Encouraging investors to “buy high quality” might seem a tired, and not very useful cliché. It often carries the faint sense of an older relative offering advice, probably unsolicited, to “always buy high quality” or the aphorism of a financial advisor who recommends that clients “build wealth by owning a portfolio of blue-chip companies for the long term.” However hackneyed, there is some substance underlying these comments (as there usually is with cliches), and, at least in small caps, we see the case for quality as notably timely as well.

It may be helpful to be more precise about what we at Royce mean by quality. Like beauty, it is often in the eye of the beholder. We classify quality companies as those that can sustain high returns on invested capital with below average leverage. There are a number of critical attributes that companies need to produce those positive outcomes, including strong competitive positions, savvy capital allocation, and favorable industry ecosystems. Yet, one could reasonably ask, since those attributes seem so obviously attractive, why aren’t the valuations of quality companies bid up so high by investors that the returns for owning these stocks are subpar? We’d offer two reasons: one is a flaw in analysis, while the other seems more like a limitation in the design of human cognition.

Regression to the mean is not only a very powerful force in financial markets, but also in commercial markets. Few companies are able to retain preeminence for extended periods of time. Indeed, all of a company’s competitors are constantly seeking to take away their leading market share, and all industries evolve over time as bargaining power alternates between buyers and sellers. If one analyzes the valuation of leading companies, there seems to be an implied “decay curve,” which presumes that any company’s superior profitability eventually regresses back to the average for all companies. And this is the result most of the time. However, if an investor can identify a select collection of companies that can defy that regression to the mean and persist with higher returns on invested capital, then that has historically produced superior investment results. For example, we calculated the returns for the top quintile of securities in the Russell 2000 from 12/31/92-6/30/21, sorted by a multi-factor combination of ROIC and the stability of Return on Assets. The average annualized 10-year rolling return for this cohort was 13.0%, compared with 8.3% for the Russell 2000 over the same period. So tilting towards these high-quality metrics was highly rewarded.

Which again prompts the question, why don’t other investors recognize this fact and act accordingly? Understandably, it’s particularly difficult to answer questions about why an action wasn’t taken with any conviction. Perhaps reframing the question may yield an insight – why are quality attributes less valued than, say, companies with recent, and expected near term, high growth? We’d suggest that the attractive attributes of notably cheap stocks, or distinctively fast-growing ones, are more easily and immediately recognized, perhaps prompting a visceral positive response. The appeal of quality, however, is more subtle. While quality is the feature, compounding is the benefit, meaning that companies with high returns on invested capital can take their free cash flow, reinvest it in their business or thoughtfully acquire another, thereby compounding wealth over long periods of time. Here’s where, perhaps, the design limitation in human cognition enters. Investors are humans, after all, and are certainly capable of extrapolating in a linear fashion. If a company is experiencing either fast or slow growth, its stock is often valued as if those conditions will always persist, even though they often do not.

So why do investors have such a hard time anticipating the benefits of compounding? While that question may be more scientifically answered by at an evolutionary psychologist, what we can offer is that figuring out what 10% compounded over 20 years is worth was not a very practical skill for much of human existence, so perhaps few of us developed that capacity. Back to our own profession, I am consistently surprised by investors’ reaction to learning that $1,000 invested a month at 10%/year compounds to more than $201,000 over 10 years and more than $720,000 over 20 years.. They often find it unbelievable, but of course, it’s just math. And these investors often find the growth in wealth over the second 10 years, which is where the benefit of compounding really accelerates, difficult to comprehend. So the benefit of high-quality companies that can compound wealth over long-term periods only becomes visible in the more distant future, and most of us humans seem wired to not value that kind of future benefit very highly.

In our view, this timeless case for investing in high quality small caps is underscored by a timely rationale in today’s market. From the analysis we have done, high-quality small-cap companies have had a consistent performance profile compared with the overall small-cap market through different phases of market cycles. As shown in the chart below, which uses averages for the past four full market cycles, high ROE stocks (a simplified proxy for high quality) have on average outperformed the Russell 2000 Index and low ROE stocks during market declines. This relative array has typically reversed in the first year off a market trough, when high ROE stocks lagged. However, in the second year of a small-cap market cycle, high ROE stocks have reasserted their leadership. This is timely as we are now in the second year following the most recent small-cap market trough in March 2020.

Low Quality Has Led Early While High Quality Has Led in the Second Year of Small-Cap Rebounds

Average Russell 2000 ROE Quintile Performance for Past Four Market Recoveries

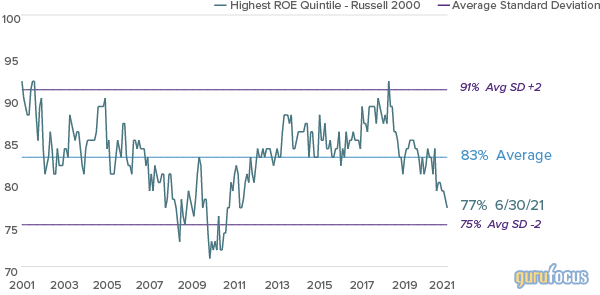

Adding greater weight to the timely case, as the result of their recent lagging performance, the chart below shows that high ROE stocks are now more attractively valued on a relative basis than at any time since 2012.

Highest Quintile ROE in the Russell 2000 vs. Russell 2000 Median EV/EBIT1

From 6/30/01 through 6/30/21

Our third observation supporting the timely case for high quality small caps is based on the relationships between the level of overall market return and the spread of high-quality stocks outperformance. As the chart below shows, high quality stocks have had the greatest amount of excess return in five year periods when the small cap market delivered single digit results. This is a timely observation because our expectations for overall small cap returns over the next five years is in the high single digit range, which historically been a good market environment for high quality stocks.

High Quality Stocks Have Added Most During Periods of Lower Market Returns

Monthly Rolling Five-Year Average Excess Returns for Quintile 1 ROIC Minus Russell 2000 from 4/30/98 through 6/30/21

Past performance is no guarantee of future results

Source: FactSet

We think these three timely observations about high quality small caps—the market cycle perspective, these stocks’ current low relative valuations, and their historical outperformance in five-year periods with single-digit returns—bolster the current case for high quality small caps. However clichéd, buying quality is still a historically sound, analytically robust, and timely investment opportunity.

Mr. Lipper’s thoughts and opinions concerning the stock market are solely their own and, of course, there can be no assurance with regard to future market movements. No assurance can be given that the past performance trends as outlined above will continue in the future.