Between very high capital ratios going into COVID with a substantial sum of earnings still coming in the door—aided in no small part by stimulus checks—we felt comfortable adding to select financial businesses, and that decision, as noted earlier, has been beneficial to this year’s results thus far.

Lastly, in terms of fixed income, we are holding a little more than 25% of the Fund in fixed income— including mortgages, asset-backed securities and corporates, among other sectors—and cash. In certain environments, fixed income offers interesting yields and over certain cycles the potential for appreciation of the principal. We are not in one of those times. Just as we are wary of reaching too far out on the spectrum when it comes to valuations on the equities side, we are equally mindful of not chasing a few extra basis points of yield if it entails more than commensurate risk— and that is, at a high level, the setup for many fixed income areas currently. Still, if one is careful, there are acceptable risks that one can take today in fixed income for some income generation. In any event, we will always devote a portion of the Fund to what we deem sensible fixed income, as well as cash equivalents.

Conclusion

Given the strong performance enjoyed by many investors this year in stocks, a legitimate question is to ask whether there are still appealing opportunities. We would encourage investors to look very much individually at companies throughout different areas of the economy and markets. A detailed scan should reveal that many fine businesses still represent good value, particularly considering that conditions for most sectors are improving. Owning durable compounding machines with the potential for free cash flow growth over many years is a core part of our discipline. We feel it is a sensible and perennial way to invest as stewards of both our and others’ savings—pre-COVID, through COVID and after.

At Davis Advisors, we seek to purchase durable businesses at value prices and hold them for the long term. The more than $2 billion Davis Advisors, the Davis family and Foundation, our employees, and Fund directors have invested in similarly managed accounts and strategies remains a true sign of our commitment to and conviction in this enduring philosophy.2

We are grateful for your confidence and trust, and we look forward to continuing our investment journey together.

1The Combined Index is a composite blend of 60% of the S&P 500 Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index and represents a broad measure of the U.S. stock and bond markets, including market sectors in which the fund may invest.

2As of 6/31/21.

This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. Equity markets are volatile and an investor may lose money. All fund performance discussed within this piece refers to Class A shares without a sales charge and are as of 6/30/21 unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.