AMC Entertainment Holdings Inc (AMC, Financial) saw its earnings beat analysts' expectations in its most recent quarter, which has caused renewed optimism for the stock. However, there are plenty of indicators that suggest that the stock will soon be on its way down. Let's take a look.

Temporary spike in sales

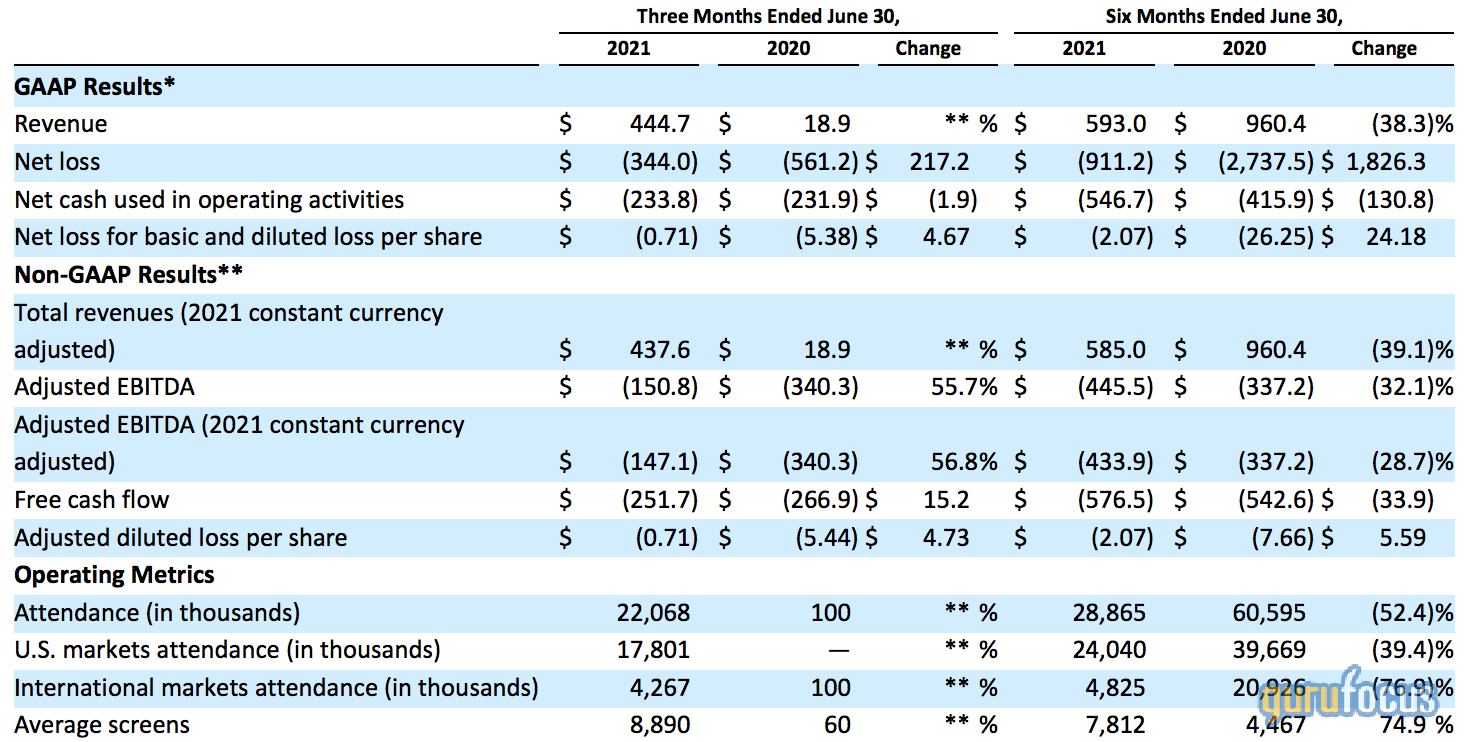

AMC has operated at 100% capacity domestically and 95% capacity overall during the past quarter. It generated revenue of $444.7 million, which is a 2,253% year-over-year increase, but you have to admit, there is an easy comparison from the corresponding quarter of 2020, when theaters were shut down.

Source: AMC

The general bull case for AMC's stock is that people have taken advantage of their local re-openings and pent-up demand was caused by the frustration of sitting at home for such a long time.

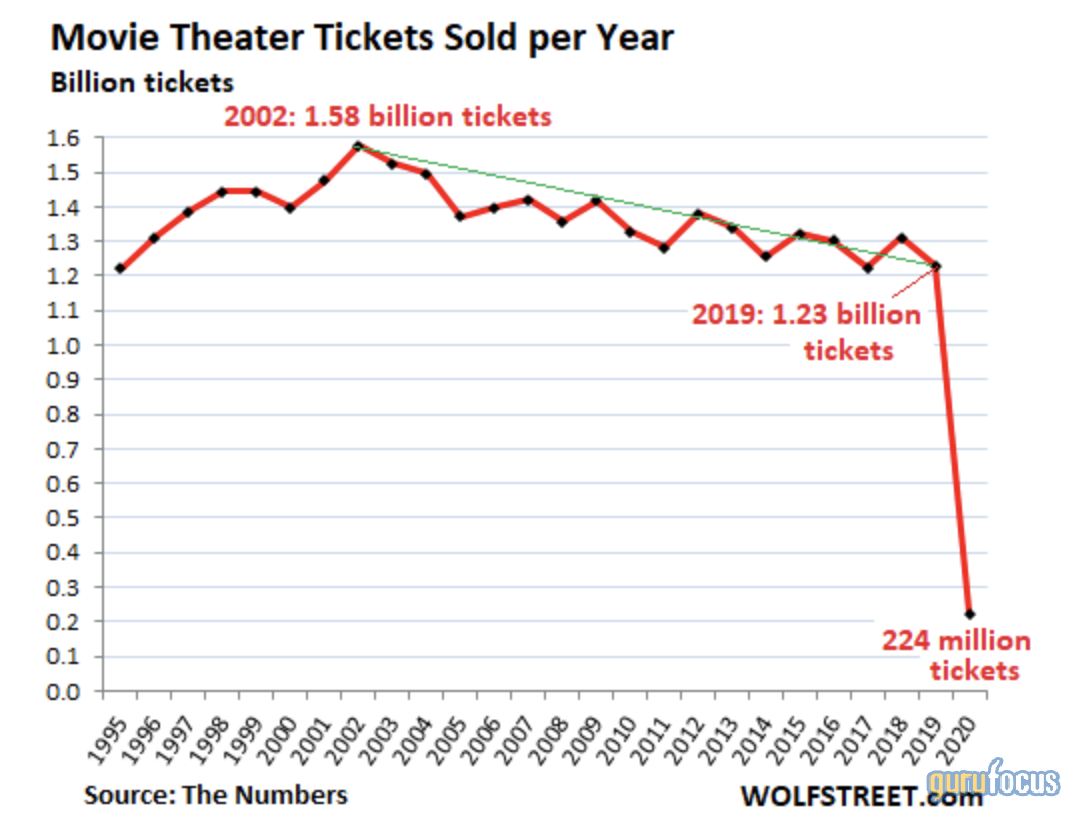

However, even with a significant increase in revenue, AMC has yet to reach its March 2020 number of $856 million. AMC's future revenue is expected to remain suppressed by a lackluster ticket sales trajectory for cinemas due to the increasing popularity of subscriptions.

Source: Wolfstreet

Furthermore, AMC has struggled with its net income since 2019; the stock's weak diluted EPS has been a problem for a while, and a stock's price also tends to correlate with its EPS.

I firmly believe that the earnings surprise isn't something to read into too much. AMC will definitely experience a retracement, but I highly doubt that the company will match or exceed previous numbers.

Valuation metrics

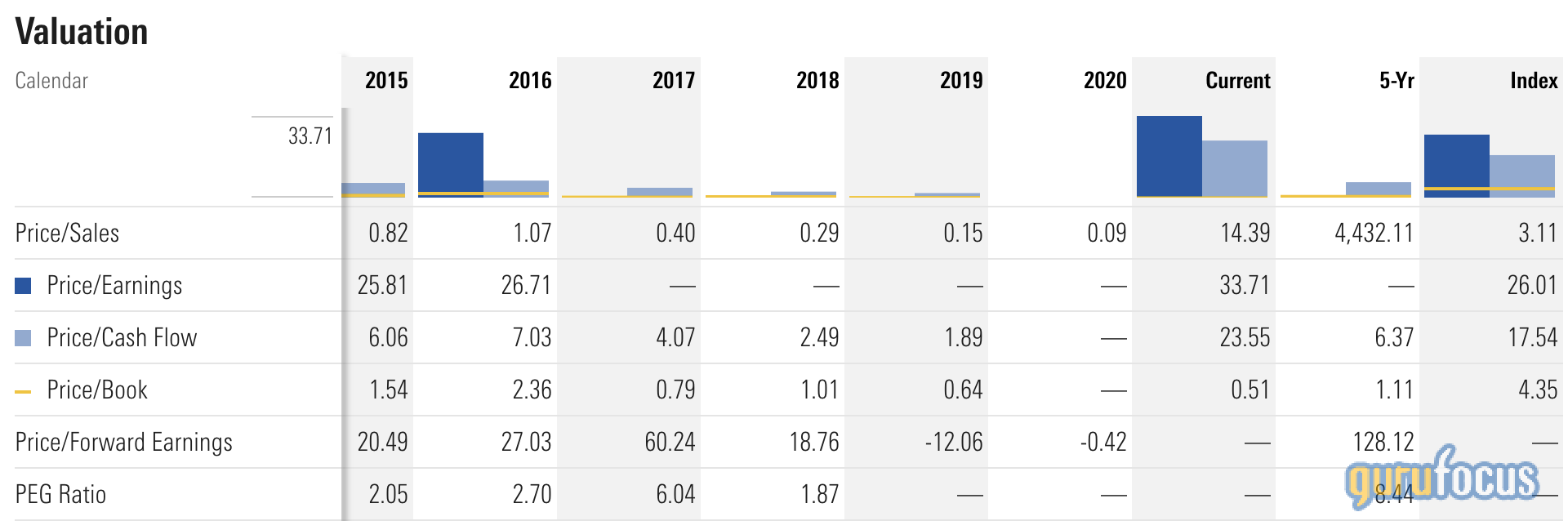

Key relative valuation metrics are way overcooked for this stock. Investors need to remember that this is a stock that's been trading for more than a decade, which means that relative value will play a significant role in the long run, as markets reach a stronger form of efficiency. Below is a chart from Morningstar showing the historical price-earnings, price-sales, price-book, forward price-earnings and PEG ratios for AMC. As we can see, the stock's current valuation metrics are higher now than they have been in the past, when the company was in better shape.

Source: Morningstar

Retail inflow

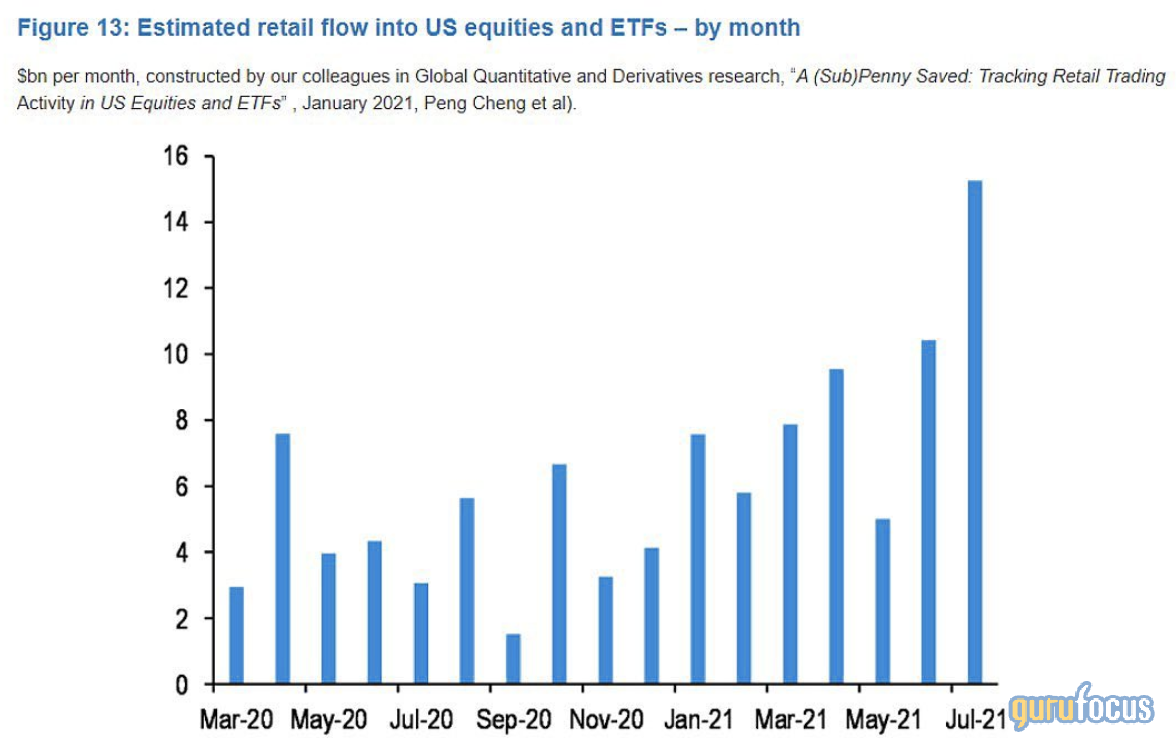

There's been a significant inflow to AMC stock by retail investors yet again, but the stock simultaneously lost more than 26% of its value as the effort to trigger another short squeeze fell flat. I think that retail investors are starting to look past this strategy, which means AMC could be plummeting back to earth soon.

Source: JP Morgan (JPM, Financial)

Final word

I think AMC stock is a dangerous investment at the moment. Many might buy back in after the earnings beat, expecting the movie theater industry to get back to pre-pandemic levels soon, but the trajectory of critical indicators suggests that it's on its way down. Even if it does get back to pre-pandemic levels, it won't be as profitable as it used to be, as the company keeps taking on increasing levels of debt.