Pershing Square Holdings Ltd. (LSE:PSH, Financial), the asset management company led by Bill Ackman (Trades, Portfolio), disclosed this week that it established a 7.1% stake in Universal Music Group approximately one month after Ackman’s special purpose acquisition company Pershing Square Tontine Holdings (PSTH, Financial) backed out of its acquisition agreement.

The U.K.-based activist firm acquired 128,555,017 shares of the music giant, which is 7.1% of the company, from Vivendi SE (XPAR:VIV, Financial) for approximately $2.8 billion, representing an equity value of 33 billion euros ($38.73 billion) for UMG.

Pershing Square Holdings takes toned-down stake following SPAC fall out

Pershing Square Tontine Holdings Ltd. (LSE:PSH, Financial) announced in June a definitive agreement with Vivendi SE (XPAR:VIV, Financial) to acquire 10% of UMG’s outstanding shares for approximately $4 billion. The firm then announced on July 19 that Pershing’s board of directors scrapped the SPAC acquisition and instead assigned the share purchase agreement to Pershing Square Holdings. Ackman and his management team said that issues raised by the Securities and Exchange Commission regarding the transaction led the firm to seek an alternative initial business combination.

On Tuesday, Pershing Square Holdings announced the acquisition of a toned-down 7.1% stake in the music company for a cash consideration of approximately $2.5 billion. Pershing also mentioned that the firm and its affiliates have the right to acquire an additional 2.9% of UMG’s outstanding shares at the same price of $21.78 per share (approximately 18.58 euros) by Sept. 9, which the firm intends to exercise.

Vivendi expects to spin off UMG in September

Vivendi’s shareholders approved the UMG spin off in June, paving the way for UMG’s listing on the Euronext Amsterdam exchange in September. The proposal involves distribution of 60% of UMG’s share capital to shareholders through an initial public offering.

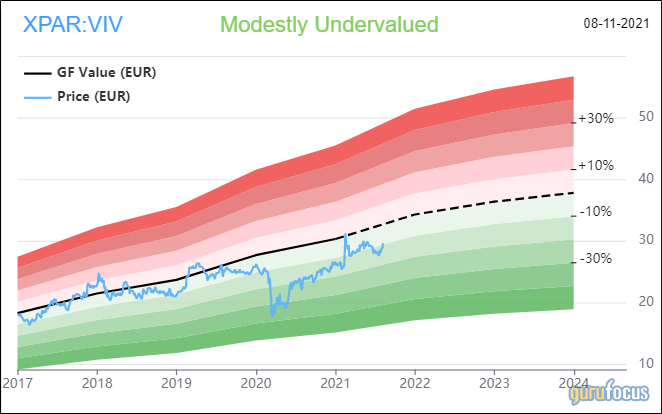

Shares of Vivendi traded around €29.57, showing that the stock is modestly undervalued based on Wednesday’s price-to-GF-Value ratio of 0.90.

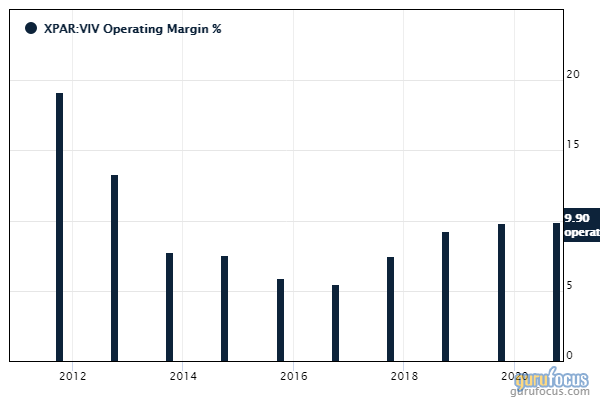

GuruFocus ranks the French music company’s profitability 7 out of 10 on several positive investing signs, which include a return on equity that outperforms more than 65% of global competitors and an operating margin that has increased approximately 13.80% per year on average over the past five years and tops more than 73% of global diversified media companies.

See also

According to top-10 holdings statistics, a Premium feature of GuruFocus, Pershing’s top holdings as of the March quarter filing date include Lowe’s Companies Inc. (LOW, Financial), Hilton Worldwide Holdings Inc. (HLT, Financial), Restaurant Brands International Inc. (QSR, Financial) and Chipotle Mexican Grill Inc. (CMG, Financial).