Pfizer Inc. (PFE, Financial) has delivered remarkable results powered by its Covid-19 vaccine, BNT162b2, which it developed with German partner BioNtech SE (BNTC, Financial). Pfizer said it now expects revenue of approximately $33.5 billion in 2021 for its Covid-19 vaccine alone. This is the highest single-year revenue for any drug in history.

The updates on Pfizer’s vaccine were part of the company’s second-quarter financial report. Overall, Pfizer reported adjusted diluted earnings of $1.07 per share and sales of $19 billion for the quarter, beating the consensus estimates, which called for earnings of $0.97 per share and sales of $18.7 billion. Pfizer also increased its estimates for the full fiscal year, saying it now expects adjusted diluted earnings between $3.95 and $4.05, up from its previous estimate of between $3.55 and $3.65.

Pfizer is also developing booster shots for its Covid-19 vaccines, and some countries, including Israel, have already implemented programs to provide boosters to their most vulnerable people.

The New Pfizer

Last year, Pfizer split off its old drug division “Upjohn,” combining it with generics company Mylan to form Viatris (VTRS, Financial). Viatris shares were distributed to shareholders as a result of the merger. Previously, the company had also combined its consumer health products (over the counter drugs) group with that of GlaxoSmithKline (GSK, Financial), which will also be spun out as independent company.

The so-called "New Pfizer" is now a pure play innovation based prescription biopharmaceutical company. This model has the potential to report far higher growth numbers and attract higher valuation multiples, though the downside is that if the company fails to keep producing blockbuster drugs, share prices could experience an equally sharp drop.

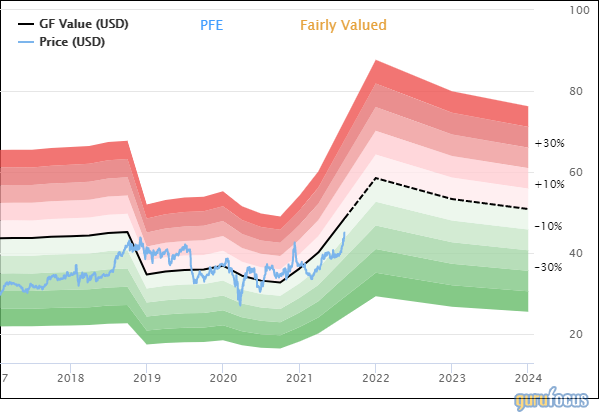

Based on analyst estimates for future earnings and the stock's historical valuation multiples, the GF Value line is predicting a sharp rise of Pfizer’s intrinsic value through the end of the year. The momentum appears to be with Pfizer.

It's not only the Covid-19 vaccine that is providing upside, though. Other major drugs in Pfizer’s portfolio continue to deliver, as shown in the below slide from the company’s recent earnings presentation.

Pfizer's R&D head said the company is working on other mRNA based vaccines with its partner BioNtech, including a flu vaccine with higher efficacy than currently available. It will first focus on prophylactic (preventative) vaccines, and then work on vaccines for therapeutic areas including rare disease and oncology.

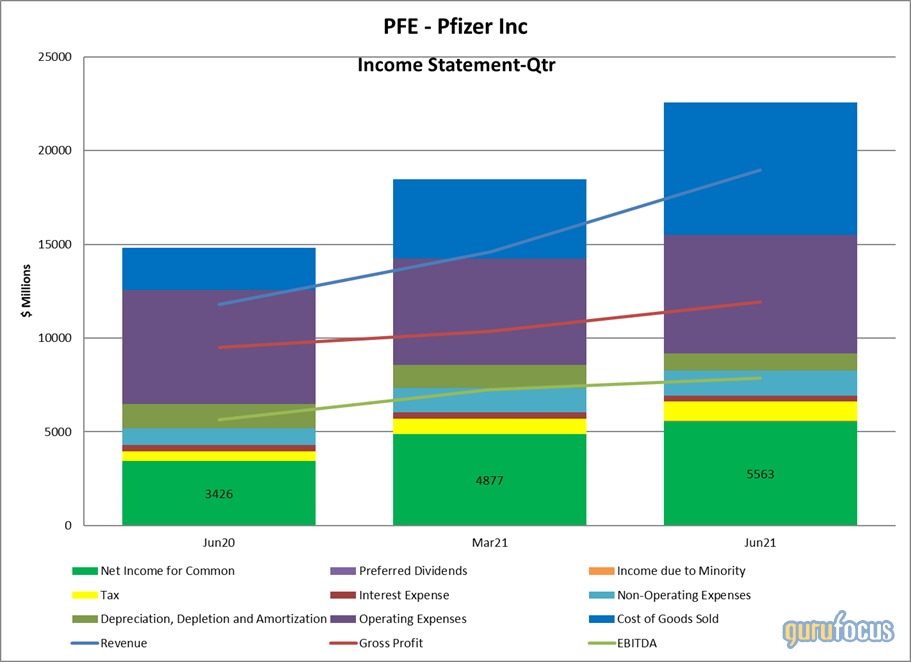

The chart below compares Pfizer’s income statement from the previous quarter and the year before. As we can see, net profits are booming.

Conclusion

Pfizer has indicated that it expects a 6% compounded annual growth rate (CAGR) on its top line and a “double digit” CAGR on the bottom line through 2025. Looking at the long-term historical EPS chart, Pfizer has been growing its EPS at a rate of 8% per year.

Using the GuruFocus discounted cash flow (DCF) calculator, I came up with an intrinsic value estimate of $67.25 per share for Pfizer, with a margin of safety of 33% (below are the assumptions I used). Given Pfizer’s focus on biopharma and the recent momentum, I don’t think this is an outrageous estimate.