On Tuesday, GuruFocus’ modified version of Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) CEO Warren Buffett (Trades, Portfolio)’s favorite market indicator stood at 151.3%, up from the July 1 reading of 149.7% and near a record high.

Dow nears record close despite renewed surges in Coronavirus cases

The Dow Jones Industrial Average closed at 35,116.40 on Tuesday, up 278.24 points from Monday’s close of 34,838.16 and 180.93 points higher than last Friday’s close of 34,935.47.

Stocks surged as gains from banks and industrial companies outweighed setbacks from travel companies and surging Coronavirus cases. The U.S. Centers for Disease Control and Prevention said earlier this week that the seven-day average of new Covid-19 cases nationwide topped 72,790 on Friday, surpassing last summer’s peak of approximately 68,700 new cases per day.

UBS Americas Chief Investment Officer Solita Marcelli said in a note that while the delta variant of the virus is spreading and that a modest pullback in activity “cannot be ruled out,” any potential slowdowns should be “muted.” Randy Fredrick, managing director of trading and derivatives at the Schwab Center for Financial Research, added that the market may be “skittish” to any piece of news due to high valuations and thus, volatility may be slightly high going into the third quarter.

Buffett indicator remains near record high

The ratio of total market cap to the sum of gross domestic product and Federal Reserve Bank assets stood at 151.5%. Based on the current market valuation level, the implied U.S. stock market return per year going forward is -1.8% assuming that valuations revert to the 20-year median market valuation level of approximately 91%.

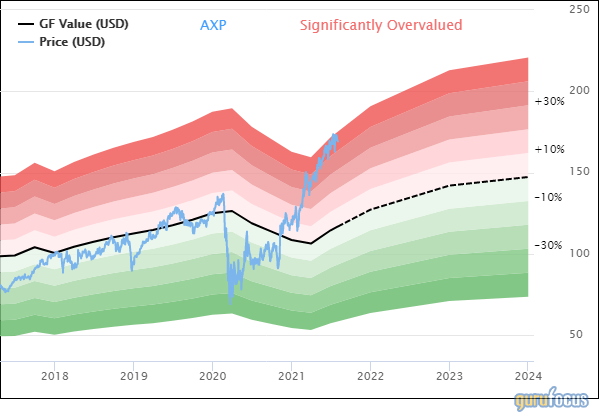

Berkshire’s top holdings like Apple Inc. (AAPL, Financial) and American Express Corp. (AXP, Financial) remain significantly overvalued based on the GF Value line. GuruFocus’ exclusive valuation method considers several key factors, including historical price multiples and internal adjustments for past performance and future growth estimates.

Also check out: